FIN534 Class Web Page, Fall '18

Jacksonville

University

Instructor:

Maggie Foley

Term Project (due in week 6) (references from prior semesters: 1 2 )

Business Finance Online, an interactive learning tool

for the Corporate Finance Student https://www.zenwealth.com/BusinessFinanceOnline/index.htm

Weekly

SCHEDULE, LINKS, FILES and Questions

|

Week |

Coverage, HW, Supplements -

Required |

|

Miscellaneous |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week1 |

Marketwatch Stock Trading Game (Pass

code: havefun) (game will start on 10/22/2018

and will end on 12/5/2018) 1. URL for your

game: 2. Password for

this private game: havefun 3. Click on the 'Join Now' button to get

started. 4. If you are an

existing MarketWatch member, login.

If you are a new user, follow the link for a Free account - it's easy! 5. Follow the

instructions and start trading! Chapter 2 Financial Statements Topics in Chapter 2:

·

Experts explain:

Financial Statements (video) ·

Finviz.com/screener for

ratio analysis (https://finviz.com/screener.ashx) Chapter 3 Analysis of Financial Statements Topics in Chapter 3:

·

DuPont identity: video

ROE = (net income / sales) * (sales / assets) * (assets /

shareholders' equity) This equation for ROE breaks it into three widely used and

studied components: ROE = (net profit margin) * (asset turnover) * (equity

multiplier) Nike Income Statement (values in 000's)

Nike Balance Sheet (values in 000's)

Nike Cash Flow Statement (values in 000's)

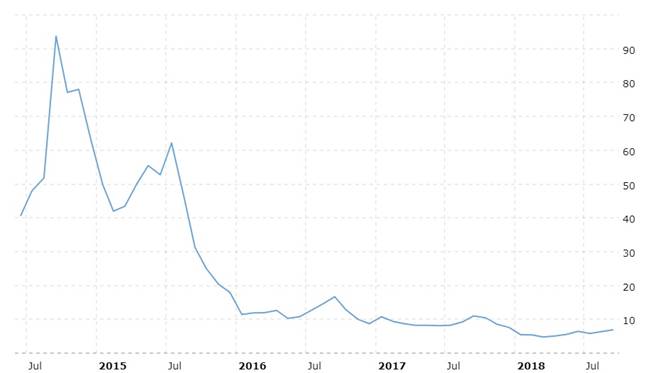

Nike Stock price

chart in the past four years

Between Nike and GoPro, which company is

worth investing? But are you sure? Is GoPro over-valued? Or under-valued? And

what about Nike? Homework of Week 1 – No homework assignment FYI: Below are Benjamin Graham’s seven time-tested

criteria to identify strong value stocks.

https://cabotwealth.com/daily/value-investing/benjamin-grahams-value-stock-criteria/Value Stock Criteria List:

VALUE CRITERIA #1:

Look for a quality rating that is average or

better. You don’t need to find the best quality companies–average

or better is fine. Benjamin Graham recommended using Standard & Poor’s rating system and required companies to have an S&P

Earnings and Dividend Rating of B or better. The S&P rating system ranges

from D to A+. Stick to stocks with ratings of B+ or better, just to be

on the safe side. VALUE CRITERIA #2:

Graham advised buying companies with Total Debt

to Current Asset ratios of less than 1.10. In value investing it is important

at all times to invest in companies with a low debt load. Total Debt to

Current Asset ratios can be found in data supplied by Standard & Poor’s, Value Line, and many other services. VALUE CRITERIA #3:

Check the Current Ratio (current assets divided

by current liabilities) to find companies with ratios over 1.50. This is a

common ratio provided by many investment services. |

|

http://www.jufinance.com/10k/bs http://www.jufinance.com/10k/is http://www.jufinance.com/10k/cf Ratio Analysis (plus balance sheet, income statement) https://www.jufinance.com/ratio GoPro Income Statement (values in 000's)

