FIN415 Class Web

Page, Spring '24

Jacksonville

University

Instructor:

Maggie Foley

Term Project Part I

(due with final)

Term

project part II (excel questions)

(due with final)

Weekly SCHEDULE,

LINKS, FILES and Questions

|

Week |

Coverage, HW, Supplements -

Required |

Supplemental Reaching Materials |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 1 |

Marketwatch Stock Trading Game (Pass

code: havefun) 1. URL for your game: 2. Password for this private

game: havefun. 3. Click on the 'Join Now'

button to get started. 4. If you are an

existing MarketWatch member, login. If you are a new user, follow

the link for a Free account - it's easy! 5. Follow the instructions and

start trading! 6. Game will be over

on 4/17/2019 How to Use

Finviz Stock Screener (youtube, FYI)

How To Win

The MarketWatch Stock Market Game (youtube, FYI)

How Short Selling

Works (Short Selling for Beginners) (youtube, FYI)

|

- |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PRESS RELEASE OCTOBER 4,

2023 World Bank’s Fall 2023 Regional Economic Updates

East

Asia and the Pacific: Growth in developing East Asia and

Pacific is projected to remain strong at 5% in 2023 but will ease in the

second half of 2023 and is forecast to be 4.5% during 2024, the World Bank

said on Sunday in its semi-annual economic

outlook for the region. Europe and

Central Asia: Economic growth for the emerging market and developing

economies (EMDEs) of the Europe and Central Asia region has been revised up

to 2.4% for 2023, says the World Bank’s Economic

Update for the region, released today. Latin America

and the Caribbean: Latin America and the Caribbean (LAC) made

progress in macroeconomic resiliency over previous decades and navigated the

multiple post-pandemic crises with relative success. Yet, according to a new World Bank

report, growth remains inadequate to reduce poverty and create

jobs, while fiscal constraints limit necessary investments. Middle East

and North Africa: Growth of the economies in the Middle East

and North Africa (MENA) is expected to fall sharply this year. The region’s

gross domestic product (GDP) is forecast to plummet to 1.9% in 2023 from 6%

in 2022, due to oil production cuts amidst subdued oil prices, tight global

financial conditions, and high inflation, according to the latest issue of

the World Bank MENA Economic Update (MEU). South

Asia: South Asia is expected to grow by 5.8% this year—higher

than any other developing country region in the world, but slower than its

pre-pandemic pace and not fast enough to meet its development goals, says the

World Bank in its twice-a-year regional

outlook. Sub-Saharan Africa: Sub-Saharan Africa’s economic outlook remains bleak amid an elusive growth recovery. According to the latest World Bank Africa’s Pulse report, rising instability, weak growth in the region’s largest economies, and lingering uncertainty in the global economy are dragging down growth prospects in the region. In class exercise: 1. In 2023, which region is projected to have

the highest economic growth? A) East

Asia and the Pacific B)

Europe and Central Asia C)

South Asia Answer:

A the Pacific Explanation: According to the World Bank, East Asia and the Pacific are projected

to have the highest growth at 5% in 2023. 2. Why is economic growth in the Middle

East and North Africa (MENA) expected to fall sharply in 2023? A)

Increased oil production B)

Subdued oil prices C)

Improved global financial conditions Answer: B Explanation: The decline in economic growth in MENA is attributed to oil

production cuts amidst subdued oil prices, among other factors. 3. Which region's economic growth has

been revised up for 2023? A)

Latin America and the Caribbean B)

Sub-Saharan Africa C)

Europe and Central Asia Answer:

C Explanation: The World Bank's Economic Update for the Europe and Central Asia

region revised the growth for 2023 up to 2.4%. 4. What is the projected growth rate for

South Asia in 2023? A) 3.5% B) 5.8% C) 7.2% Answer:

B Explanation: South Asia is expected to grow by 5.8% in 2023 according to the

World Bank. 5. Why does Latin America and the

Caribbean face challenges despite progress in macroeconomic resiliency? A) Insufficient

job creation B) Lack

of poverty reduction C)

Fiscal constraints limiting investments Answer:

C Explanation: The World Bank report mentions that fiscal constraints limit

necessary investments despite progress in macroeconomic resiliency. 6. What is the primary reason for the

projected decline in economic growth in the Middle East and North Africa in

2023? A) Oil production cuts B)

Inflation C) Global financial stability Answer:

A Explanation: The World Bank MENA Economic Update attributes the decline in

economic growth to oil production cuts, among other factors. 7. How does South Asia's expected growth in

2023 compare to its pre-pandemic pace? A)

Higher B)

Lower C) Same Answer:

B Explanation: The World Bank mentions that South Asia's expected growth in 2023 is

slower than its pre-pandemic pace. 8. Which region is forecasted to have the

slowest growth in 2024? A)

Latin America and the Caribbean B) East

Asia and the Pacific C)

Middle East and North Africa Answer:

A Explanation: According to the World Bank,

growth in Latin America and the Caribbean is forecasted to be 4.5% in 2024. Published on Let's Talk Development

https://blogs.worldbank.org/developmenttalk/global-economic-outlook-five-charts-1

The global economy is set to slow substantially in 2023. The

lagged and current effects of monetary tightening, as well as more

restrictive credit conditions, are expected to weigh on activity in the

second half of the year, with weakness persisting into 2024. Excluding China,

growth in emerging market and developing economies (EMDEs) is set to decline

markedly, with the outlook weakest in countries with elevated fiscal and

financial vulnerabilities. The resurgence of recent banking sector turmoil

represents a serious risk. Widespread financial stress could have especially

severe economic consequences.

1. Global growth is slowing

The global economy is forecast to slow substantially this

year, with a pronounced deceleration in advanced economies. Monetary tightening

is expected to have its peak impact this year for many major economies.

Global growth is forecast to decline to 2.1 percent in 2023, a full

percentage point less than in 2022, before a tepid recovery to 2.4 percent in

2024. In emerging market and developing economies (EMDEs) excluding China,

growth is projected to fall to 2.9 percent in 2023, from 4.1 percent in 2022,

as tight global financial conditions and subdued external demand weigh on

activity. Global growth could weaken more than anticipated in the event of

further financial sector stress, or if persistent inflation prompts tighter-than-expected

monetary policy. Contributions

to global growth

In

class exercise 1.

What is the forecasted global growth rate for 2023? A)

3.1% B)

2.1% C)

4.4% Answer:

B Explanation:

The global economy is forecasted to slow substantially in 2023, with a

projected growth rate of 2.1%. 2.

What is the primary factor expected to contribute to the global economic

slowdown in 2023? A)

Monetary tightening B)

Increased government spending C)

Expansionary credit conditions Answer:

A Explanation:

The lagged and current effects of monetary tightening are anticipated to

substantially slow the global economy in 2023. 3.

How much is global growth forecasted to recover in 2024? A)

1.4% B)

3.4% C)

2.4% Answer: C Explanation:

After the projected decline in 2023, global growth is expected to experience

a recovery to 2.4% in 2024. 4.

In emerging market and developing economies (EMDEs) excluding China, what is

the projected growth rate for 2023? A)

3.9% B)

2.9% C)

4.8% Answer:

B Explanation:

Growth in EMDEs, excluding China, is projected to fall to 2.9% in 2023 due to

tight global financial conditions and subdued external demand. 5.

What could lead to a more severe weakening of global growth according to the

information? A)

Further financial sector stress B)

Government stimulus packages C)

Decreased inflation Answer: A Explanation:

Further financial sector stress could lead to a more severe weakening of

global growth. 6.

Which sector poses a serious risk to the global economy? A)

Technology B)

Healthcare C)

Banking Answer: C Explanation:

The resurgence of recent banking sector turmoil represents a serious risk to

the global economy. 7.

What is the expected impact of monetary

tightening on advanced economies in 2023? A)

Acceleration of growth B)

Pronounced deceleration C)

Stable economic conditions Answer: B Explanation:

Monetary tightening is expected to have a pronounced decelerating impact on

advanced economies in 2023. 8.

What is the primary reason for the

projected decline in growth in emerging market and developing economies

(EMDEs) excluding China? A)

Subdued external demand B)

Increased government investment C)

Expansive credit conditions Answer: A Explanation:

The decline in growth is attributed to tight global financial conditions and

subdued external demand. 9.

