FIN301,FIN 509 & FIN510 Class Web Page, Summer'21

Weekly SCHEDULE, LINKS, FILES and Questions

|

Week |

Coverage, HW, Supplements -

Required |

Equations and

Assignments |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Weekly

Thursday class url: https://us.bbcollab.com/guest/e16136f1cab14057ba2f68d150977a7d Weekly

Saturday Q&A (7-8 pm) https://us.bbcollab.com/guest/02cf97530549475087efccd04a8927ce Class Schedule:

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 0 |

Market

Watch Game Use the information and directions below

to join the game. 1. URL for your game: 2. Password for this private game: havefun. 3. Click on the 'Join Now' button to get

started. 4. If you are an existing MarketWatch member, login. If you are a new user, follow the link

for a Free account - it's

easy! 5. Follow the instructions and start trading! Market Watch Tutorial-

Stock Market Competition 2018 NHSA (youtube)

|

Pre-class assignment: Set up marketwatch.com account and have

fun |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week1,2 |

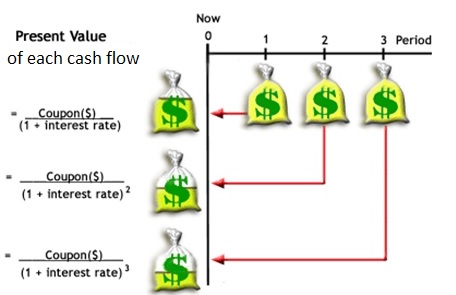

Chapter 5 Time value of money The time value of money -

German Nande (youtube)

Week 1 in class exercise (word file) Solution Concept of FV, PV,

Rate, Nper Calculation of FV, PV,

Rate, Nper Concept of interest

rate, compounding rate, discount rate

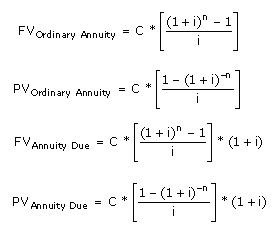

Chapter 6 Time Value of Money 2 Concept of PMT, NPV Calculation of FV, PV,

Rate, Nper, PMT, NPV, NFV Concept of EAR, APR Calculation of EAR,

APR HOMEWORK of Chapters 5

and 6 1. The Thailand

Co. is considering the purchase of some new equipment. The quote consists of a

quarterly payment of $4,740 for 10 years at 6.5 percent interest. What is the

purchase price of the equipment? ($138,617.88) 2. The

condominium at the beach that you want to buy costs $249,500. You plan to

make a cash down payment of 20 percent and finance the balance over 10 years

at 6.75 percent. What will be the amount of your monthly mortgage

payment? ($2,291.89) 4. Shannon wants

to have $10,000 in an investment account three years from now. The account

will pay 0.4 percent interest per month. If Shannon saves money every month,

starting one month from now, how much will she have to save each month?

($258.81)

(Hint: Bridget’s is an annuity due, so abs(fv(8%/12, 10*12, 150, 0,

1)) --- type =1; Jordan’s is an ordinary annuity, so abs(fv(8%/12, 10*12, 175,

0) --- type =0, or omitted. There is a mistake in the help video for this

question. Sorry for the mistake.) 14. What is the

future value of weekly payments of $25 for six years at 10 percent? ($10,673.90) 15. At the end of

this month, Bryan will start saving $80 a month for retirement through his

company's retirement plan. His employer will contribute an additional $.25

for every $1.00 that Bryan saves. If he is employed by this firm for 25 more

years and earns an average of 11 percent on his retirement savings, how much

will Bryan have in his retirement account 25 years from

now? ($157,613.33) 16. Sky

Investments offers an annuity due with semi-annual payments for 10 years at 7

percent interest. The annuity costs $90,000 today. What is the amount of each

annuity payment? ($6,118.35) 17. Mr. Jones

just won a lottery prize that will pay him $5,000 a year for thirty years. He

will receive the first payment today. If Mr. Jones can earn 5.5 percent on

his money, what are his winnings worth to

him today? ($76,665.51) 18. You want to

save $75 a month for the next 15 years and hope to earn an average rate of

return of 14 percent. How much more will you have at the end of the 15 years

if you invest your money at the beginning of each month rather than the end

of each month? ($530.06) 19. What is the

effective annual rate of 10.5 percent compounded

semi-annually? (10.78%) 22. What is the

effective annual rate of 12.75 percent compounded daily? (13.60 percent) 23. Your

grandparents loaned you money at 0.5 percent interest per month. The APR on

this loan is _____ percent and the EAR is _____ percent. (6.00; 6.17) FYI only: help for homework Part 1(Qs

1-2) Part 2(Qs

4-8) Part 3(Qs 9-12) Part 4(Qs

13-16) Part 5(Qs

17-20) Part 6(Qs 21-24) (Q13: Bridget’s is an annuity

due, so abs(fv(8%/12, 10*12, 150, 0, 1)) --- type

=1; Jordan’s is an ordinary annuity, so abs(fv(8%/12, 10*12, 150, 0) --- type

=0, or omitted. There is a mistake in the help video for this question. Sorry

for the mistake.) Quiz 1- Help Videos |

Calculators Time

Value of Money Calculator © 2002 - 2019 by Mark A. Lane,

Ph.D. Math Formula FV = PV *(1+r)^n PV = FV /

((1+r)^n) N = ln(FV/PV) / ln(1+r) Rate = (FV/PV)1/n -1 Annuity: N = ln(FV/C*r+1)/(ln(1+r)) Or N = ln(1/(1-(PV/C)*r)))/ (ln(1+r))

EAR = (1+APR/m)^m-1 APR = (1+EAR)^(1/m)*m Excel Formulas To get FV, use FV

function. =abs(fv(rate, nper, pmt, pv)) To get PV, use PV

function = abs(pv(rate, nper, pmt, fv)) To get r, use rate

function = rate(nper, pmt, pv, -fv) To get number of years, use nper function = nper(rate, pmt, pv, -fv) To get annuity payment, use PMT

function = abs(pmt(rate, nper, pv, -fv)) To get Effective rate (EAR), use

Effect

function = effect(nominal_rate, npery) To get annual percentage rate

(APR), use nominal function APR = nominal(effective rate, npery) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week3 |

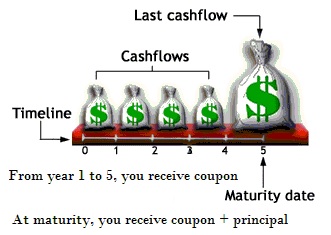

Chapter

7 Bond Pricing Simplified Balance Sheet of WalMart

https://www.wsj.com/market-data/quotes/WMT/financials/annual/balance-sheet For discussion: · What is this “long term debt”? · Who is the lender of this “long term

debt”? So this long term debt is

called bond in the financial market. Where can you find the pricing

information and other specifications of the bond issued by WMT?

How

Bonds Work (video) Investing

Basics: Bonds(video) FINRA – Bond market information http://finra-markets.morningstar.com/BondCenter/Default.jsp WAL-MART STORES INC

http://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C104227&symbol=WMT.GP Coupon

Rate

7.550 % Maturity

Date

02/15/2030

Credit and Rating

Elements

Classification

Elements

Special

Characteristics

Issue

Elements

Bond

Elements

For class discussion: Interest rates are

low. So, shall you invest in short

term bond or long term bond? In class exercise: 1.

Find

bonds sponsored by WMT ·

just go to www.finra.org, è Investor center è market data è bond è corporate bond ·

Search for Walmart bonds For

discussion: ·

What are the ratings of the WMT bonds? How does the rating

agency rate a bond? Altman Z Score video

·

Why some WMT bonds are priced higher than the par value, while

others are priced at a discount? ·

Why some WMT bonds have higher coupon rates than other bonds?