GoPro Balance Sheet (values in 000's)

GoPro Cash flow Statement (values in 000's)

GoPro Stock price

chart in the past four years

GoPro ---

VALUE CRITERIA #4:

Criteria four is simple: Find companies with positive earnings per share growth during the past five years with no earnings deficits. Earnings need to be higher in the most recent year than five years ago. Avoiding companies with earnings deficits during the past five years will help you stay clear of high-risk companies. VALUE CRITERIA #5:

Invest in companies with price to earnings per share (P/E) ratios of 9.0

or less. Look for companies that are selling at bargain prices. Finding

companies with low P/Es usually eliminates high growth companies, which

should be evaluated using growth investing techniques. VALUE

CRITERIA #6:

Find companies with price to book value (P/BV) ratios less than 1.20.

P/E ratios, mentioned in rule 5, can sometimes be misleading. P/BV ratios are

calculated by dividing the current price by the most recent book value per

share for a company. Book value provides a good indication of the underlying

value of a company. Investing in stocks selling near or below their book

value makes sense. VALUE

CRITERIA #7:

Invest in companies that are currently paying dividends. Investing in

undervalued companies requires waiting for other investors to discover the

bargains you have already found. Sometimes your wait period will be long and

tedious, but if the company pays a decent dividend, you can sit back and

collect dividends while you wait patiently for your stock to go from

undervalued to overvalued. One last thought. We like to find out why a stock is selling at a bargain price. Is the company competing in an industry that is dying? Is the company suffering from a setback caused by an unforeseen problem? The most important question, though, is whether the company’s problem is short-term or long-term and whether management is aware of the problem and taking action to correct it. You can put your business acumen to work to determine if management has an adequate plan to solve the company’s current problems. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 2 |

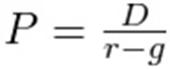

Chapter 1 An Overview of Financial Management Concepts: Primary market vs. secondary market Money market security vs. stock vs. bond Goal of a corporation IPO vs. SEO vs. Going private NYSE vs. NASDAQ Agency problem Investment bank vs. commercial bank Intrinsic value vs. market value FCF vs. Earning

Let’s focus on Amazon,

Apple, and Tesla. 1.

The history of the three

firms? Who provide capitals to them before they went for IPO? 2.

When do they IPO? SEO?

Do they have debts? 3.

Any differences in board

structure among the three firms? CEO? Do you trust them? Any agency problems

in those firms? What can you do to eliminate the agency problems? 4.

Their WACC? Which one

has the highest WACC? The lowest one? Make sense? 5.

Their intrinsic value? Market

value? Let’s give it a try to

calculate the intrinsic values of the three firms using the above equation.

What is your conclusion? Free Cash Flow of Amazon https://www.zacks.com/stock/chart/AMZN/fundamental/free-cash-flow-ttm

https://www.marketwatch.com/investing/stock/amzn/financials/cash-flow Note: The Company's trailing twelve month (TTM)

Free Cash Flow is a measure of financial performance and represents the cash

that a company is able to generate after factoring the money required to

maintain or expand its asset base. Free cash flow is important because it

allows a company to pursue opportunities that enhance shareholder value. Free Cash Flow = net income +

depreciation and amortization - capital expenditures. 6. Read the attached article about Amazon and

its acquisition of whole food. Do you think that it is a value creation deal?