How much is global growth expected to

decline in 2023 compared to 2022? A)

0.5% B)

1.0% C)

1.5% Answer: B Explanation:

Global growth is forecasted to decline by a full percentage point, from 3.1%

in 2022 to 2.1% in 2023. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part II In class exercise – practice of

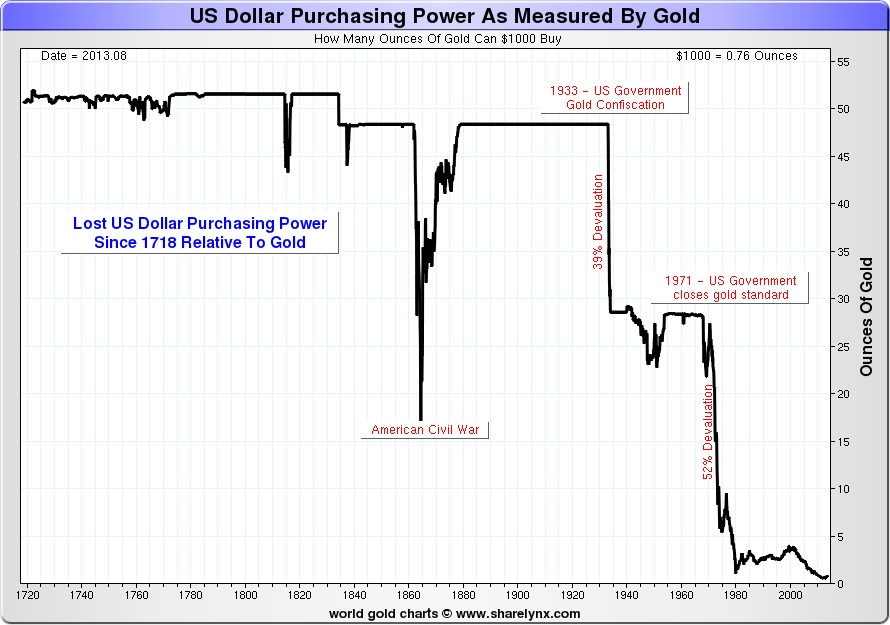

converting currencies 1. If the dollar

is pegged to gold at US $1800 = 1 ounce of gold and the British pound is

pegged to gold at £1200 = 1 ounce of gold. What should be the exchange rate between

US$ and British £? How much can you make without any risk if the exchange

rate is 1£ = 2$? Assume that your initial investment is $1800. What about the

exchange rate

set at 1£ = 1.2$? What about your initial investment is £1200? Solution: 1£ = 2$ (note

that the exchange rate is set at 1£ = 1.5$ since $1800 = £1500=1 ounce of

gold è $1.5=1£). è With $1800, you can buy 1 ounce of gold at US $1800

= 1 ounce of gold. èWith

one ounce of gold, you can sell it in UK at £1200 = 1 ounce of gold, so you

can get back £1200 è convert

£ to $ at $2=1£ as given èget

back £1200 * 2$/£ = $2400 > $1800, initial investment è you could make a profit of $600 ($2400 -

$1800=$600) è Yes. 1£ = 1.2$ (note

that the exchange rate is set at 1£ = 1.5$ since $1800 = £1500=1 ounce of

gold è $1.5=1£). è With $1800, you can buy either 1 ounce of gold at US

$1800 = 1 ounce of gold. è With

one ounce of gold, you can sell it in UK at £1200 = 1 ounce of gold, so you

can get back £1200 è convert

£ to $ at $1.2=1£ as givenèget

back £1200 * 1.2$/£ = $1440 < $1800 è you will lose $360 ($1440 - $1800=$-360) è No. è So should convert to £ first and then buy gold in

UK è With $1800, you can convert to £1500 ($1800 /

(1.2$/£ = £1500 ). è buy

gold in UK at £1200 = 1 ounce of gold, so you can get back £1500/£1200 = 1.25

ounce of gold è Sell gold in US at US $1800 = 1 ounce of

gold è So get back 1.25 ounce of gold * $1800 = $2250 >

$1800 è you will make a profit of $450 ($2250 -

$1800=$450) è Yes. 2. If the Euro (EUR) to US Dollar

(USD) exchange rate is 1.18, and the US Dollar to Japanese Yen (JPY) exchange

rate is 110, what is the implied exchange rate between Euro and Japanese Yen?

Answer: The implied exchange rate between

Euro and Japanese Yen is approximately 129.80 (110 * 1.18). Explanation: ·

1

EUR = 1.18 USD; 1 USD = 110 JPY. So

1.18 USD/EUR * 110 JPY/USD = 1.18 * 110 = 129.80 JPY/EUR (one EUR =

129.80 JPY) ·

Or,

1 EUR = 1.18 USD è 1 USD = (1/1.18) EUR; 1USD

= 110 JPY, so è (1/1.18)EUR = 110 JPY è 1 EUR = 110/(1/1.18) =

129.80 JPY 3. If the Euro to the British

Pound (GBP) exchange rate is 0.85, and the Swiss Franc (CHF) to Euro exchange

rate is 1.10, what is the implied exchange rate between British Pound and

Swiss Franc? Answer: The implied exchange rate

between British Pound and Swiss Franc is approximately (1/0.85)/1.1 = 1.07 CHF/GBP è one GBP is worth 1.07 CHF Explanation: ·

1

EUR = 0.85 GBPè 1 GBP = (1/0.85) EUR, 1

CHF = 1.10 EUR, so (1/0.85) EUR/ GBP / 1.1 EUR/CHF = (1/0.85)/1.1 CHF/EUR =

1.07 CHF/GBP ·

Or

1 EUR = 0.85 GBP, 1 CHF=1.1 EUR è 1 EUR = (1/1.1) CHF, so 1

EUR = 0.85 GBP = (1/1.1) CHF è 1 GBP = (1/1.1)/0.85 =

1.07 CHF 4. If the Australian Dollar

(AUD) to US Dollar exchange rate is 0.75, and the Canadian Dollar (CAD) to US

Dollar exchange rate is 1.25, what is the implied exchange rate between

Australian Dollar and Canadian Dollar? Answer: The implied exchange rate

between Australian Dollar and Canadian Dollar is 0.60 (0.75 / 1.25). Explanation: ·

1

AUD = 0.75 USD, 1 CAD = 1.25 USD, So 1 AUD can get 0.75 USD, and since 1 USD

can get (1/1.25=0.8) 0.8 CAD, so 1 AUD = 0.75 *(1/1.25) = 0.6 CAD. So one AUD

is worth 0.6 CAD. ·

Or,

0.75USD/AUD * (1/1.25) CAD/USD = 0.75 * 0.8 CAD/AUD = 0.6 CAD/AUD Homework chapter1-1 (due with first

midterm exam) 1.

If the dollar is pegged to gold at US $1800 = 1 ounce of

gold and the British pound is pegged to gold at €1500 = 1 ounce of gold. What

should be the exchange rate between US$ and Euro €? How much can you make

without any risk if the exchange rate is 1€ = 1.5$? (hint: $1800 è get gold

è sell

gold for euro è convert

euro back to $) How much can you make without any risk if

the exchange rate is 1€ = 0.8$? (hint: $1800 è

get euro è buy gold using euro è

sell gold for $) Assume that your initial

investment is $1800. (answer: $1.2/euro, $450, $900) 2.

If USD to the Chinese Yuan (CNY)

exchange rate is 7.35, and USD to the Indian Rupee (INR) exchange rate is 94.20,

what is the implied exchange rate between Chinese Yuan and Indian Rupee, eg 1

CNY = ? INR? (answer: 1 CNY = 12.816

INR) 3.

If the New Zealand Dollar (NZD) to

Australian Dollar (AUD) exchange rate is 1.05, and the Singapore Dollar (SGD)

to New Zealand Dollar exchange rate is 0.94, what is the implied exchange

rate between Singapore Dollar and Australian Dollar? (answer: 1 AUD = 1.013 SGD, or 1 SGD = 0.987 AUD) 4.