How does WMT determine the coupon rates? ·

Why some WMT bonds have higher yields than other bonds? Does a

bond’s yield change daily? ·

Which of the WMT bonds are the most attractive one to you? Why? http://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C610043&symbol=WMT4117477 2. 2.

Understand what is coupon, coupon rate, yield, yield to maturity, market price,

par value, maturity, annual bond, semi-annual bond, current yield. 3. 3.

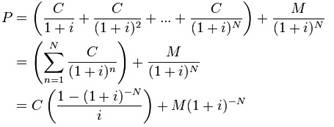

Understand how to price bond Bond

price = abs(pv(yield, maturity, coupon, 1000)) ------- annual coupon Bond

price = abs(pv(yield/2, maturity*2, coupon/2,

1000)) ------- semi-annual coupon Also change the yield and observe the

price changes. Summarize the price change pattern and draw a graph to

demonstrate your findings. Again, when yield to maturity of

this semi_annual coupon bond is

4%, how should this WMT bond sell for? 4. Understand

how to calculate bond returns Yield

to maturity = rate(maturity, coupon, -market price, 1000) ----

annual coupon Yield

to maturity = rate(maturity*2, coupon/2, -market price, 1000)*2

----- semi-annual coupon Bond

Calculator (www.jufinance.com/bond) For example, when the annual coupon bond

is selling for $1,100, what is its return to investors? For example, when the semi-annual

coupon bond is selling for $1,100, what is its return to investors? 5. Current

yield: For the above bond, calculate current yield. 6. Zero

coupon bond: coupon=0 and treat it as semi-annual coupon bond. Example:

A ten year zero coupon bond is selling for $400. How

much is its yield to maturity? A ten year zero coupon bond’s yield to

maturity is 10%. How much is its price? 7. Understand

what is bond rating and how to read those

ratings. a. Who

are Moody, S&P and Fitch? b. What

is WMT’s rating? c. Is

the rating for WMT the highest? d. Who

earned the highest rating? Supplement: Municipal Bond

For

class discussion: ·

Shall you invest in municipal bonds? ·

Are municipal bonds better than investment

grade bonds? The risks investing in a bond ·

Bond investing: credit Risk (video) ·

Bond investing: Interest rate risk (video) ·

Bond investing: increased risk

(video) Market data website: 1. FINRA http://finra-markets.morningstar.com/BondCenter/Default.jsp (FINRA bond market

data) 2. WSJ Market watch on Wall Street Journal has

daily yield curve and bond yield information. http://www.marketwatch.com/tools/pftools/ https://www.youtube.com/watch?v=yph8TRldW6k 3. Bond Online http://www.bondsonline.com/Todays_Market/ Homework 1. Firm AAA’s bonds

price = $850. Coupon rate is 5% and par is $1,000. The bond has

six years to maturity. Calculate for current yield? (5.88%) 2. For a zero

coupon bond, use the following information to calculate its yield to

maturity. (14.35%) Years

left to maturity = 10 years. Price = $250. 3. For a

zero coupon bond, use the following information to calculate its price. ($456.39)

Years left to maturity = 10 years. Yield = 8%. 4. Imagine that an annual

coupon bond’s coupon rate = 5%, 15 years left. Draw price-yield profile. (hint: Change interest rate, calculate new price and draw

the graph). 5. IBM 5 year 2% annual coupon bond is

selling for $950. How much this IBM bond’s YTM? 3.09% 6. IBM 10 year

4% semi-annual coupon bond is selling for $950. How much is

this IBM bond’s YTM? 4.63% 7. IBM 10 year 5% annual coupon

bond offers 8% of return. How much is the price of this

bond? 798.7 8. IBM 5 year 5% semi-annual coupon

bond offers 8% of return. How much is the price of this bond? $878.34 9. IBM 20 year zero

coupon bond offers 8% return. How much is the price of this bond? 208.29 10. Collingwood

Homes has a bond issue outstanding that pays an 8.5 percent coupon and

matures in 18.5 years. The bonds have a par value of $1,000 and a market

price of $964.20. Interest is paid semiannually. What is the yield to

maturity? (8.90%) 11. Grand Adventure

Properties offers a 9.5 percent coupon bond with annual payments. The yield

to maturity is 11.2 percent and the maturity date is 11 years from today.

What is the market price of this bond if the face value is $1,000? ($895.43) 12. The zero coupon

bonds of D&L Movers have a market price of $319.24, a face value of

$1,000, and a yield to maturity of 9.17 percent. How many years is it until

these bonds mature? (12.73 years) 13. A zero coupon bond

with a face value of $1,000 is issued with an initial price of $212.56. The

bond matures in 25 years. What is yield to maturity? (6.29%) 14. The bonds issued by Stainless

Tubs bear a 6 percent coupon, payable semiannually. The bonds

mature in 11 years and have a $1,000 face value. Currently, the bonds sell

for $989. What is the yield to maturity? (6.14%) Videos

--- homework help Part I Q1-Q2 Q3-Q4 Q5-Q8 Q9-Q14 Quiz

2- Help

Video |

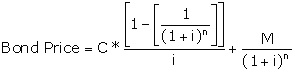

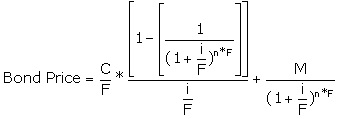

Bond Pricing Formula (FYI)

Bond Pricing Excel Formula Summary of

bond pricing excel functions To calculate bond price (annual coupon bond): Price=abs(pv(yield to maturity, years left to maturity, coupon

rate*1000, 1000) To calculate yield to maturity (annual coupon bond):: Yield

to maturity = rate(years left to maturity, coupon rate *1000, -price, 1000) To calculate bond price (semi-annual coupon bond): Price=abs(pv(yield to maturity/2, years left to maturity*2,

coupon rate*1000/2, 1000) To calculate yield to maturity (semi-annual coupon

bond): Yield

to maturity = rate(years left to maturity*2, coupon rate *1000/2,

-price, 1000)*2 To calculate number of years left(annual coupon bond) Number

of years =nper(yield to maturity, coupon

rate*1000, -price, 1000) To calculate number of years left(semi-annual coupon bond) Number

of years =nper(yield to

maturity/2, coupon rate*1000/2, -price, 1000)/2 To calculate coupon (annual coupon bond) Coupon

= pmt(yield to maturity, number of years left, -price, 1000) Coupon

rate = coupon / 1000 To calculate coupon (semi-annual coupon bond) Coupon

= pmt(yield to maturity/2, number of years left*2, -price, 1000)*2 Coupon

rate = coupon / 1000 Low interest on Walmart

bonds not worthy of investment (FYI) MONEY

& INVESTING June

28, 2018 ericBRETAN https://naples.floridaweekly.com/articles/low-interest-on-walmart-bonds-not-worthy-of-investment/ What do

you do if you need a few extra bucks and don’t have

the money? If it is a small purchase, you may put it on your credit card. If

it is something larger, you may have to go to the bank and get a loan. But

what if you are a business and need more than a few extra bucks? What if you

need $16 billion — what do you do then? Walmart recently faced this problem after its acquisition

of the Indian E-commerce company Flipkart Group.

The solution was to issue corporate bonds to the public in return for the

cash needed to fund the purchase. But just what are corporate bonds, how are

they priced and issued, and are they a good investment? A bond

is simply an investment where the investor loans money to a borrower in

exchange for a set interest rate for a given period of time. At the bond’s maturity, the investor receives the principal back as

well. For bonds issued by corporations, typically interest is paid every six

months although some bonds pay quarterly or monthly interest payments.

Corporations issue bonds that mature anywhere from less than a year (this

debt is often called commercial paper) to 30 years or more. Large companies

like Disney or Coca-Cola have even issued 100-year maturity bonds. To

issue a bond, a company typically will meet with a bank or investment bank to

structure the investment. First, the parties will determine the size of the

bond. If the company borrows too much, it may hurt its credit rating or have

trouble making the interest payments. If it borrows too little, the borrower

may not have the funds to maximize its growth or business opportunities.