Or opposite? If you have Amazon stocks, do you vote for this deal or not? Whole foods and Jana

Harvard Business Case Study (FYI) 7. Apple acquires Tesla. Do you think that it

is possible? 8. How can a firm increase its intrinsic

value? Its market value? Apple not buying stake in

Tesla would be 'biggest mistake of Tim Cook's career': Strategist (video)

9. What is the role of hedge funds?

Investment banks? Other shareholder activists? 10. The role of the government? The

government just gave its explanation for appealing the $85 billion

AT&T-Time Warner merger (video)

11. The stocks are changing hands among

investors in the secondary market, not in the primary market. Why are CEOs so

worried for stock market performance? 12. Why do firms borrow for long term in bond

market, not for short term from banks? Homework Questions on Page 54 (due with mid term) 1(a-i), 2, 3, 4, 5, 6, 7, 8, 10 (as follows) (1-1)

Define each of the following terms: a. Proprietorship; partnership; corporation;

charter; bylaws b. Limited partnership; limited liability partnership;

professional corporation c. Stockholder wealth maximization d. Money market;

capital market; primary market; secondary market e. Private markets; public

markets; derivatives f. Investment bank; financial services corporation;

financial intermediary g. Mutual fund; money market fund h. Physical location

exchange; computer/telephone network i. Open outcry auction; dealer market;

automated trading (1-2)

What are the three principal forms of business organization? What are

the advantages and disadvantages of each? (1-3)

What is a firm’s fundamental

value (which is also called its intrinsic value)? What might cause a firm’s

intrinsic value to be different from its actual market value? (1-4)

Edmund Corporation recently made

a large investment to upgrade its technology. Although these improvements

won’t have much of an impact on performance in the short run, they are

expected to reduce future costs significantly. What impact will this

investment have on Edmund’s earnings per share this year? What impact might

this investment have on the company’s intrinsic value and stock price? (1-5)

Describe the ways in which capital can be transferred from suppliers of

capital to those who are demanding capital. (1-6)

What are financial intermediaries, and what economic functions do they

perform? (1-7)

Is an initial public offering an example of a primary or a secondary

market transaction? (1-8)

Contrast and compare trading in face-to-face auctions, dealer markets,

and automated trading platforms. (1-9)

What are some similarities and differences between the NYSE and the

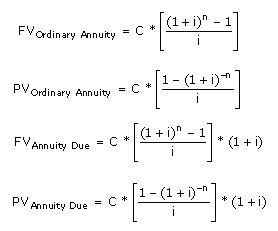

NASDAQ Stock Market? Chapter 4 Time Value of Money Topics: n Future Value and Compounding n Present Value and

Discounting n Rates of Return/Interest

Rates n Amortization Summary of this chapter ·

Time value of money is

regarded as the most basic and the most important knowledge for finance.

There are five factors associated with the time value of money: interest

rate, time remaining for investment, periodical payment, present value, and

future value. Any of these four values can be considered while trying to

identify the fifth aspect, by using equations, calculators, or Excel

worksheet. Examples can be viewed on the powerpoint slides. ·

Let us focus on the amortization table.

The template is available. ·

Anytime

you want to get a loan to buy a car or a house;

you can request a copy of the amortization table from your banker. The

table shows you the value of your

monthly payments, and you will be able to determine from each payment, the value

of interest charged and how much will be paid

into your account. Furthermore, from the table, you can determine the remaining balance of the loan

for the subsequent months. ·

How to generate an amortization table

independently? ·

You can use this template. ·

The input information should be included in

the top part of this template. The APR is the annual percentage rate. The

frequency refers to how many times the value is

compounded in a year. The loan

amount is the total value of the loan. The loan term refers to the duration

of the loan. After analyzing the input segment, the analysis section will

show the periodical rate and the total number of periods for the loan as well as the periodical payment. ·

The last part of this table represents the

actual amortization table. The initial balance shows the value of the loan

before a payment is made. The next

column shows the periodic payment. It is the fixed amount of the different periods. The interest

payment indicates how much is paid as

interest. It is calculated by

multiplying the initial balance by the periodic interest rate. Since the loan

balance is reduced after each payment,

the interest payment also reduces. The section repayment of principal

indicates how much is paid into your

account. It is the difference between the periodic payment and the payments

made as interest. The ending balance shows the remaining debt. It is the

difference between the initial balance and the repayment of principal. The ending balance will eventually become