What is your opinion on

arbitrage across borders? Do you think that arbitrage crypto will work? (Optional homework question) Crypto

arbitrage:Cryptocurrency arbitrage is a strategy in which investors buy a

cryptocurrency on one exchange, and then quickly sell it on another exchange

for a higher price. Cryptocurrencies trade on hundreds of different

exchanges, and often the price of a coin or token may differ on one exchange

versus another. How I Became A Crypto Billionaire

In 5 Years (CNBC)

The FTX Collapse,

Explained | What Went Wrong | WSJ (youtube)

|

Sam Bankman Fried Explains His Arbitrage Techniques Nicholas Pongratz, April 9, 2021·3 min read https://www.yahoo.com/video/sam-bankman-fried-explains-arbitrage-132901181.html A former ETF trader at Jane Street, Sam Bankman-Fried developed a

net worth of $9 billion from trading crypto in three and a half years. He

explained his success comes from lucrative arbitrage opportunities in crypto. Bankman-Fried launched a crypto-trading firm called Alameda Research

in 2017. The company now manages over $100 million in digital assets. The

firm’s large-scale trades made Bankman-Fried a self-made billionaire by the

age of 29. He is also the CEO and founder of the FTX Exchange, a

cryptocurrency derivatives trading exchange. Upon

entering the crypto markets, he discovered that Bitcoin was growing very

rapidly in trading volumes. This meant there would also be large price

discrepancies, making it ideal for arbitrage, taking advantage of the price

differences. The

Kimchi Premium One

opportunity he exploited was what is known as the kimchi premium. While

Bitcoin was pricing at around $10,000 in the US, it traded for $15,000 on

Korean exchanges. This was because of a huge demand for Bitcoin in Korea,

Bankman-Fried said. Around its peak, there was a vast spread of around 50%, he said. However,

because the Korean won is a regulated currency, it was difficult to scale

this arbitrage. Bankman-Fried said: “Many found a way to do it for small size. Very, very hard to do it

for big size, even though there are billions of dollars a day volume trading

in it because you couldn’t offload the Korean won easily for non-crypto.” Although nowhere near as significant, the premium still exists today.

According to CryptoQuant, the premium is listed at 18%. 10% Daily Returns in Japan Bankman-Fried

then sought a similar opportunity in other markets, which he found in Japan.

He said: “It

wasn’t trading quite the same premium. But it was trading at a 15% premium or

so at the peak, instead of 50%.” After

buying Bitcoin for $10,000 in the US, investors could send it to a Japanese

exchange. There they could sell it for $11,500 worth of Japanese yen. At that

point, they could convert the amount back to dollars. Because

of the trade’s global nature and the wire transfers involved, it would take

up to a day to perform. ”But it was doable, and you could scale it, making

literally 10% per weekday, which is just absolutely insane,” Bankman-Fried

said. Bankman-Fried was successful where others were not because he managed

to facilitate all the different components involved in the trade. For

example, finding the right platform to buy Bitcoin at scale, then getting

approval to use Japanese exchanges and accounts. There was also the

difficulty of even getting millions of dollars out of Japan and into the US

every day. “You do have to put together this incredibly sophisticated global

corporate framework in order to be able to actually do this trade,”

Bankman-Fried said. “That’s the real task, the real hard part.” High

Edge, Low Risk The

decentralized aspect of the crypto ecosystem enables these large arbitrage

premiums to exist. With other financial markets, there is a cross merging

between exchanges and central clearing firms or brokers, Bankman-Fried

explained. “So it’s really capital-intensive, and also you have to worry about

counterparty risk,” he added. But once investors and traders come to understand the crypto space

intimately, they can figure out where the counterparty risk is close to zero,

but the edge is still high. According to Bankman-Fried: “There’s a lot of money to be made, if you can really figure out and

pinpoint when there is and isn’t a ton of edge and when there is and isn’t a

ton of actual counterparty risk.” For

discussion: ·

Any issues with SBF’s trading strategy? Hint: ·

Market Volatility: Cryptocurrency markets are

known for their volatility. Sudden and unpredictable price movements can

affect arbitrage opportunities, leading to unexpected gains or losses. ·

Regulatory Challenges: Dealing with different

regulations in various countries poses a challenge, as mentioned in the case

of the Kimchi Premium in Korea. Regulatory changes or uncertainties can

impact the feasibility and scalability of the strategy. ·

Execution Risk: Coordinating large-scale trades

across different exchanges and regions involves execution risks, such as

delays in wire transfers and potential slippage in prices during the

execution of trades. ·

Liquidity Concerns: In less liquid markets or

during times of high demand, executing large trades without significantly

impacting the market price can be challenging. ·

Other issues??? Changes in investors’

preferences? Market competition? In class

exercise 1. What contributed

significantly to Sam Bankman-Fried's net worth growth in the crypto market? A) Launching a cybersecurity firm B) Exploring lucrative arbitrage opportunities C) Founding a traditional stock brokerage Answer:

B Explanation: Sam Bankman-Fried attributes his success to

identifying and capitalizing on lucrative arbitrage opportunities in the

crypto market. 2. In which year

did Sam Bankman-Fried launch the crypto-trading firm Alameda Research? A) 2015 B) 2017 C) 2019 Answer:

B Explanation: Alameda Research, Sam Bankman-Fried's

crypto-trading firm, was launched in 2017. 3. What is the

primary reason behind the kimchi premium in the crypto market? A) High demand for Bitcoin in Korea B) Regulatory restrictions on Bitcoin trading C) A decline in global Bitcoin trading volumes Answer:

A Explanation: The kimchi premium occurs due to the

significant demand for Bitcoin in Korea, leading to price discrepancies. 4. How did

Bankman-Fried exploit the kimchi premium? A) By manipulating exchange rates B) By taking advantage of

large price discrepancies C) By offloading Korean won

for non-crypto Answer:

C Explanation: Bankman-Fried found it challenging to scale

the arbitrage due to difficulties in offloading Korean won for non-crypto. 5. In the Japanese market, what premium did

Bitcoin trade at its peak? A) 5% B) 15% C) 30% Answer:

B Explanation: Bitcoin traded at a 15% premium in the

Japanese market at its peak, according to Sam Bankman-Fried. 6. What was the

approximate daily return Sam Bankman-Fried mentions for the Japan-related

arbitrage opportunity? A) 5% B) 15% C) 10% Answer:

C Explanation: Bankman-Fried mentioned making

approximately 10% per weekday with the Japan-related arbitrage opportunity. 7. Why does

Bankman-Fried emphasize the importance of a sophisticated global corporate

framework for successful trades? A) To manage counterparty risk

B) To avoid taxes C) To manipulate market prices Answer:

A Explanation: A sophisticated global corporate framework

is necessary to manage counterparty risk and execute complex trades successfully. 8. According to

Bankman-Fried, what makes the crypto space different from traditional

financial markets in terms of arbitrage? A) Higher counterparty risk B) Lower edge C) Decentralized nature and low counterparty risk Answer:

C Explanation: The decentralized nature of the crypto

space reduces counterparty risk, making it more favorable for arbitrage

compared to traditional markets. 9. What does Bankman-Fried highlight as the key

to successful arbitrage in the crypto space? A) High capital investment B) Extensive market knowledge C) Diversified portfolio Answer:

B Explanation: According to Bankman-Fried, understanding

the crypto space intimately is crucial for identifying when there is a high

edge and low counterparty risk in arbitrage opportunities. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part III: Multilateral

Trade vs. Bilateral Trade Trade agreement

(video)

Summary:

The

video mentions several forms of trade barriers, including: ·

Tariffs

or Taxes on Goods: These are mentioned as taxes imposed on

imported goods to make them more expensive in the domestic market. ·

Quotas

or Limits on Quantity: The video discusses limits set on the

quantity or value of goods that can be imported during a specific period, restricting

the volume of foreign products. ·

Standards:

Regulations and requirements, such as safety standards or non-genetically

modified organism (GMO) ingredients, are highlighted as factors influencing

trade. ·

Administrative

Delays: The video refers to inspections,

paperwork, and bureaucratic procedures causing delays in the importation of

goods. ·

Countertrade

Requirements: Mandates for the trade partner to

purchase something from the country are mentioned as a form of reciprocal

obligation in trade agreements. ·

Embargoes:

Complete trade restrictions with specific countries, mentioned in the context

of political actions or disagreements. In class exercise: Question

1: What is a tariff in international

trade? a)

A limit on the quantity of imported goods b)

A tax imposed on exported goods c)

A tax imposed on imported goods Answer: C Explanation:

Tariffs are taxes imposed on imported goods to make them more expensive in

the domestic market. Question

2: What is the purpose of quotas in international trade? a)

To encourage free trade b)

To limit the quantity of imported goods

c)

To set safety standards for imported goods Answer: B Explanation:

Quotas are restrictions on the quantity or value of imported goods during a

specific period. Question

3: How do administrative delays impact international trade? a)

They create delays through inspections and paperwork b)

They expedite the importation process c)

They reduce taxes on imported goods Answer: A Explanation:

Administrative delays involve inspections and paperwork, causing delays in

the importation process. Question

4: What is the purpose of countertrade requirements in trade agreements? a)

To eliminate trade restrictions b)

To create reciprocal obligations for trade partners c)

To set safety standards for exported goods Answer: B Explanation:

Countertrade requirements mandate that the trade partner must purchase

something from the country, creating reciprocal obligations. Question

5: What does an embargo in international trade involve? a)

A tax imposed on imported goods b)

Limits on the quantity of exported goods c)

Complete trade restrictions with specific

Answer: C Explanation:

Embargoes involve complete trade restrictions with specific countries. Question

6: What is the primary purpose of tariffs? a)

To encourage imports b)

To discourage exports c)

To make imported goods more expensive Answer: C Explanation:

Tariffs are taxes imposed on imported goods to make them less competitive in

the domestic market. Question

7: How do quotas impact the availability of foreign goods? a)

They increase the quantity of imported goods b)

They restrict the quantity of imported goods

c)

They have no impact on imported goods Answer: B Explanation:

Quotas limit the quantity or value of imported goods, restricting their

availability. Question

8: What role do standards play in international trade? a)

They set tax rates on exported goods b)

They regulate safety and product specifications c)

They encourage free trade Answer: B Explanation: Standards

involve regulations specifying safety requirements or certain product

specifications. Question

9: How do embargoes differ from tariffs? a)

Embargoes involve complete trade restrictions with specific countries b)

Tariffs are taxes on exported goods c)

Embargoes encourage free trade Answer: A Explanation:

Embargoes involve complete trade restrictions with specific countries, while

tariffs are taxes on imported goods. Multilateralism Explained

| Model Diplomacy (youtube)

In class exercise Question

1: What is the primary focus of multilateralism? a)

Cooperation between two countries b)

Cooperation between three or more countries

c)

Cooperation within a single country Answer: B Explanation:

Multilateralism involves cooperation amongst three or more countries to find

cooperative solutions to common problems. Question

2: Which issue is mentioned as an example of a global problem that requires

multilateral cooperation? a)

Climate change b)

National security c)

Economic inequality Answer: A Explanation:

Climate change is cited as a problem that doesn't respect national boundaries

and requires global cooperation. Question

3: What is the challenge posed by global epidemics? a)

Limited impact on international travel b)

Isolation within a single country c)

Ease of spread between countries Answer: C Explanation:

Global epidemics can spread easily from one country to another, especially

with international travel. Question

4: What are traditional examples of universal membership organizations for

multilateral cooperation? a)

Regional alliances b)

The United Nations, the International Monetary Fund, the World Bank c)

Bilateral agreements Answer: B Explanation:

Traditional examples include global organizations like the United Nations,

the International Monetary Fund, and the World Bank. Question

5: Which multilateral institution is highlighted as an example beyond

treaty-based bodies? a)

United Nations b)

Group of 20 (G20) c)

World Health Organization Answer B Explanation:

The G20, composed of major economies, is mentioned as a broader multilateral

institution. Question

6: What does the G20 symbolize? a)

Exclusivity of Western countries b)

Isolation from emerging nations c)

Expansion of the table to include new global actors Answer C Explanation:

The G20 symbolizes the need to include new actors transforming the world in

global decision-making. Question

7: Which nations are mentioned as part of the BRIC nations? a)

Brazil, Russia, India, China b)

Belgium, Romania, Indonesia, Canada c)

Bahrain, Rwanda, Iran, Colombia Answer: A Explanation:

BRIC stands for Brazil, Russia, India, and China. Question

8: What is mentioned as a challenge to multilateral cooperation in terms of

established powers? a)

Consistent alignment of priorities b)

Difficulty in compromise and sacrifice c)

Homogeneity of values Answer: B Explanation:

Cooperation in multilateral settings requires compromise and sacrifice, which

may be challenging for established powers. Answer Take

away: ·

Multilateral trade

agreements strengthen the global economy by making developing countries

competitive. ·

They standardize

import and export procedures giving economic benefits to all member

nations. ·

Their complexity

helps those that can take advantage of globalization, while those who cannot

often face hardships. For

class discussion: Do you agree with the above points?

Why or why not? Multilateral Trade

Agreements With Their Pros, Cons and Examples

5 Pros and 4 Cons to the World's

Largest Trade Agreements https://www.thebalance.com/multilateral-trade-agreements-pros-cons-and-examples-3305949 BY KIMBERLY AMADEO REVIEWED

BY ERIC ESTEVEZ Updated October

28, 2020 Multilateral trade

agreements are commerce treaties among three or more nations. The

agreements reduce tariffs and make

it easier for businesses to import and export. Since they are

among many countries, they are difficult to negotiate. That same broad scope makes them more

robust than other types of trade agreements once all

parties sign. Bilateral agreements are

easier to negotiate but these are only between two countries. They don't

have as big an impact on economic growth as does a multilateral

agreement. 5 Advantages of multilateral

agreements · Multilateral

agreements make all signatories treat each other equally. No country can

give better trade deals to one country than it does to another. That

levels the playing field. It's especially critical for emerging

market countries. Many of them are smaller in

size, making them less competitive. The Most

Favored Nation Status confers the

best trading terms a nation can get from a trading partner. Developing

countries benefit the most from this trading status. · The

second benefit is that it increases trade for every participant. Their

companies enjoy low tariffs. That makes their exports

cheaper. · The

third benefit is it standardizes commerce regulations for all

the trade partners. Companies save legal costs since they follow the same

rules for each country. · The

fourth benefit is that countries can negotiate trade deals with

more than one country at a time. Trade agreements undergo

a detailed approval process. Most countries would prefer to get one

agreement ratified covering many countries at once. · The

fifth benefit applies to emerging markets. Bilateral trade agreements

tend to favor the country with the best economy. That puts the weaker nation

at a disadvantage. But making emerging markets stronger helps the

developed economy over time. As those emerging markets become

developed, their middle class population increases. That creates

new affluent customers for everyone. 4 Disadvantages of multilateral

trading · The

biggest disadvantage of multilateral agreements is that they are

complex. That makes them difficult and time consuming to

negotiate. Sometimes the length of negotiation means it won't take place

at all. · Second,

the details of the negotiations are particular to trade and business

practices. The public often misunderstands them. As a result, they receive

lots of press, controversy, and protests. · The

third disadvantage is common to any trade agreement. Some companies and

regions of the country suffer when trade borders disappear. · The

fourth disadvantage falls on a country's small businesses. A

multilateral agreement gives a competitive advantage to giant

multi-nationals. They are already familiar with operating in a

global environment. As a result, the small firms can't compete. They lay off

workers to cut costs. Others move their factories to countries with a

lower standard of living. If a region depended on that industry, it

would experience high unemployment rates. That makes multilateral

agreements unpopular. Pros

Cons

Examples Some regional trade

agreements are multilateral. The largest had been the North American

Free Trade Agreement (NAFTA), which was ratified on

January 1, 1994. NAFTA quadrupled trade between the United

States, Canada, and Mexico from its 1993 level to

2018. On July 1, 2020, the U.S.-Mexico-Canada Agreement (USMCA) went

into effect. The USMCA was a new trade agreement between the three countries

that was negotiated under President Donald Trump. The Central American-Dominican

Republic Free Trade Agreement was signed on August 5, 2004. CAFTA-DR

eliminated tariffs on more than 80% of U.S. exports to six countries: Costa

Rica, the Dominican Republic, Guatemala, Honduras, Nicaragua, and El

Salvador. As of November 2019, it had increased trade by 104%, from

$2.44 billion in January 2005 to $4.97 billion. The Trans-Pacific

Partnership would have been bigger than NAFTA.