Second, the company and bank will determine the appropriate maturity for the

bonds. Factors such as the use of the funds, overall interest rate

environment, and credit worthiness of the borrower all will affect this

decision. Finally,

the bank will price the bonds. Most bonds are issued at par meaning they are

issued at the face value of the bond, often $1,000. The “price” of the bond is then the interest rate that the buyer of

the bond will receive. For example, a company can issue a 10 year bond at par

that is priced at an interest rate of 6.2 percent. The interest rate of a

corporate bond is determined by two factors. The first is the overall rate

environment, typically determined by U.S. government debt rates. The second is

the credit worthiness of the issuer, which determines the additional interest

that investors demand to hold the bonds over Treasury rates. This “spread” can be very small for well

capitalized and stable companies like Microsoft or Apple or very large for risky

biotech firms. After

the interest rate of the bonds is set, the investments are sold to the public

at the face value of the bonds. Going forward, however, the bonds will trade

on the open market and will either trade at a premium or discount to the face

value. If overall interest rates go up or the credit worthiness of the

company declines, the bond’s value will decline as

investors sell the bonds to buy more stable bonds or bonds with higher

interest rates. Conversely, if interest rates decline or the company credit

strengthens, the bonds’ value will rise as investors

buy the bond. In the

case of Walmart, several maturities of bonds were

offered to investors to fund the staggering $16 billion needed to fund its

acquisition. The longest dated bonds, 30 years to maturity, were priced at

just 1.05 percent over the 30 year Treasury rate or around 4.1 percent. This

very low rate speaks very highly of the credit worthiness of Walmart. However, one of the main bond credit ratings

companies, S&P, stated that the company’s strong

AA credit rating may be placed under review because of the significant

acquisitions the company has recently made and the resulting debt issued to

pay for them. Therefore, I would be hesitant to tie up my money for 30 years

at such a low interest rate and feel that there are plenty of better

investments to earn a better risk adjusted return. ¦ — Eric Bretan, the co- owner of Rick’s

Estate & Jewelry Buyers in Punta Gorda, was a

senior derivatives marketer and investment banker for more than 15 years at

several global banks. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 4 |

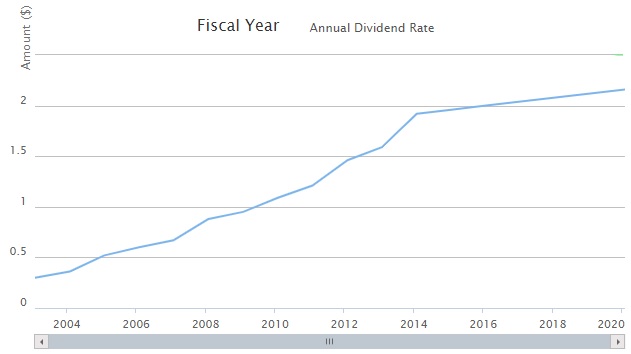

Chapter

8 Stock Valuation Part I Dividend payout and Stock Valuation For

class discussion: · Why

can we use dividend to estimate a firm’s intrinsic value? · Are future dividends predictable? Ford’s dividends: https://www.nasdaq.com/market-activity/stocks/f/dividend-history

· Refer to the following table for Wal-mart (WMT’s dividend history) http://stock.walmart.com/investors/stock-information/dividend-history/default.aspx

Stock Splits

Wal-Mart Stores, Inc. was incorporated on Oct. 31, 1969. On

Oct. 1, 1970, Walmart offered 300,000 shares of its

common stock to the public at a price of $16.50 per share. Since that time,

we have had 11 two-for-one (2:1) stock splits. On a purchase of 100 shares at

$16.50 per share on our first offering, the number of shares has grown as

follows:

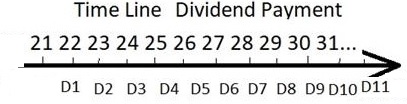

Can you

estimate the expected dividend in 2022? And in 2023? And on and on…

Can you write down the

math equation now? WMT stock price = ? Can you calculate now? It

is hard right because we assume dividend payment goes to infinity. How can we

simplify the calculation? We can assume that

dividend grows at certain rate, just as the table on the right shows. Discount rate is r (based

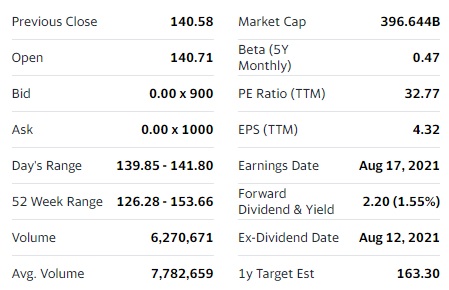

on Beta and CAPM that we will learn in chapter 13) From finance.yahoo.com

What does each item indicate? From finviz.com https://finviz.com/quote.ashx?t=WMT

Part II: Constant

Dividend Growth-Dividend growth model Calculate stock prices 1) Given next dividends and price Po= Po= Po= Po= ……

Refer to http://www.calculatinginvestor.com/2011/05/18/gordon-growth-model/ · Now let’s apply this

Dividend growth model in problem solving. Constant dividend growth

model calculator (www.jufinance.com/stock) Equations ·

Po= D1/(r-g) or Po= Do*(1+g)/(r-g) ·

r = D1/Po+g = Do*(1+g)/Po+g ·

g= r-D1/Po = r- Do*(1+g)/Po ·

·

Capital Gain yield = g ·

·

Dividend Yield = r – g = D1 / Po = Do*(1+g) / Po ·

D1=Do*(1+g); D2= D1*(1+g);

D3=D2*(1+g)… Exercise: 1.

Consider the

valuation of a common stock that paid $1.00 dividend at the end of the last

year and is expected to pay a cash dividend in the future. Dividends are

expected to grow at 10% and the investors required rate of return is 17%. How

much is the price? How much is the dividend yield? Capital gain yield? 2.

The current market

price of stock is $90 and the stock pays dividend of $3 with a growth rate of

5%. What is the return of this stock? How much is the dividend yield? Capital

gain yield? Part III:

Non-Constant Dividend Growth Calculate stock prices 1) Given next dividends and price Po= Po= Po= Po= …… Non-constant dividend growth model calculator (https://www.jufinance.com/dcf/) Equations Pn = Dn+1/(r-g) = Dn*(1+g)/(r-g), since

year n, dividends start to grow at a constant rate. Where Dn+1= next dividend in year n+1; Do = just paid dividend in year n; r=stock return; g= dividend growth rate; Pn= current market price in year n; Po = npv(r, D1, D2,

…, Dn+Pn) Or, Po = D1/(1+r) + D2/(1+r)2 + … +

(Dn+Pn)/(1+r)n In class exercise for non-constant dividend growth model

(similar to quiz questions) 1. You

expect AAA Corporation to generate the following free cash flows over the

next five years:

Since

year 6, you estimate that AAA's free cash flows will grow at 6% per year.

WACC of AAA = 15% ·

Calculate the enterprise

value for DM Corporation. ·

Assume that AAA has $500 million

debt and 14 million shares outstanding, calculate its stock price. Answer:

2. AAA pays no dividend currently. However,

you expect it pay an annual dividend of $0.56/share 2 years from now with a

growth rate of 4% per year thereafter. Its equity cost = 12%, then its stock

price=? Answer: Do=0 D1=0 D2=0.56 g=4% after year 2 è P2 = D3/(r-g), D3=D2*(1+4%) è P2 = 0.56*(1+4%)/(12%-4%) = 7.28 r=12% Po=? Po = NPV(12%, D1, D2+P2), D2 = 0.56,

P2=7.28. SO Po = NPV(12%, 0,0.56+7.28) = 6.25 (Note: for non-constant growth model,

calculate price when dividends start to grow at the constant rate. Then use

NPV function using dividends in previous years, last dividend plus price. Or

use calculator at https://www.jufinance.com/dcf/

) 3.