zero after all the scheduled payments have been

made. ·

The time value of money - German Nande (video

https://www.youtube.com/watch?v=MhvjCWfy-lw

NPV

calculator (FYI) NFV calculator (FYI) Time Value of Money Calculator (FYI) Homework

of Chapter 4 (due with mid term) n Questions on P183: 1: e, g, h, i, j; 4, 5 n Problems on P184: 1, 2, 3, 4, 16, 17, 19, 27, 29 (You can use formula/financial calculator/spreadsheet: for each question one approach is

enough. You may use multiple

approaches to double check.) n Develop an Amortization Schedule in Excel: 5-year Auto Loan of $30,000 with APR 3% (use the home mortgage loan example in course materials as a template) Page

183: (4-1) Define each of the following terms: e. Perpetuity; consol g. Compounding; discounting h. Annual,

semiannual, quarterly, monthly, and daily compounding i. Effective annual

rate (EAR or EFF%);nominal (quoted) interest rate; APR; periodic rate (4-4)

If a firm’s earnings per share grew from $1 to $2

over a 10-year period, the total growth

wouldbe100%,buttheannualgrowthratewouldbelessthan10%.Trueorfalse?Explain. (4-5)

Would you rather have a savings account that pays 5% interest compounded semiannually

or one that pays 5% interest compounded daily? Explain Page

184: 1.

If

you deposit $10,000 in a bank account that pays 10% interest annually, how

much will be in your account after 5 years? 2.

What is the present

value of a security that will pay $5,000 in 20 years if securities of equal

risk pay 7% annually? 3.

Your parents will retire

in18 years. They currently have$250,000, and they think they will need $1

million at retirement. What annual interest rate must they earn to reach

their goal, assuming they don’t save any additional

funds? 4.

If you deposit money

today in an account that pays 6.5% annual interest, how long will it take to

double your money? 16.

Find the amount to which $500 will grow under each of the following

conditions. a. 12% compounded annually for 5 years b. 12% compounded

semiannually for 5 years c. 12% compounded quarterly for 5 years d. 12%

compounded monthly for 5 years 17.

Find the present value of $500 due in the future under each of the following

conditions. a. 12% nominal rate, semiannual compounding, discounted back 5

years b. 12% nominal rate, quarterly compounding, discounted back 5 years c.

12% nominal rate, monthly compounding, discounted back 1 year 19.

Universal Bank pays 7% interest, compounded annually, on time deposits. Regional

Bank pays 6% interest, compounded quarterly. a. Based on effective interest

rates, in which bank would you

prefer to deposit your money? b. Could

your choice of banks be influenced by the fact that you might want to

withdraw your funds during the year as opposed to at the end of the year? In

answering this question, assume that funds must be left on deposit during an

entire compounding period in order for you to receive any interest. 27.

What is the present value of a perpetuity of $100 per year if the appropriate

discount rate is 7%? If interest rates in general were to double and the

appropriate discount rate rose to 14%, what would happen to the present value

of the perpetuity? 29.

Assume that your aunt sold her house on December 31, and to help close the

sale she took a second mortgage in the amount of $10,000 as part of the

payment. The mortgage has a quoted (or nominal) interest rate of 10%;it calls

for payments every 6 months, beginning on June30, and is to be amortized over

10 years. Now, 1yearlater, your aunt must inform the IRS and the person who

bought the house about the interest that was included in the two payments

made during the year. (This interest will be income to your aunt and a

deduction to the buyer of the house.) To the closest dollar, what is the

total amount of interest that was paid during the first year? |

|

FYI: Amazon.com Inc. (AMZN) https://www.stock-analysis-on.net/NASDAQ/Company/Amazoncom-Inc/DCF/Present-Value-of-FCFF

Present Value of Free Cash Flow to

the Firm (FCFF)

In

discounted cash flow (DCF) valuation techniques the value of the stock is

estimated based upon present value of some measure of cash flow. Free cash

flow to the firm (FCFF) is generally described as cash flows after direct

costs and before any payments to capital suppliers.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 3 |