Negotiations concluded on October 4, 2015. After becoming

president, Donald Trump withdrew from the agreement. He promised to

replace it with bilateral agreements. The TPP was between

the United States and 11 other countries bordering the Pacific

Ocean. It would have removed tariffs and standardized business

practices. All global trade agreements

are multilateral. The most successful one is the General

Agreement on Trade and Tariffs. Twenty-three countries signed GATT in

1947. Its goal was to reduce tariffs and other trade barriers. In September 1986, the Uruguay

Round began in Punta del Este, Uruguay. It centered on extending

trade agreements to several new areas. These included services and

intellectual property. It also improved trade in agriculture and

textiles. The Uruguay Round led to the creation of the World Trade

Organization. On April 15, 1994, the 123 participating governments

signed the agreement creating the WTO in Marrakesh, Morocco. The

WTO assumed management of future global multilateral negotiations. The WTO's first project was the Doha round of

trade agreements in 2001. That was a

multilateral trade agreement among all WTO members. Developing countries

would allow imports of financial services, particularly banking. In so

doing, they would have to modernize their markets. In return, the developed

countries would reduce farm subsidies. That would boost the growth

of developing countries that were good at producing food. Farm lobbies in the United States and

the European Union doomed

Doha negotiations. They refused to agree to lower subsidies or accept

increased foreign competition. The WTO abandoned the Doha round in July 2008. On December 7, 2013, WTO

representatives agreed to the so-called Bali package. All countries

agreed to streamline customs standards and reduce red tape to expedite

trade flows. Food security is an issue. India wants to subsidize food so

it could stockpile it to distribute in case of famine. Other countries worry

that India may dump the cheap food in the global market to gain market

share. In class exercise Question 1: What

is the primary focus of multilateral trade agreements? a) Commerce treaties among three or more nations b) Commerce treaties between two nations c) Bilateral agreements for economic growth Answer: A Explanation: Multilateral trade

agreements involve commerce treaties among three or more nations to reduce

tariffs and ease import-export processes. Question 2: Why are multilateral agreements

considered more robust than bilateral agreements? a) They are easier to negotiate b) They involve many countries and are difficult

to negotiate c) They have a smaller impact on economic growth Answer: B Explanation: The broad

scope of multilateral agreements involving many countries makes them more

robust. Question 3: What advantage do multilateral

agreements provide for emerging market countries? a) Exclusivity in trade deals b) Most Favored Nation Status and equal

treatment c) Preferential treatment for smaller economies Answer: B Explanation: Multilateral

agreements ensure equal treatment among signatories, benefiting emerging

market countries. Question 4: How do multilateral agreements impact

trade for participants? a) They decrease trade for participants b) They have no impact on trade dynamics c) They increase trade by providing low

tariffs Answer: C Explanation: Participants

in multilateral agreements enjoy low tariffs, making their exports cheaper

and increasing trade. Question 5: Why do countries prefer negotiating

trade deals with more than one country at a time? a) Faster approval process b) Detailed approval process for one agreement

covering many countries at once c) Avoidance of trade negotiations Answer: B Explanation: Negotiating

one agreement covering many countries at once is preferred due to the detailed

approval process. Question 6: What is the significance of emerging

markets becoming stronger in the context of multilateral agreements? a) Creates new affluent customers and benefits the

developed economy over time b) No impact on developed economies c) Weakens the developed economy Answer: A Explanation: Strengthening

emerging markets creates new affluent customers, benefiting the developed

economy over time. Question 7: What is the biggest disadvantage of

multilateral agreements mentioned in the video? a) They are easily understood by the public b) They are complex and time-consuming to

negotiate c) They have a minimal impact on businesses Answer: B Explanation: The

complexity of multilateral agreements makes them difficult and time-consuming

to negotiate. Question 8: Why do negotiations of multilateral

agreements often receive press, controversy, and protests? a) Lack of public interest b) Smooth negotiation process c) Public misunderstanding due to particular trade

details Answer: C Explanation: Public

misunderstanding of trade details leads to press, controversy, and protests. Question 9: What is a common consequence when

trade borders disappear? a) No impact on businesses b) Some companies and regions suffer c) Enhanced business opportunities Answer: B Explanation: When trade

borders disappear, some companies and regions may suffer due to increased

competition. Question 10: Which entities benefit the most from

multilateral agreements, creating a competitive advantage? a) Giant multi-nationals b) Small businesses c) Medium-sized enterprises Answer: A Explanation: Multilateral

agreements give a competitive advantage to giant multi-nationals, which are

familiar with global operations. Question 11: What does the video suggest about the

impact of multilateral agreements on small businesses? a) They gain a competitive advantage b) They experience high unemployment rates c) They become globally competitive Answer: B Explanation: Small

businesses may face challenges and lay off workers due to the competitive

advantage given to larger corporations. Question 12: What is the primary benefit of the

Most Favored Nation Status in multilateral agreements? a) Exclusive trade deals for a single country b) Tariff reductions for developed economies c) Best trading terms a nation can get from a

trading partner Answer: C Explanation: Most Favored

Nation Status confers the best trading terms a nation can get from a trading

partner. Bilateral

Trade By JULIA KAGAN Updated December 21,

2020, Reviewed by TOBY WALTERS, Fact checked by ARIEL COURAGE https://www.investopedia.com/terms/b/bilateral-trade.asp What

are bilateral and

unilateral contracts? (youtube)

In class exercise Question 1: What characterizes a bilateral

contract? A) One promise from the offeror B) Two promises exchanged between parties C) Performance as acceptance Answer: B Explanation: In a

bilateral contract, there are at least two promises exchanged between the

parties. Question 2. What is typical of a unilateral

contract? A) Performance as acceptance B) Two promises exchanged C) Money exchange Answer: A Explanation: In a

unilateral contract, performance serves as acceptance of the offer. What Is Bilateral Trade? Bilateral

trade is the exchange of goods between two nations promoting trade and

investment. The two countries will

reduce or eliminate tariffs, import quotas, export restraints, and other

trade barriers to encourage trade and investment. In the United States, the Office of

Bilateral Trade Affairs minimizes trade deficits through negotiating free

trade agreements with new countries, supporting and improving existing trade

agreements, promoting economic development abroad, and other actions. KEY TAKEAWAYS ·

Bilateral trade

agreements are agreements between countries to promote trade and commerce. ·

They eliminate trade

barriers such as tariffs, import quotas, and export restraints in order to

encourage trade and investment. ·

The main advantage

of bilateral trade agreements is an expansion of the market for a country's

goods through concerted negotiation between two countries. ·

Bilateral trade agreements can also result in the closing

down of smaller companies unable to compete with large multinational

corporations. Understanding Bilateral Trade The goals of bilateral trade

agreements are to expand access between two countries’ markets and increase

their economic growth. Standardized business operations in five general areas

prevent one country from stealing another’s innovative products, dumping

goods at a small cost, or using unfair subsidies. Bilateral

trade agreements standardize regulations, labor standards, and environmental

protections. The

United States has signed bilateral trade agreements with 20 countries,

some of which include Israel, Jordan, Australia, Chile, Singapore, Bahrain,

Morocco, Oman, Peru, Panama, and Colombia. Advantages and Disadvantages of

Bilateral Trade Compared to multilateral trade

agreements, bilateral trade agreements

are negotiated more easily, because only two nations are party to the

agreement. Bilateral trade agreements initiate and reap trade benefits faster

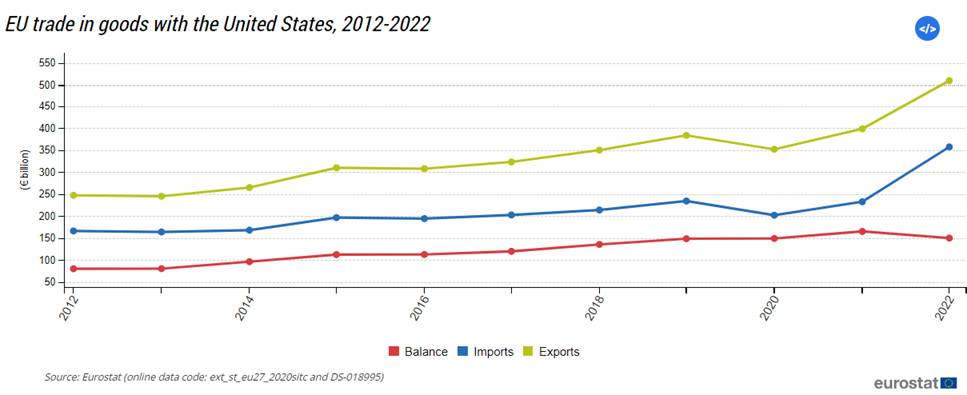

than multilateral agreements. Examples of Bilateral Trade The European Union and the United States have the largest bilateral trade and

investment relationship and enjoy the most integrated economic relationship

in the world. Although overtaken by China in 2020 as the largest trading

partner specifically for goods, when services and investment are taken into

account, the US remains the EU’s largest trading partner by far. The transatlantic relationship is a

key artery of the world economy. Either the EU or the US is the largest trade

and investment partner of almost every other country in the global economy.