Required return =12%. Do = $1.00, and

the dividend will grow by 30% per year for the next 4 years. After t = 4, the dividend is expected to

grow at a constant rate of 6.34% per year forever. What is the stock price ($40)? (similar to quiz question) Answer: Do=1 D1 = 1*(1+30%) = 1.3 D2= 1.3*(1+30%) = 1.69 D3 = 1.69*(1+30%) = 2.197 D4 = 2.197*(1+30%) = 2.8561 D5 = 2.8561*(1+6.34%), g=6.34% P4 = D5/(r-g) = 2.8561*(1+6.34%) /(12%

- 6.34%) Po = NPV(12%, 1.3, 1.69,

2.197, 2.8661+2.8561*(1+6.34%) /(12% - 6.34%)) = 40 Or use calculator at https://www.jufinance.com/dcf/

Part IV: How to

pick stocks? (FYI) How to

pick stocks – Does it work? PE ratio Stock screening tools ·

Reuters stock screener to help select stocks http://stockscreener.us.reuters.com/Stock/US/ ·

FINVIZ.com http://finviz.com/screener.ashx use screener on finviz.com to narrow down your choices of

stocks, such as PE<15, PEG<1, ROE>30% ·

WSJ stock screen http://online.wsj.com/public/quotes/stock_screener.html ·

Simply the Web's Best Financial Charts You can find analyst rating from MSN money For instance, ANALYSTS RATINGS Zacks average brokerage recommendation is Moderate Buy

Summary of stock

screening rules from class discussion PEG<1 PE<15 (? FB’s PE>100?) Growth

rate<20 ROE>10% Analyst

ranking: strong buy only Zacks average =1 (from Ranking stocks using PEG

ratio) current

price>5 How to pick stocks Capital Asset Pricing Model (CAPM)Explained https://www.youtube.com/watch?v=JApBhv3VLTo Ranking stocks using PEG ratio https://www.youtube.com/watch?v=bekW_hTehNU HOMEWORK 1.

Northern Gas

recently paid a $2.80 annual dividend on its common stock. This dividend

increases at an average rate of 3.8 percent per year. The stock is currently

selling for $26.91 a share. What is the market rate of return? (14.60

percent) 2. Douglass Gardens pays an annual dividend that is expected

to increase by 4.1 percent per year. The stock commands a market rate of return

of 12.6 percent and sells for $24.90 a share. What is the expected amount of

the next dividend? ($2.12) 3. IBM just paid $3.00 dividend per share to investors. The

dividend growth rate is 10%. What is the expected dividend of the next year? ($3.3) 4. The current market price of stock is $50 and the stock is

expected to pay dividend of $2 with a growth rate of 6%. How much is the

expected return to stockholders? (10%) 5.

Investors of Creamy Custard common stock earns 15% of return. It just paid a dividend of

$6.00 and dividends are expected to grow at a rate of 6% indefinitely. What

is expected price of Creamy Custard's stock? ($70.67) Homework

Video of this week Quiz 3- Help Video (have non-constant growth dividend

questions) Part I Part II Part

III Part IV

|

P/E Ratio Summary by

industry (FYI) --- Thanks to Dr Damodaran Data Used: Multiple data services Date of Analysis: Data used is as of January 2021 Download as an excel file instead: http://www.stern.nyu.edu/~adamodar/pc/datasets/pedata.xls For global datasets: http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Details

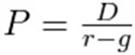

about how to derive the model mathematically (FYI) The Gordon growth model is a simple discounted cash flow

(DCF) model which can be used to value a stock, mutual fund, or even the

entire stock market. The model is named after Myron Gordon who first

published the model in 1959. The Gordon model assumes that a financial security

pays a periodic dividend (D) which grows at a constant rate

(g). These growing dividend payments are assumed to continue forever.

The future dividend payments are discounted at the required rate of return

(r) to find the price (P) for the stock or fund. Under these simple assumptions, the price of the

security is given by this equation:

In this equation, I’ve used the “0” subscript

on the price (P) and the “1” subscript on the dividend (D) to

indicate that the price is calculated at time zero and the dividend is the

expected dividend at the end of period one. However, the equation is

commonly written with these subscripts omitted. Obviously, the assumptions built into this

model are overly simplistic for many real-world valuation problems. Many

companies pay no dividends, and, for those that do,

we may expect changing payout ratios or growth rates as the

business matures. Despite

these limitations, I believe spending some time experimenting with the

Gordon model can help develop intuition about the relationship between

valuation and return. Deriving the Gordon Growth Model Equation

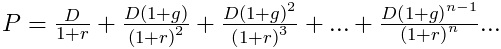

The Gordon growth model calculates the present value of

the security by summing an infinite series of discounted dividend payments

which follows the pattern shown here:

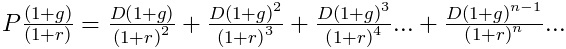

Multiplying both sides of the previous equation by

(1+g)/(1+r) gives:

We can then subtract the second equation from the first

equation to get:

Rearranging and simplifying:

Finally,

we can simplify further to get the Gordon growth model equatio |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

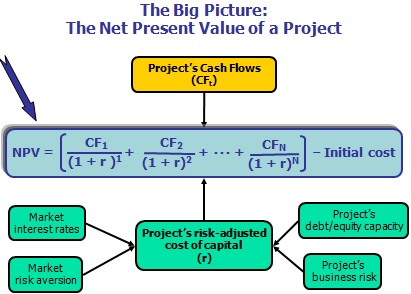

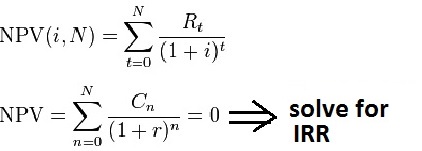

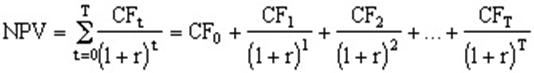

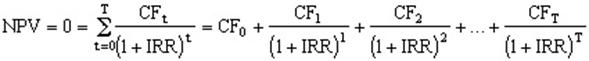

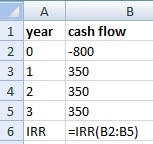

Chapter 9 Capital

Budgeting

1. NPV Excel syntax Syntax NPV(rate,value1,value2, ...) Rate is the rate of discount over

the length of one period. Value1, value2, ...

are 1 to 29 arguments representing the payments and income. · Value1, value2, ... must

be equally spaced in time and occur at the end of

each period. NPV uses the order of value1, value2, ... to interpret the order of cash flows. Be

sure to enter your payment and income values in the correct sequence. 2. IRR Excel syntax Syntax IRR(values, guess) Values is an array or a reference to cells that contain

numbers for which you want to calculate the internal rate of return. Guess is a number that you guess is

close to the result of IRR.

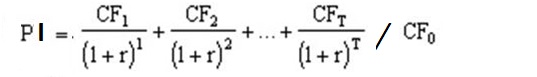

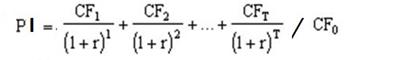

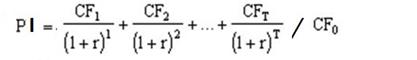

Or, PI =

NPV / CFo +1 Profitable

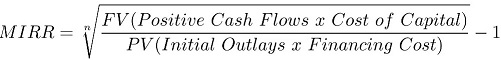

index (PI) =1 + NPV / absolute value of CFo 3. MIRR( values, finance_rate, reinvest_rate ) Where

the function arguments are as follows:

Modified Rate of Return:

Definition & Example (video)

https://study.com/academy/lesson/modified-rate-of-return-definition-example.html NPV, IRR, Payback Period calculator I NPV, IRR,

Payback Period calculator II

Excel Template - NPV, IRR, MIRR, PI, Payback, Discounted

payback In class exercise Part I: Single project 1.