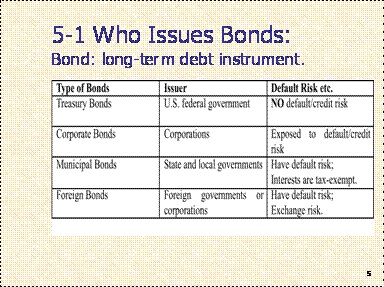

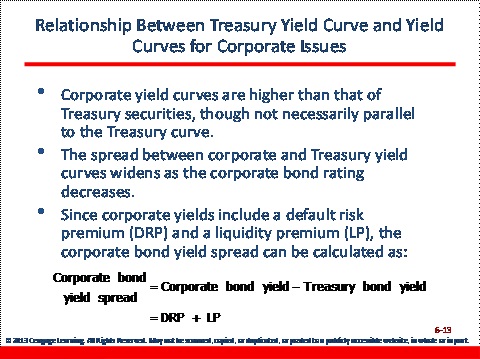

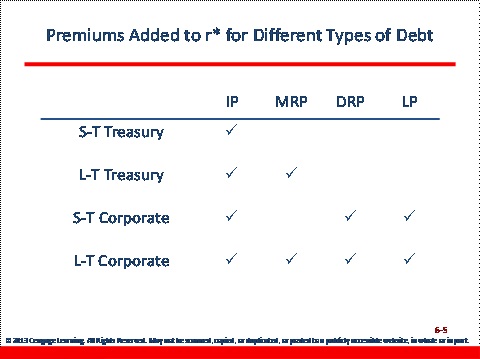

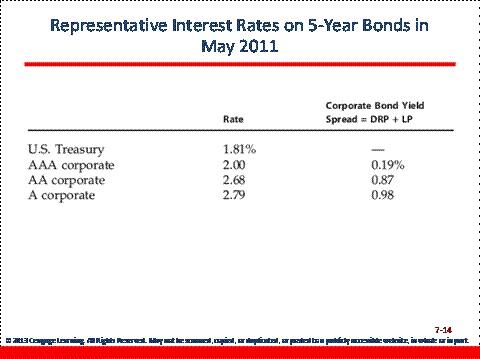

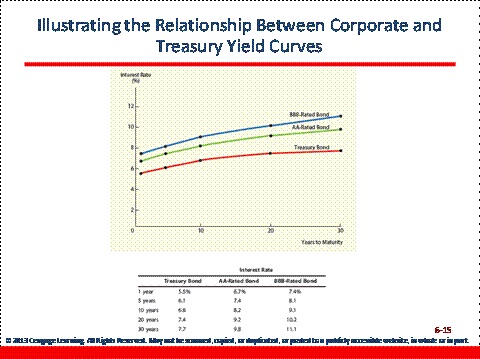

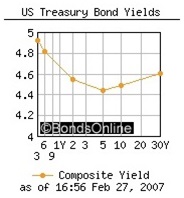

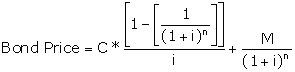

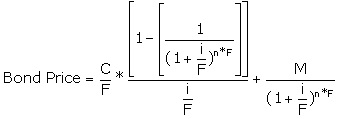

Chapter 5 Bond, Bond Valuation and Interest Rates For class discussion: ·

Name major categories of

bonds

As an investor, which type of bond is your

favorite one? Why? ·

Why we say that bond is

safer than stock? How to calculate bond market prices? Where can you find

bond price information? Bond

calculator here (www.jufinance.com/bond) ·

What are the key

determinants to bond valuation? ·

What is current yield?

Capital gain yield? Yield to call? ·

What is premium bond?

Discount bond? Between premium bond and discount bond, which one might be

called back? Which one will not be called back? ·

Once we know the yield

to maturity (YTM) of a bond, we can calculate its price. But how to figure

out YTM?