Taken together, the economies of both territories account for one third of

global trade in goods and services and close to one third of world GDP in

terms of purchasing power. Trade picture ·

Bilateral trade and

investment support millions of jobs in the EU and the US. Around 9.4 million

people are directly employed. Indirectly, as many as 16 million jobs on both

sides of the Atlantic are supported. ·

The EU-US trade and

investment relationship remains strong despite the economic challenges

related to the Covid-19 pandemic. ·

Transatlantic trade

reached an all-time high of 1.2 trillion euro in 2021, surpassing

pre-pandemic levels by more than 10%. ·

The United States

remains the EU’s number one trading partner in services. Bilateral trade in

services reached a record in 2021 and accounted for more than 500 billion

euro. ·

The size of trade in

services and goods between the EU and the US is matched by their mutual

investments, which are the biggest in the world and which are a substantial

driver of the transatlantic relationship. ·

Total US investment

in the EU is four times higher than in the Asia-Pacific region. EU foreign

direct investment in the US is around 10 times the amount of EU investment in

India and China together. ·

Total investment

includes foreign direct investment, where the EU and the US are each other’s

biggest sources. In 2020, the EU registered €2.1 trillion in outward stock,

and €2.3 trillion in inward stock. ·

The transatlantic

relationship is a key feature of the overall global economy and trade flows.

For most countries, either the EU or the US is the largest trade and

investment partner.

In class exercise Question 1:

What is bilateral trade? A) The exchange of goods

between two nations B) The exchange of goods

within a single nation C) The exchange of goods in

a multilateral setting Answer:

A Explanation:

Bilateral trade involves the exchange of goods between two nations. Question 2: What do

bilateral trade agreements aim to achieve? A) Increase trade barriers B) Standardize business

operations C) Encourage competition Answer:

B Explanation:

Bilateral trade agreements aim to standardize business operations and

eliminate trade barriers. Question 3: What is a key

advantage of bilateral trade agreements? A) Slower negotiation

process B) Faster initiation and

benefits C) Increased competition Answer:

B Explanation:

Bilateral trade agreements initiate and reap trade benefits more quickly

compared to multilateral agreements. Question 4: How do bilateral

trade agreements affect smaller companies? A) Promote their growth B) Have no impact C) May lead to closure due

to competition Answer:

C Explanation:

Bilateral trade agreements can result in the closing down of smaller companies

unable to compete with large multinational corporations. Question 5: Which areas do

bilateral trade agreements standardize? A) Regulatory standards,

labor standards, and environmental protections B) Marketing strategies and

pricing C) Technology and innovation Answer:

A Explanation:

Bilateral trade agreements standardize regulations, labor standards, and

environmental protections. Question 6: Which country

has signed bilateral trade agreements with 20 nations, including Israel and

Jordan? A) China B) United States C) European Union Answer:

B Explanation:

The United States has signed bilateral trade agreements with various

countries, including Israel and Jordan. Question 7: How do bilateral

trade and investment support jobs in the EU and the US? A) 9.4 million jobs directly

employed B) No significant impact on

employment C) Decrease in job

opportunities Answer:

A Explanation:

Bilateral trade and investment support around 9.4 million jobs directly

employed in the EU and the US. Question 8: What is a key

feature of the transatlantic relationship in terms of trade and investment

flows? A) Least influential in the

global economy B) Mutual investments being

the smallest in the world C) Either the EU or the US

is the largest trade and investment partner for most countries Answer:

C Explanation:

Either the EU or the US is the largest trade and investment partner for most

countries, making it a key feature of the transatlantic relationship. Homework chapter1-2 (due with first

midterm exam) 1)

What is bilateralism? What is Multilateralism? 2)

Do you advocate for bilateralism or multilateralism as being

more suitable for the U.S. economy? Why

Trade

agreement https://ustr.gov/trade-agreements/free-trade-agreements https://www.trade.gov/us-free-trade-agreement-partner-countries 3)

Watch Hear Trump hint at what to

expect in his second term (CNN). ·

What

are your thoughts on the proposed policies outlined in Trump's second-term agenda,

particularly focusing on trade, energy, regulation, education, and

environmental issues? ·

How

do you think these policies might impact the United States and its global

relations, and what aspects do you find most noteworthy or concerning? |

Rust Belt https://www.investopedia.com/terms/r/rust-belt.asp (FYI) By JAMES CHEN Updated Aug 25, 2020 What happened to the Rust

Belt? (youtube)

In class exercise Question 1: What term was coined in the 1980s to describe the former

industrial heartland of America? A) Steel Belt B) Rust Belt C)

Manufacturing Zone Answer: B Explanation: The term

"Rust Belt" came into use in the 1980s to describe the declining

industrial region. Question

2: What event largely attributed to the upset in the Rust Belt during the

2016 election? A)

Hillary Clinton's extensive campaigning B)

Donald Trump's refusal to visit the region C)

Hillary Clinton's reluctance to campaign in the Rust Belt Answer: C Explanation: The upset in

the Rust Belt during the 2016 election is largely attributed to Hillary Clinton's

refusal to campaign there. Question

3: What region was once referred to as the industrial heartland of America? A)

West Coast B)

Midwest C)

Northeast Answer: B Explanation: The Midwest was

once referred to as the industrial heartland of America. Question

4: What contributed to the decline of American manufacturing in the Midwest? A)

Labor costs and increased competition B)

Increased demand for American goods C)

Decreased foreign trade ties Answer: A Explanation: The decline in

the Midwest was fueled by labor costs and increased competition. Question

5: What fueled the post-war boom for the U.S.? A)

European economic decline B)

Increased domestic manufacturing C)

The Marshall Plan Answer: C Explanation: The Marshall Plan

fueled a post-war economic boom for the U.S. by aiding European

reconstruction. Question

6: Which region faced competition from East Asia during the Cold War? A)

South America B)

Middle East C)

Midwest Answer: C Explanation: The Midwest

faced competition from East Asia, including Japan, during the Cold War. Question

7: What technological advancement contributed to job loss in the Midwest? A)

Increased manual labor B)

Automation C)

Traditional manufacturing methods Answer: B Explanation: Increased use

of automation reduced the number of laborers in manufacturing. Question

8: What term describes the region challenged by Japan in the auto and

electronics industries? A)

Silicon Valley B)

Manufacturing Hub C)

Rust Belt Answer: C Explanation: Japan challenged

the Rust Belt in the auto and electronics industries. What

Is the Rust Belt? The Rust Belt is a colloquial term used to

describe the geographic region stretching from New York through the Midwest

that was once dominated by the coal industry, steel production,

and manufacturing. The Rust Belt became an industrial hub due to its proximity to

the Great Lakes, canals, and rivers, which allowed companies to

access raw materials and ship out finished products. The region received the name Rust Belt in the

late 1970s, after a sharp decline in industrial work left many

factories abandoned and desolate, causing increased rust from exposure to the

elements. It is also referred to as the Manufacturing Belt and the

Factory Belt. KEY TAKEAWAYS

Understanding

the Rust Belt The term Rust Belt is often used in a derogatory sense to

describe parts of the country that have seen an economic decline—typically

very drastic. The rust belt region

represents the deindustrialization of an area, which is often

accompanied by fewer high-paying jobs and high poverty rates. The result

has been a change in the urban landscape as the local population has moved to

other areas of the country in search of work. Although there is no definitive boundary, the states that are

considered in the Rust Belt–at least partly–include the following:

There are other states in the U.S. that have also experienced

declines in manufacturing, such as states in the deep south, but they are not

usually considered part of the Rust Belt. The region was home to some of

America's most prominent industries, such as steel production

and automobile manufacturing. Once recognized as the industrial

heartland, the region has experienced a sharp downturn in industrial activity

from the increased cost of domestic labor, competition from overseas,

technology advancements replacing workers, and the capital

intensive nature of manufacturing. Poverty in the Rust Belt Blue-collar jobs have increasingly moved

overseas, forcing local governments to rethink the type of manufacturing

businesses that can succeed in the area. While some cities managed to adopt new technologies, others

still struggle with rising poverty levels and declining populations. Below are the poverty rates from the U.S. Census

Bureau as of 2018 for each of the Rust Belt states listed above. Poverty Rates in the Rust Belt. There are other U.S. states that have high poverty rates, such

as Kentucky (16.9%), Louisiana (18.6%), and Alabama (16.8%). However, the

rust belt states have–at a minimum–a double-digit percentage of their

population in poverty. History

of the Rust Belt Before being known as the Rust Belt, the area was generally

known as the country's Factory, Steel, or Manufacturing Belt. This area, once

a booming hub of economic activity, represented a great portion of U.S.

industrial growth and development. The natural resources that were found in the area led to its

prosperity—namely coal and iron ore—along with labor and ready access to transport

by available waterways. This led to the rise in coal and steel plants, which

later spawned the weapons, automotive, and auto parts industries. People

seeking employment began moving to the area, which was dominated by both the

coal and steel industries, changing the overall landscape of the region. But that began to change between the 1950s and 1970s. Many

manufacturers were still using expensive and outdated equipment and

machinery and were saddled with the high costs of domestic labor and materials.