How much is MIRR? IRR? Payback period?

Discounted payback period? NPV? WACC: 11.00% Year 0 1 2 3 Cash

flows -$800 $350 $350 $350 Answer: 1)

NPV: NPV = -800 + 350/(1+11%) +

350/(1+11%)2 + 350/(1+11%)3 = 55.30 Or in excel: = npv(11%, 350,

350, 350)-800 = 55.30 2)

IRR:

So NPV = 0 = -800 +

350/(1+IRR) + 350/(1+IRR)2 + 350/(1+IRR)3 , use Solver,

can get IRR = 14.93% Or in excel:

3)

PI: profitable index

SO, PI= (350/(1+11%) + 350/(1+11%)2 + 350/(1+11%)3

) / 800 = 1.069 Or PI = NPV/800 + 1 = 55.30/800 + 1 = 1.069 4)

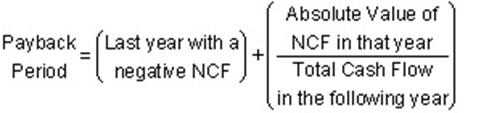

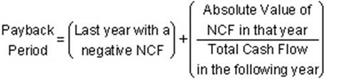

Payback period:

A portion of the third year = (800-350-350)/350 = 100/350 =

0.2857 So it takes 2 + 0.2857 = 2.2857 years to pay off the debt of

$800. 5)

Discounted payback period:

Note: All the cash flows in the above equation should be the

present values.

A portion of the third year = (800-315.32-284.07)/255.92 =

0.78 So it takes 2 + 0.78 = 2.78 years to pay off the debt of $800.

Or use the calculator at https://www.jufinance.com/capital/ Part

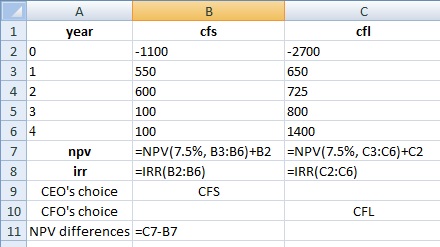

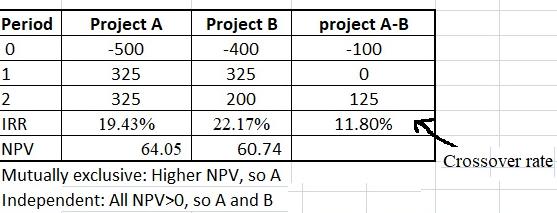

II: Multi-Projects 1.

Projects S and L, whose cash flows are

shown below. These projects are

mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best

selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the

project with the higher IRR rather than the one with the higher NPV, how

much, if any, value will be forgone, i.e., what's the chosen NPV versus the

maximum possible NPV? Note that (1) “true value” is measured by NPV,

and (2) under some conditions the choice of IRR vs. NPV will have no effect

on the value gained or lost. WACC: 7.50% Year 0 1 2 3 4 CFS -$1,100 $550 $600 $100 $100 CFL -$2,700 $650 $725 $800 $1,400 Answer:

If the required rate of return is 10%. Which

project shall you choose? 1) How

much is the cross over rate? (answer:

11.8%) 2) How

is your decision if the required rate of return is 13%? (answer: NPV of

B>NPV of A) · Rule for mutually exclusive projects: (answer:

Choose B) · What about the two projects are

independent? (answer: Choose both)

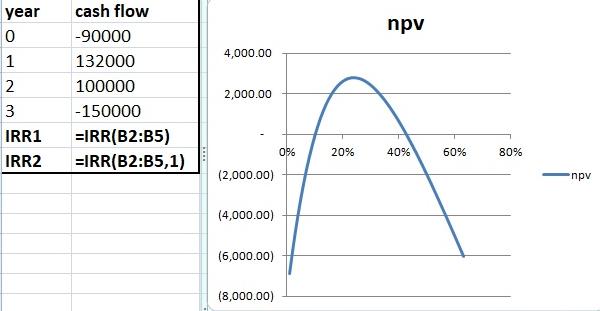

Part III More on IRR – (non-conventional cash flow) Suppose an investment will cost

$90,000 initially and will generate the following cash flows: – Year 1: 132,000 – Year 2: 100,000 – Year 3: -150,000 The required return is 15%.

Should we accept or reject the project? 1) How does the

NPV profile look like? (Answer: Inverted NPV profile) 2) IRR1= 10.11% --

answer 3) IRR2= 42.66% --

answer Answer:

HOMEWORK Year Cash flows 1 $8,000 2 4,000 3 3,000 4 5,000 5 10,000 1) How

much is the payback period (approach one)? ----

4 years 2) If

the firm has a 10% required rate of return. How much is NPV (approach

2)?-- $2456.74 3) If

the firm has a 10% required rate of return. How much is IRR (approach

3)? ---- 14.55% 4) If

the firm has a 10% required rate of return. How much is PI (approach

4)? ---- 1.12 Question 2: Project with an initial cash outlay of $60,000 with

following free cash flows for 5 years. Year FCF Initial

outlay –60,000 1 25,000 2 24,000 3 13,000 4 12,000 5 11,000 The firm has a 15% required rate of return. Calculate payback period, NPV, IRR and PI.

Analyze your results. Question 3: Mutually Exclusive

Projects 1) Consider

the following cash flows for one-year Project A and B, with required rates of

return of 10%. You have limited capital and can invest in one but one

project. Which one? § Initial

Outlay: A = -$200; B = -$1,500 § Inflow: A

= $300; B = $1,900 2) Example:

Consider two projects, A and B, with initial outlay of $1,000, cost of

capital of 10%, and following cash flows in years 1, 2, and 3: A:

$100 $200 $2,000 B:

$650 $650 $650 Which

project should you choose if they are mutually exclusive? Independent?

Crossover rate? (mutually

exclusive: A’s NPV=758.83 > B’s NPV = 616.45, so choose A; Independent,

choose all positive NPV, so choose both; Crossover

rate = 21.01%. The calculator does not work. Use IRR in Excel) Quiz 4- chapter 9 – (no

video prepared; Could use the calculator) Homework help videos (chapter 9) |

Simple

Rules’ for Running a Business

From the 20-page cellphone contract

to the five-pound employee handbook, even the simple things seem to be getting

more complicated. Companies have been complicating things for themselves, too—analyzing hundreds of factors when making decisions, or

consulting reams of data to resolve every budget dilemma. But those

requirements might be wasting time and muddling priorities. So argues Donald Sull, a lecturer at the Sloan School of Management at the

Massachusetts Institute of Technology who has also worked for McKinsey &

Co. and Clayton, Dubilier &

Rice LLC. In the book Simple Rules: How to Thrive in a Complex World,

out this week from Houghton

Mifflin Harcourt HMHC -1.36%,

he and Kathleen Eisenhardt of

Stanford University claim that straightforward guidelines lead to better

results than complex formulas. Mr. Sull recently

spoke with At Work about what companies can do to simplify, and why five

basic rules can beat a 50-item checklist. Edited excerpts: WSJ: Where, in the business

context, might “simple rules” help more than a complicated

approach? Donald Sull: Well, a common

decision that people face in organizations is capital allocation. In many organizations,

there will be thick procedure books or algorithms–one

company I worked with had an algorithm that had almost 100 variables for

every project. These are very cumbersome approaches to making decisions and

can waste time. Basically, any decision about how to focus resources—either people or money or attention—can

benefit from simple rules. WSJ: Can you give an example of

how that simplification works in a company? Sull: There’s a German company called Weima GmBH that makes shredders. At one point,

they were getting about 10,000 requests and could only fill about a thousand

because of technical capabilities, so they had this massive problem of

sorting out which of these proposals to pursue. They had a very detailed checklist with 40 or 50 items. People

had to gather data and if there were gray areas the proposal would go to

management. But because the data was hard to obtain and there were so many

different pieces, people didn’t always fill out the

checklists completely. Then management had to discuss a lot of these

proposals personally because there was incomplete data. So top management is

spending a disproportionate amount of time discussing this low-level stuff. Then Weima came

up with guidelines that the frontline sales force and engineers could use to

quickly decide whether a request fell in the “yes,” “no” or “maybe” category. They did it with five

rules only, stuff like “Weima had to collect at least 70% of the

price before the unit leaves the factory.” After that, only the “maybes” were sent to management. This

dramatically decreased the amount of time management spend evaluating these

projects–that time was decreased by almost a factor

of 10. Or, take Frontier Dental Laboratories in Canada. They were

working with a sales force of two covering the entire North American market.