·

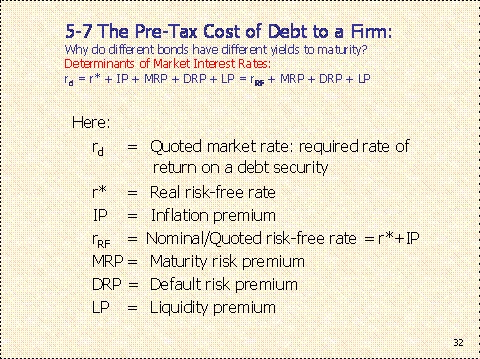

How is each component in

the above slide? ·

How to calculate IP?

What is TIPS? ·

What is interest rate

risk? What is reinvestment risk? Compare the risks between a short term bond

and a long term bond, ·

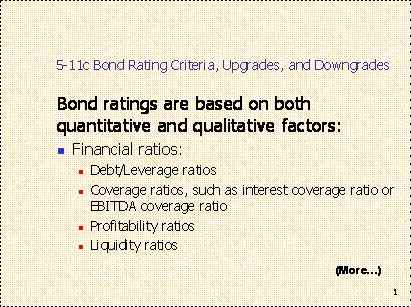

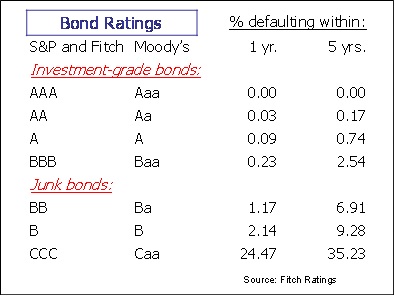

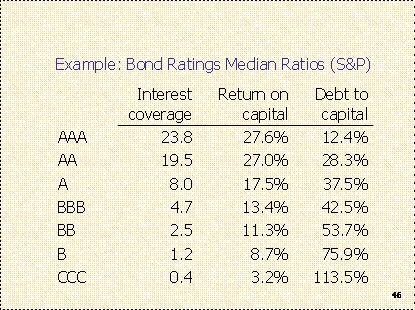

What is bond rating? Do you know z score? How

the credits are assigned? It is based on z

score. (FYI) The ratios are combined in a

function known as the Z-score that yields a score for each company. The

equation for calculating Zscores is as follows: Z = α + where a is a constant, Ri the

ratios, βi the relative weighting applied to ratio Ri and n the number

of ratios used.

·

Overall, bond yield

should look like the following.

MRPt = 0.1%

(t – 1)

Homework

of Chapter 5 (due with mid term) n Questions on P231: 1 a, b, d,

f, g, h, i, j, k, l. 2, 3; n Problems on P232: 1, 7, 12,

13. Page 231 (5-1) Define each of the following terms: a. Bond; Treasury bond; corporate bond; municipal bond; foreign bond b. Par value; maturity date; coupon payment; coupon interest rate d. Call provision; redeemable bond; sinking fund f. Premium bond; discount bond g. Current yield (on a bond); yield to maturity (YTM); yield to call (YTC) h. Indentures; mortgage bond; debenture; subordinated debenture i. Development bond; municipal bond insurance; junk bond; investment-grade bond j. Real risk-free rate of interest, r ; nominal risk-free rate of interest, rRF k. Inflation premium(IP);default risk premium(DRP); liquidity; liquidity premium(LP) l. Interest rate risk; maturity risk premium (MRP); reinvestment rate risk (5-2) “Short-term interest rates are more volatile than long-term interest rates, so short-term bond prices are more sensitive to interest rate changes than are long-term bond prices.” Is this statement true or false? Explain. (5-3) The rate of return on a bond held to its maturity date is called the bond’s yield to maturity. If interest rates in the economy rise after a bond has been issued, what will happen to the bond’s price and to its YTM? Does the length of time to maturity affect the extent to which a given change in interest rates will affect the bond’s price? Why or why not? Page 232: 5-1 Jackson Corporation’s bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds? 5-7 Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds? 5-12 A 10-year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,060. The bond sells for $1,100. (Assume that the bond has just been issued.) a. What is the bond’s yield to maturity? b. What is the bond’s current yield? c. What is the bond’s capital gain or loss yield? d. What is the bond’s yield to call? 5-13 You just purchased a bond that matures in 5 years. The bond has a face value of $1,000 and has an8% annual coupon. The bond has a current yield of 8.21%.What is the bond’s yield to maturity? Chapter 6 Risk and Return: High risk, high return. Right/Wrong? ·