To compensate, a good portion of them began looking elsewhere for cheaper

steel and labor—namely from foreign sources—which would ultimately lead to

the collapse of the region. There is no definitive boundary for the Rust

Belt, but it generally includes the area from New York through the Midwest. Decline

of the Rust Belt Most research suggests the Rust Belt started to falter in the

late 1970s, but the decline may have started earlier, notably in the 1950s,

when the region's dominant industries faced minimal competition.

Powerful labor unions in the automotive and steel manufacturing

sectors ensured labor competition stayed to a minimum. As a result, many of

the established companies had very little incentive to innovate or expand

productivity. This came back to haunt the region when the United States

opened trade overseas and shifted manufacturing production to the south. By the 1980s, the Rust Belt faced competitive

pressure—domestically and overseas—and had to ratchet down wages and prices. Operating in

a monopolistic fashion for an extended period of time played an

instrumental role in the downfall of the Rust Belt. This shows that

competitive pressure in productivity and labor markets are important to

incentivize firms to innovate. However, when those incentives are weak,

it can drive resources to more prosperous regions of the country. The region's population also showed a rapid

decline. What was once a hub

for immigrants from the rest of the country and abroad, led to an exodus of

people out of the area. Thousands of

well-paying blue-collar jobs were eliminated, forcing people to move away in

search of employment and better living conditions. Politics

and the Rust Belt The term Rust Belt is generally attributed to Walter Mondale, who

referred to this part of the country when he was the Democratic presidential

candidate in 1984. Attacking President Ronald Reagan, Mondale claimed his

opponent's policies were ruining what he called the Rust Bowl. He was

misquoted by the media as saying the rust belt, and the term stuck. Since

then, the term has consistently been used to describe the area's economic

decline. From a policy perspective, addressing the specific needs of the

Rust Belt states was a political imperative for both parties during the 2016

election. Many believe the national

government can find a solution to help this failing region succeed again. Trump's second-term agenda: revenge, trade

wars, mass deportations Reuters December 27, 202311:22 AM EST Updated 19 days

ago WASHINGTON, Dec 27 (Reuters) - Republican Donald Trump is planning to

punish his political enemies, deport millions of migrants and reshape global

trade with pricey tariffs if he wins a second White House term in the

November 2024 presidential election, according to his campaign and media

reports. Here is a look at some of the policies Trump

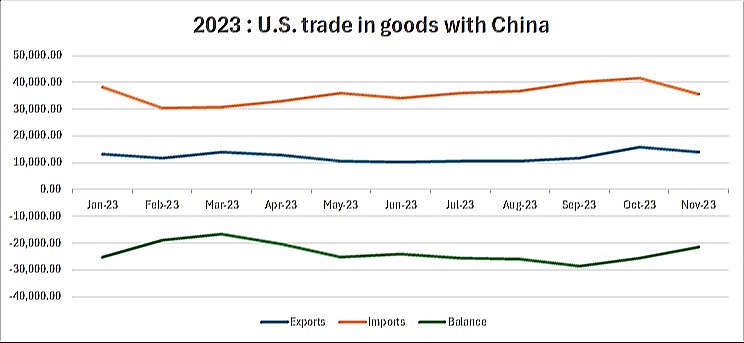

has pledged to institute: TRADE Trump has floated the idea of a 10% tariff on all goods imported

into the United States, a move he says would eliminate the trade

deficit but one critics say would lead to higher prices for American

consumers and global economic instability. He has also said he should have the authority to set higher

tariffs on countries that have established tariffs on American imports. Trump, in particular, has targeted China. He proposes phasing out

Chinese imports of goods such as electronics, steel and pharmaceuticals over

four years. He seeks to prohibit Chinese companies from owning U.S.

infrastructure in the energy and tech sectors. FEDERAL BUREAUCRACY Trump would seek to decimate what he terms the “deep state” –

career federal employees he says are clandestinely pursuing their own agendas

– through an executive order that would reclassify thousands of workers to

enable them to be fired. That would likely be challenged in court. He has vowed to fire what he terms

"corrupt" actors in national security positions and "root

out" his political opponents. Trump would require every federal employee to

pass a new civil service test of his own creation. His team is also vetting scores

of potential hires who could be counted on to implement his policies or

perhaps investigate Trump’s political enemies. He would crack down on federal whistleblowers who are typically

shielded by law and would institute an independent body to "monitor"

U.S. intelligence agencies. Trump also would seek to bring independent regulatory agencies

such as the Federal Communications Commission and the Federal Trade

Commission under presidential control. ENERGY Trump has vowed to increase U.S. production of fossil fuels by

easing the permitting process for drilling on federal land and would

encourage new natural gas pipelines. He has said he will pull the United States out of the Paris

Climate Accords, a framework for reducing global greenhouse gas emissions and

would support increased nuclear energy production. He would also roll back

the Biden White House’s electric-vehicle mandates and other policies aimed at

reducing auto emissions. ECONOMY Along with his trade and energy agendas, Trump has promised to

slash federal regulations he argues limit job creation. He and his economic

team have discussed a further round of individual and corporate tax cuts

beyond those enacted in his first term. He said as president he would

pressure the Federal Reserve to lower interest rates. Trump is proposing the government establish

so-called "freedom cities" on federal land that he says would spur

job growth and technological innovation. IMMIGRATION Trump has vowed to reinstate first-term

policies targeting illegal border crossings, roll back Biden's pro-immigrant

measures and forge ahead with sweeping new restrictions. Trump has pledged to limit access to asylum at

the U.S.-Mexico border and embark on the biggest deportation effort in

American history, which would likely trigger legal challenges and opposition

from Democrats in Congress. Trump has said he would seek to end automatic

citizenship for children born to immigrants, a move that would run against

the long-running interpretation of the U.S. Constitution. ABORTION Trump appointed three justices to the U.S.

Supreme Court who were part of the majority that did away with constitutional

protection for abortion. He likely would continue to appoint federal judges

who would uphold abortion limits. At the same time, he has said a federal

abortion ban is unnecessary, and that the issue should be resolved on a

state-by-state basis. He has argued a six-week ban favored by some Republicans

is overly harsh and that any legislation should include exceptions for rape,

incest and the health of the mother. FOREIGN AFFAIRS Trump has been critical of the U.S.'s support for Ukraine in its

war with Russia and has said he could end the war in 24 hours if elected. He has argued that Europe should reimburse the U.S. for

ammunition used in the conflict. Trump

has also said that under his presidency, America would fundamentally rethink

"NATO's purpose and NATO's mission." He has supported Israel in its fight against Hamas despite

initially criticizing its leaders after the October attacks. On the campaign trail,

he has also floated sending armed forces into Mexico to battle drug cartels

and slapping expansive tariffs on friends and foes alike. EDUCATION Trump has pledged to require America’s colleges and universities to “defend American

tradition and Western civilization” and purge them of diversity programs.