Limiting their sales guidelines to a few factors that made someone likely to

be receptive to Frontier—stuff like “dentists

who have their own practice” and “dentists

with a website”—helped focus their efforts and

increase sales 42% in a declining market. WSJ: Weima used five factors—is

that the optimal number? And how do you choose which rules to follow? Sull: You should have four to six rules. Any more than that, you’ll spend too much time trying to follow

everything perfectly. The entire reason simple rules help is because they

force you to prioritize the goals that matter. They’re

easy to remember, they don’t confuse or stress you,

they save time. They should be tailored to your specific goals, so you choose the

rules based on what exactly you’re trying to achieve.

And you should of course talk to others. Get information from different

sources, and ask them for the top things that worked for them. But focus on

whether what will work for you and your circumstances. WSJ: Is there a business leader

you can point to who has embraced the “simple rules” guideline? Donald Sull: Let’s look at when Alex Behring took over America

Latina Logistica SARUMO3.BR +1.59%,

the Brazilian railway and logistics company. With a budget of $15 million,

how do you choose among $200 million of investment requests, all of which are

valid? The textbook business-school answer to this is that you run the

NPV (net present value) test on each project and rank-order them by NPV. Alex

Behring knows this. He was at the top of the class at Harvard Business School. But instead Similarly, the global-health arm of the Gates Foundation gets

many, many funding requests. But since they know that their goal is to have

the most impact worldwide, they focus on projects in developing countries

because that’s where the money will stretch farther. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

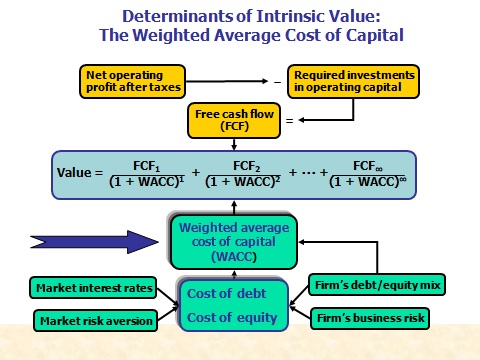

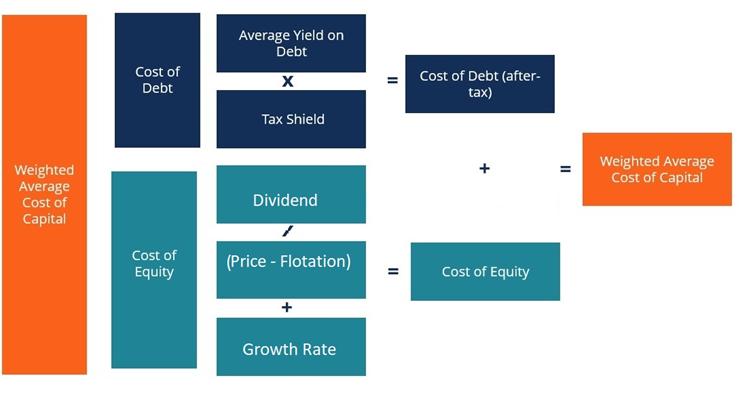

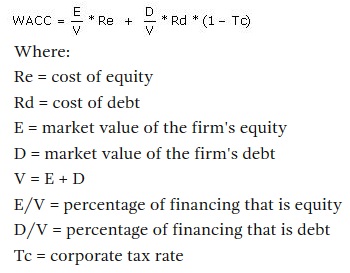

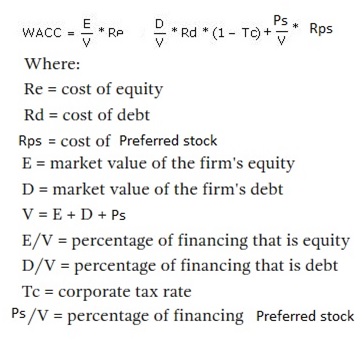

Chapter 14 Cost of Capital (optional,

not required)

For class discussion: · What is WACC? · Why is it important? · WACC increases, good or bad to stock holders? · How to apply WACC to figure out firm value?

One option (if beta is given, refer to chapter 13)

Another option (if dividend is given):

WACC Formula

WACC calculator (annual

coupon bond) (www.jufinance.com/wacc)

WACC calculator (semi-annual coupon bond) (www.jufinance.com/wacc_1)

WACC Calculator help

videos FYI

Summary of Equations

Discount rate to figure out the value of projects is called WACC (weighted average cost of capital)

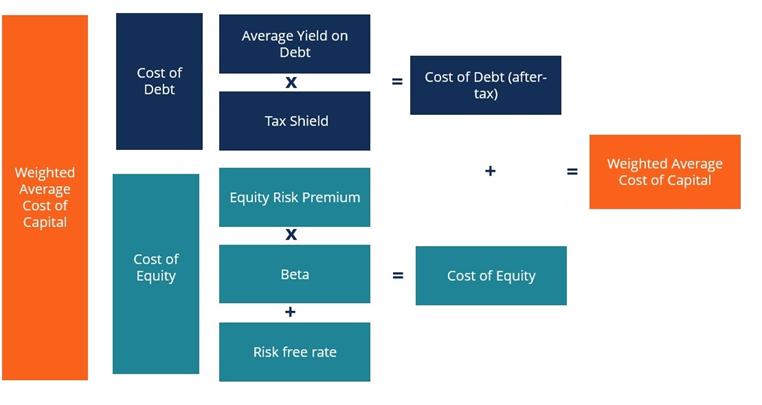

WACC = weight of debt * cost of debt + weight of equity *( cost of equity)

Wd= total debt / Total capital = total borrowed / total capital We= total equity/ Total capital Cost of debt = rate(nper, coupon, -(price – flotation costs), 1000)*(1-tax

rate) Cost of Equity = D1/(Po – Flotation Cost) + g D1: Next period dividend; Po: Current stock price; g: dividend growth rate Note: flotation costs = flotation percentage * price

Or if beta is given, use CAPM model (refer to chapter 13) Cost of equity = risk free

rate + beta *(market return – risk free rate) Cost of equity = risk free rate +

beta * market risk premium

In Class Exercise: A firm borrows money from bond market. The price they paid is $950 for the bond with 5% coupon rate and 10 years to mature. Flotation cost is $40. For the new stocks, the expected dividend is $2 with a growth rate of 10% and price of $40. The flotation cost is $4. The company raises capital in equal proportions i.e. 50% debt and 50% equity (such as total $1m raised and half million is from debt market and the other half million is from stock market). Tax rate 34%. What is WACC (weighted average cost of capital, cost of capital)? (Answer: 9.84%) 1) Why does the firm raise capital from the financial market? Is there of any costs of doing so? What do you think? 2) What is cost of debt? (Kd = rate(nper, coupon, -(price – flotation costs $)), 1000)*(1-tax rate)) 3) Cost of equity? (Ke = (D1/(Price – flotation costs $)) +g, or Ke = Rrf + Beta*MRP)) Why no tax adjustment like cost of debt? 4) WACC=Cost of capital = Percentage of Debt * cost of debt + percentage of stock * cost of stock = Wd*Kd + We* Ke Meaning: For a dollar raised in the capital market from debt holders and stockholders, the cost is WACC (or WACC * 1$ = several cents, and of course, the lower the better but many companies do not have good credits)