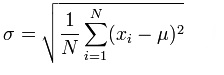

How to calculate risk of an individual

stock, like WMT? Example: 1.

Realized return Holding period return

(HPR) = (Selling price – Purchasing price + dividend)/ Purchasing price HPR

calculator (www.jufinance.com/hpr) 2.

Expected return of this

stock and its standard deviation Expected return and risk (standard

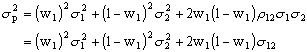

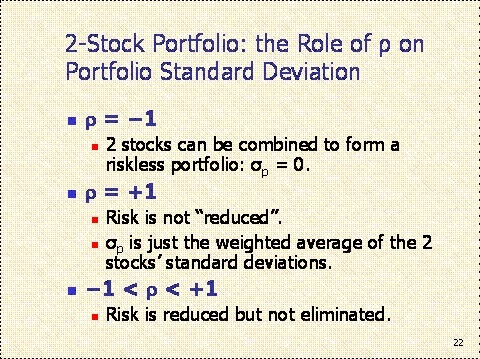

deviation) calculator (www.jufinance.com/return) · A portfolio of two

stocks, like WMT and Amazon? Portfolio Calculator (www.jufinance.com/portfolio) –

see equations below Equation:

W1 and W2 are the percentage

of each stock in the portfolio.

·

A portfolio of three stocks, like WMT,

Amazon, and APPLE? Three stocks is the sum of

three pairs of two-stock-portfolio. So same as above but repeat it three

times. ·

What about a diversified portfolio, with

25 stocks?

n As more stocks are added, each new stock

has a smaller risk-reducing impact on the portfolio. n sp falls very slowly after

about 40 stocks are included. The

lower limit for sp is about 20% = sM (M: market

portfolio). n By forming well-diversified portfolios,

investors can eliminate about half the risk of owning a single stock. n Market risk is that part of a security’s

stand-alone risk that cannot be eliminated by diversification. n Firm-specific, or diversifiable, risk is that

part of a security’s stand-alone risk that can be eliminated by

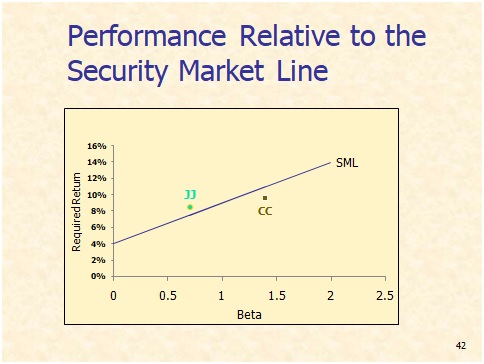

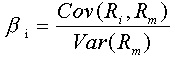

diversification. CAPM model (CAPM

calculator) 1. What is Beta? Where to find Beta?

2. Why can we use beta as measure for risk? 3. What is three month Treasurye bill’s beta?

S&P500 index’s beta? WMT’s beta? Amazon’s beta? Why are they different? 4. Use CAPM to calculate the expected return

of the above stocks 5. Find those stocks in SML

6.