He said he would direct the Justice Department to pursue civil rights cases

against schools that engage in racial discrimination. On the K-12 level, Trump would support programs allowing parents

to use public funds for private or religious instruction. CRIME Trump has pledged to appoint U.S. attorneys

who would launch probes into liberal prosecutors and district attorneys he

says are failing to contain crime in America's cities. He has said he would institute the death

penalty for human traffickers and drug dealers. He also has suggested that

looters of retail stores could be "shot" while on site. HOMELESSNESS Trump has vowed to ban so-called “urban camps”

from America’s cities and require homeless people to accept drug treatment or

face arrest. He said he would then "open large parcels

of inexpensive land" where tent cities would be relocated and staffed

with doctors, drug counselors and mental health experts. Reporting by James Oliphant; Additional

reporting by Ted Hesson; Editing by Ross Colvin and Jonathan Oatis In class exercise Question 1. Trade Policies - What is the proposed tariff

percentage on all goods imported into the United States? A) 5% B) 10% C) 15% Answer:

B Explanation: Trump suggests a 10% tariff to eliminate

the trade deficit. Question 2. Federal Bureaucracy - What executive order does Trump

plan to use to target career federal employees? A) Executive Order on National Security B) Executive Order on Tariffs C) Executive Order on Civil Service Answer:

C Explanation: Trump aims to reclassify workers to enable

their dismissal. Question 3. Energy Policies - What does Trump propose to do

with U.S. participation in the Paris Climate Accords? A) Increase commitment B) Maintain current commitment C) Withdraw Answer:

C Explanation: Trump plans to pull the U.S. out of the

Paris Climate Accords. Question 4. Economic Measures - In addition to tax cuts, what

does Trump propose to pressure the Federal Reserve to do? A) Raise interest rates B) Maintain interest rates C) Lower interest rates Answer:

C Explanation: Trump wants the Federal Reserve to lower

interest rates. Question 5. Foreign Affairs - How does Trump view the U.S.'s

support for Ukraine in its war with Russia? A) Supportive B) Critical C) Neutral Answer:

B Explanation: Trump has been critical of U.S. support for

Ukraine. Question 6. Education Policies - What does Trump want colleges

and universities to defend and purge? A) American tradition and Western civilization B) Cultural diversity C) Scientific innovation Answer:

A Explanation: Trump aims to defend these values and purge

diversity programs. Question 7. Trade with China - Which of the following goods

does Trump propose to phase out in Chinese imports over four years? A) Textiles B) Electronics, steel, and pharmaceuticals C) Agricultural products Answer:

B Explanation: Trump aims to phase out these specific

Chinese imports. Question 8. Regulatory Agencies - Which agencies does Trump

aim to bring under presidential control? A) Environmental Protection Agency (EPA) B) Federal Communications Commission (FCC) and Federal Trade

Commission (FTC) C) Department of Education Answer:

B Explanation: Trump wants these independent regulatory

agencies under presidential control.

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 2 Let’s watch this video together. Imports, Exports, and Exchange Rates: Crash Course

Economics #15 (youtube) In class exercise 1.

Who is the world's largest importer? A. China B. Canada C. United States Answer: C. 2.

Which country is the largest trading

partner of the United States? A. China B. Mexico C. Canada Answer: C. Explanation: Despite the common perception of China, the episode reveals that Canada is the largest trading partner of the United States. 3.

What is the annual difference between a

country's exports and imports called? A. Net exports B. Trade surplus C. Trade deficit Answer: A. Explanation: Net exports represent the annual difference between a country's exports and imports. 4.

What is the role of exchange rates in

international trade? A. Influencing trade balances B. Determining political stability C. Regulating labor costs Answer: A. Explanation: Exchange rates impact the affordability of imports and exports, influencing trade balances. 5.

Which organization is mentioned as working

to eradicate protectionism in international trade? A. United Nations B. World Trade Organization (WTO) C. International Monetary Fund (IMF) Answer: B. Explanation: The WTO is mentioned as an organization working to eradicate protectionism in international trade. 6.

What is the main purpose of the financial

account in the balance of payments? A. Recording the sale and purchase of goods B. Tracking financial assets' transactions C. Documenting foreign aid and donations Answer: B. Explanation: The financial account records transactions related to financial assets, such as stocks and bonds. 7.

Why did some critics argue against NAFTA

(North American Free Trade Agreement)? A. It increased trade deficits B. It created manufacturing jobs C. It favored rich countries Answer: A. Explanation: Critics argued that NAFTA significantly increased US trade deficits. 8.

Why do some countries choose to peg their

currency to another currency? A. To increase exchange rates B. To maintain stability in exchange rates C. To encourage imports Answer: B. Explanation: Some countries peg their currency to another to keep the exchange rate in a certain range and maintain stability. 9.

What does the episode emphasize as the

overall impact of international trade on the global standard of living? A. It has no impact on the global standard of living B. It always improves the global standard of living C. It improves the global standard of living, despite individual challenges Answer: C. Explanation: The episode concludes that, in the aggregate, international trade improves the global standard of living, even though there may be individual challenges. 10. What does the episode suggest

about protectionist policies like high tariffs on imports? A. They always benefit the economy B. They have no impact on the economy C. They usually hurt the economy Answer: C. Explanation: Protectionist policies, like high tariffs, are mentioned as usually hurting the economy more than helping.

Topic 1- What is BOP? The balance of payment of a country contains two

accounts: current and capital. The current account records exports and imports of goods and services

as well as unilateral transfers, whereas the capital account records purchase and sale transactions of foreign

assets and liabilities during a particular year. Summary: Current Account: ·

Definition: The

current account represents the country's transactions in goods, services,

income, and current transfers with the rest of the world. ·

Components: A. Trade Balance: The difference between exports and imports

of goods. B. Services: Transactions related to services (e.g.,

tourism, transportation). C. Income: Receipts and payments of interest, dividends, and

wages. D. Current Transfers: Gifts, aids, and remittances. Capital Account: ·

Definition: The

capital account tracks capital transfers and the acquisition or disposal of

non-financial assets. Now includes financial account. ·

Components: A. Capital Transfers: Non-financial transfers (e.g., debt

forgiveness) and financial transfers. B. Acquisition/Disposal of Non-Financial Assets: Sale or

purchase of non-financial assets, such as patents, goodwill, copy rights,

etc, and financial assets, such as FDI, changes in reserves, portfolio

investment, and financial derivative. Balance of Payments (BoP): ·

Definition: The BoP

is a comprehensive record of a country's economic transactions with the rest

of the world over a specific period. ·

Equation: BoP = Current Account + Capital Account ·

Significance: It

indicates whether a country has a surplus or deficit in its transactions with

the rest of the world. Summary: ·

Current Account: Records

day-to-day transactions, including trade, services, income, and transfers. ·

Capital Account:

Deals with transfers of non-financial and financial assets and capital

transfers. ·

Balance of Payments:

The overall record combining the Current and Capital Accounts, reflecting a

country's economic relationship with the world. Part I

- What is the current account? From

khan academy:

Current vs. Capital Accounts: What's the

Difference? By

THE INVESTOPEDIA TEAM, Updated June

29, 2021, Reviewed by ROBERT C. KELLY Current

vs. Capital Accounts: An Overview The

current and capital accounts represent two halves of a nation's balance of

payments. The current account

represents a country's net income over a period of time, while the capital

account records the net change of assets and liabilities during a particular

year. In

economic terms, the current account deals with the receipt and payment in

cash as well as non-capital items, while the capital account reflects sources

and utilization of capital. The sum of

the current account and capital account reflected in the balance of payments

will always be zero. Any surplus or deficit in the current account is matched

and canceled out by an equal surplus or deficit in the capital account. KEY

TAKEAWAYS ·

The current and

capital accounts are two components of a nation's balance of payments. ·

The current account

is the difference between a country's savings and investments. ·

A country's capital

account records the net change of assets and liabilities during a certain

period of time. Current Account The

current account deals with a country's short-term transactions or the

difference between its savings and investments. These are also referred to as

actual transactions (as they have a real impact on income), output and

employment levels through the movement of goods and services in the economy. The current account consists of visible trade

(export and import of goods), invisible trade (export and import of services),

unilateral transfers, and investment income (income from factors such as land

or foreign shares). The credit and debit of foreign exchange from these

transactions are also recorded in the balance of the current account. The

resulting balance of the current account is approximated as the sum total of

the balance of trade. Current Account vs. Capital Account Transactions

are recorded in the current account in the following ways: Exports are noted as credits in the balance

of payments Imports are recorded as debits in the

balance of payments The

current account gives economists and other analysts an idea of how the

country is faring economically. The

difference between exports and imports, or the trade balance, will determine

whether a country's current balance is positive or negative. When it is

positive, the current account has a surplus, making the country a "net

lender" to the rest of the world. A deficit means the current account

balance is negative. In this case, that country is considered a net borrower. If imports