No

homework for chapter 14

|

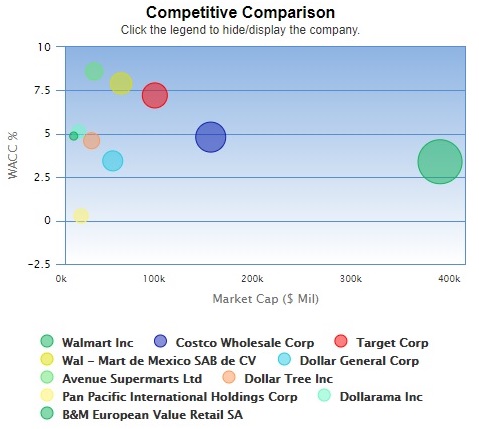

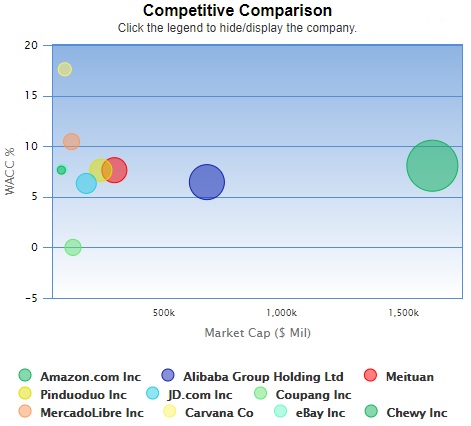

Walmart Inc (NYSE:WMT) WACC %:3.20%

(7/27/2021) As of today, Walmart Inc's

weighted average cost of capital is 3.20%. Walmart

Inc's ROIC % is 8.81% (calculated

using TTM income statement data). Walmart Inc

generates higher returns on investment than it costs the company to raise the

capital needed for that investment. It is earning excess returns. A firm that

expects to continue generating positive excess returns on new investments in

the future will see its value increase as growth increases. https://www.gurufocus.com/term/wacc/WMT/WACC/Walmart%2BInc Amazon.com

Inc (NAS:AMZN) WACC %:7.80% (7/27/2021) As of today, Amazon.com Inc's weighted average

cost of capital is 7.80%. Amazon.com Inc's ROIC % is 13.47% (calculated

using TTM income statement data). Amazon.com Inc generates higher returns on

investment than it costs the company to raise the capital needed for that

investment. It is earning excess returns. A firm that expects to continue

generating positive excess returns on new investments in the future will see

its value increase as growth increases. https://www.gurufocus.com/term/wacc/AMZN/WACC-Percentage/Amazon.com%20Inc

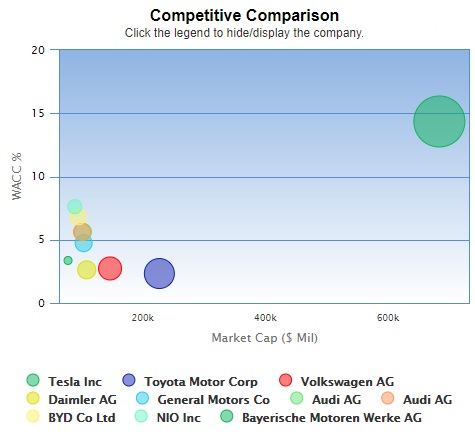

Tesla (NAS:TSLA) WACC

%:13.2% (7/27/2021) As of today, Tesla’s weighted average cost of

capital is 13.2%. Apple Inc's ROIC % is 5.66% (calculated

using TTM income statement data). https://www.gurufocus.com/term/wacc/NAS:TSLA/WACC-/Tesla

Cost of Capital by Sector (US) Date of Analysis: Data used is as of January 2021

http://people.stern.nyu.edu/adamodar/New_Home_Page/datafile/wacc.htm |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

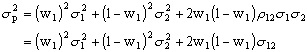

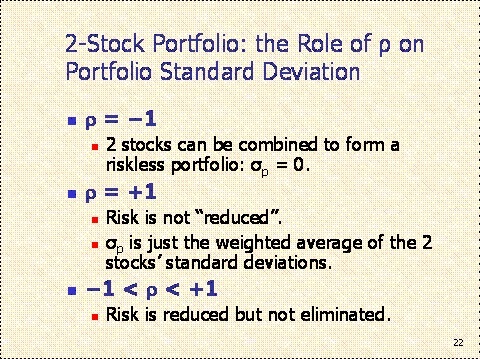

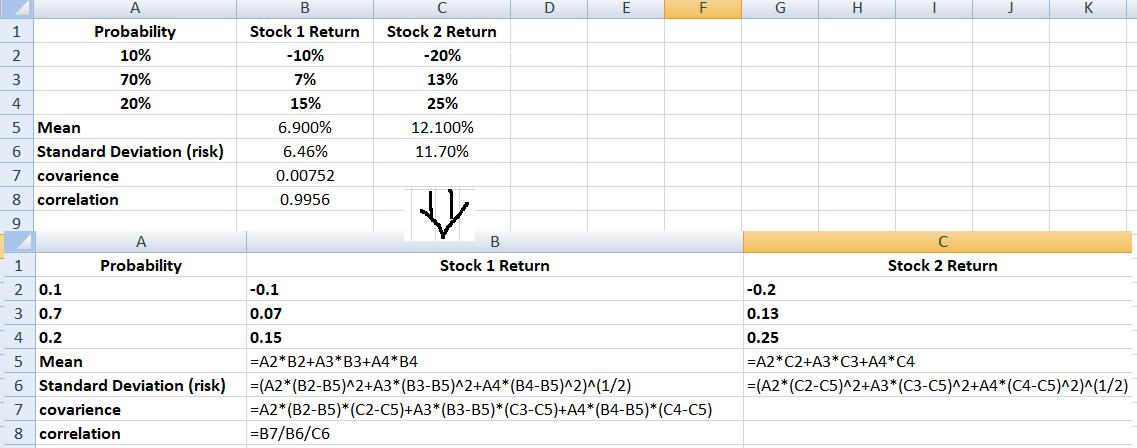

Chapter 13 Risk and Return In class

exercise Risk and Return Equations (FYI): 1. Expected return and

standard deviation Given a probability distribution of

returns, the expected return can be calculated using the following equation:

where

https://www.zenwealth.com/businessfinanceonline/RR/ExpectedReturn.html Given an asset's expected return,

its variance can be calculated using the following equation:

where

The standard deviation is

calculated as the positive square root of the variance.

https://www.zenwealth.com/businessfinanceonline/RR/MeasuresOfRisk.html 2. Two stock portfolio

equations:

W1 and W2 are the percentage of each stock in the

portfolio.

In class

exercise and solution

3.. Historical returns Holding period return (HPR) =

(Selling price – Purchasing price + dividend)/ Purchasing price 4. CAPM (Capital Asset

Pricing Model) model · What is Beta? Where to find Beta?

Beta

is a measurement of a stock's price fluctuations, which is often called

volatility, and is used by investors to gauge how quickly a stock's price

will rise or fall. Because beta is calculated from past returns, it's not

considered as reliable a tool to forecast rises in stock prices, and it is

more commonly used by options traders. Beta compares the changes in a

company's stock returns against the returns of the market as a whole. Online

brokerages give investors extensive data on a stock's beta value, and some

free financial news websites also show current beta measurements. · What

Is the Capital Asset Pricing Model?

The Capital Asset Pricing Model (CAPM)

describes the relationship between systematic risk and expected

return for assets, particularly stocks. CAPM is widely used throughout

finance for pricing risky securities and generating expected

returns for assets given the risk of those assets and cost of capital. Ri = Rf + βi

*( Rm -

Rf)

------ CAPM model Ri = Expected return of investment Rf = Risk-free rate βi = Beta of the investment Rm = Expected return of market (Rm -

Rf) =

Market risk premium Investors expect to be compensated for risk and the time

value of money. The risk-free rate in the CAPM formula accounts for

the time value of money. The other components of the CAPM formula account for

the investor taking on additional risk. The beta of a potential investment is a

measure of how much risk the investment will add to a portfolio that looks

like the market. If a stock is riskier than the market, it will have a beta

greater than one. If a stock has a beta of less than one, the formula assumes

it will reduce the risk of a portfolio. A stock’s beta is then multiplied by

the market risk premium, which is the return expected from the market

above the risk-free rate. The risk-free rate is then added to the product of

the stock’s beta and the market risk premium.

The result should give an investor the required

return or discount rate they can use to find the value of an

asset. The goal of the CAPM formula is to evaluate whether a stock is

fairly valued when its risk and the time value of money are compared to its

expected return. For example, imagine an investor is

contemplating a stock worth $100 per share today that pays a 3% annual

dividend. The stock has a beta compared to the market of 1.3, which means it

is riskier than a market portfolio. Also, assume that the risk-free rate is

3% and this investor expects the market to rise in value by 8% per year. The expected return of the stock based on the CAPM formula is

9.5%. The expected return of the CAPM formula is used to discount

the expected dividends and capital appreciation of the stock over the

expected holding period. If the discounted value of those future cash flows

is equal to $100 then the CAPM formula indicates the stock is fairly valued

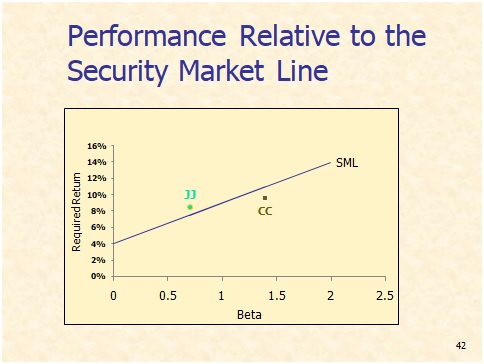

relative to risk. (https://www.investopedia.com/terms/c/capm.asp) · SML – Security Market Line

HOMEWORK 1. AAA

firm’s stock has a 0.25 possibility to make 30.00% return, a 0.50 chance to

make 12% return, and a 0.25 possibility to make -18%

return. Calculate expected rate of return (Answer: 9%) 2. If

investors anticipate a 7.0% risk-free rate, the market risk premium = 5.0%,

beta = 1, Find the return. (answer:12%) 3. AAA

firm has a portfolio with a value of $200,000 with the following four stocks.

Calculate the beta of this portfolio ( answer: 0.988) Stock value β A $

50,000.00 0.9500 B 50,000.00 0.8000 C 50,000.00 1.0000 D 50,000.00 1.2000 Total $200,000.00 4. A

portfolio with a value of $40,000,000 has a beta = 1. Risk free rate = 4.25%,

market risk premium = 6.00%. An additional $60,000,000 will be included in

the portfolio. After that, the expected return should be 13%. Find the

average beta of the new stocks to achieve the goal ( answer:

1.76) 5. Stock A

has the following returns for various states of the economy: State of the

Economy Probability Stock

A's Return Recession 10% -30% Below

Average 20% -2% Average 40% 10% Above

Average 20% 18% Boom 10% 40% Stock A's

expected return is? Standard deviation? (answer:

expected return = 8.2%, variance=0.02884, standard deviation=16.98%,

visit https://www.jufinance.com/return/) 6. Collectibles

Corp. has a beta of 2.5 and a standard deviation of returns of 20%. The

return on the market portfolio is 15% and the risk free rate is 4%. What is

the risk premium on the market? 7. An

investor currently holds the following portfolio: Amount Invested 8,000 shares of

Stock A $16,000 Beta = 1.3 15,000 shares of

Stock B $48,000 Beta = 1.8 25,000 shares of

Stock C $96,000 Beta = 2.2 The beta

for the portfolio is? 8. Deleted 9. Assume that

you have $165,000 invested in a stock that is returning 11.50%, $85,000

invested in a stock that is returning 22.75%, and $235,000 invested in a

stock that is returning 10.25%. What is the expected return of your portfolio? 10. If you hold

a portfolio made up of the following stocks: Investment

Value Beta Stock

A $8,000 1.5 Stock

B $10,000 1.0 Stock

C $2,000 .5 What is the

beta of the portfolio? 11. You

own a portfolio consisting of the stocks below. Stock Percentage

of

portfolio Beta 1. 20% 1 2. 30% 0.5 3. 50% 1.6 The risk free

rate is 3% and market return is 10%. a. Calculate

the portfolio beta. b. Calculate

the expected return of your portfolio. 12. An

investor currently holds the following portfolio: Amount Invested 8,000 shares of

Stock A $10,000 Beta = 1.5 15,000 shares of

Stock B $20,000 Beta = 0.8 25,000 shares of

Stock C $20,000 Beta = 1.2 Calculate the

beta for the portfolio. Homework Help videos Q1 Q5 Q2 Q3 Q4 Q6 Q7 Q9 TO THE END Quiz 5

prep video Part

I (has three questions from chapter 8) Part

II |

How much does Amazon worth?” --- FYI only: Amazon.com Inc. (AMZN) https://www.stock-analysis-on.net/NASDAQ/Company/Amazoncom-Inc/DCF/Present-Value-of-FCFF

Present

Value of Free Cash Flow to the Firm (FCFF)

In

discounted cash flow (DCF) valuation techniques the value of the stock is estimated

based upon present value of some measure of cash flow. Free cash flow to the

firm (FCFF) is generally described as cash flows after direct costs and

before any payments to capital suppliers.

Intrinsic Stock Value (Valuation Summary)

Amazon.com

Inc., free cash flow to the firm (FCFF) forecast

1 Weighted Average Cost of Capital (WACC)

Amazon.com

Inc., cost of capital

1 USD $ in millions Equity (fair value) = No. shares

of common stock outstanding × Current share price Debt (fair value). See Details » 2 Required rate of return on equity

is estimated by using CAPM. See Details » Required rate of return on

debt. See Details » Required rate of return on debt

is after tax. Estimated (average) effective

income tax rate WACC

= 16.17% FCFF Growth Rate (g)

FCFF growth rate

(g) implied by PRAT model

Amazon.com

Inc., PRAT model

2017

Calculations 2 Interest expense, after tax =

Interest expense × (1 – EITR) 3 EBIT(1 – EITR) = Net income

(loss) + Interest expense, after tax 4 RR = [EBIT(1 – EITR) – Interest

expense (after tax) and dividends] ÷ EBIT(1 – EITR) 5 ROIC = 100 × EBIT(1 – EITR) ÷

Total capital 6 g = RR × ROIC FCFF growth rate

(g) forecast

Amazon.com

Inc., H-model

where: Calculations g2 = g1 + (g5 – g1) × (2 – 1) ÷ (5 – 1) g3 = g1 + (g5 – g1) × (3 – 1) ÷ (5 – 1) g4 = g1 + (g5 – g1) × (4 – 1) ÷ (5 – 1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 7 |

Final

Exam (will be posted on blackboard) (on youtube, no WACC, no financial statement) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||