What is market

efficiency? Do you agree with the hypothesis that market is efficient? Do you

have any evidence to disapprove it? Homework

of Chapter 6 (due with mid term) Questions

on P284:1(a, b, d, f, g, h, i, j, k, l, m), 3; Problems

on P286:1, 2, 3, 5, 10. Page 284 (6-1) Define the following terms,

using graphs or equations to illustrate your answers where feasible. a. Risk in general; stand-alone risk;

probability distribution and its relation to risk b. Expected rate of return, r ^ c. Continuous probability distribution d. Standard deviation, σ; variance,

σ2 f. Risk premium for Stock i, RPi; market

risk premium, RPM g. Capital Asset Pricing Model (CAPM) h. Expected return on a portfolio, r ^ p;

market portfolio i. Correlation as a concept; correlation

coefficient, ρ j. Market risk; diversifiable risk;

relevant risk k. Beta coefficient, b; average stock’s

beta l. Security Market Line (SML); SML

equation m. Slope of SML and its relationship to

risk aversion Page 286 6-1 Your investment club has only two

stocks in its portfolio. $20,000 is invested in a stock with a beta of 0.7,

and $35,000 is invested in a stock with a beta of 1.3.What is the

portfolio’s beta? 6-2 AA Corporation’s stock has a beta of

0.8. The risk-free rate is 4% and the expected return on the market is 12%.

What is the required rate of return on AA’s stock? 6-3 Suppose that the risk-free rate is 5%

and that the market risk premium is 7%. What is the required return on (1)

the market, (2) a stock with a beta of 1.0, and (3) a stock with a beta of

1.7? 6-5 A stock’s return has the following

distribution:

Calculate the stock’s expected return and

standard deviation 6-10 Suppose you manage a $4 million fund

that consists of four stocks with the following investments:

If the market’s required rate of return is

14% and the risk-free rate is 6%, what is the fund’s required rate of return? |

|

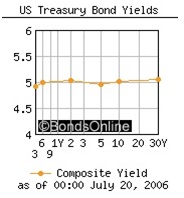

FYI

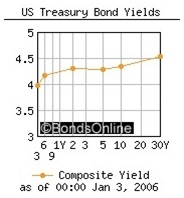

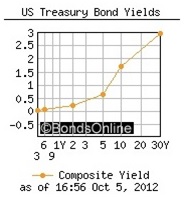

What is yield curve? ( http://www.yieldcurve.com/MktYCgraph.htm) Market watch on Wall Street Journal has daily yield curve and

interest rate information. http://www.marketwatch.com/tools/pftools/ Draw yield curve yourself using the following information

·

What can yield curve

tell us? What is yield

curve, video (youtube) Daily Treasury Yield

Curve Rates

Summary of Yield Curve

Shapes and Explanations Normal Yield Curve

Steep Curve – Economy is improving

Inverted Curve – Recession is coming

To

become inverted, the yield curve must pass through a period where

long-term yields are the same as short-term rates. When that happens the

shape will appear to be flat or, more commonly, a little raised in the

middle. Unfortunately, not all

flat or humped curves turn into fully inverted curves. Otherwise we'd all get

rich plunking our savings down on 30-year bonds the second we saw their

yields start falling toward short-term levels. On the other hand, you

shouldn't discount a flat or humped curve just because it doesn't guarantee a

coming recession. The odds are still pretty good that economic slowdown and

lower interest rates will follow a period of flattening yields.

What You Can Learn from the Yield

Curve (FYI) A flattening trend often

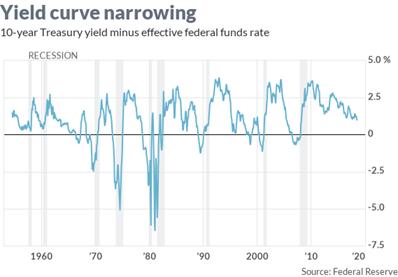

is a red flag, but experts warn against betting on short-term market swings. By Jeff Brown, Contributor Sept. 10, 2018, at 10:23 a.m. Why Investors Watch the Yield Curve (FYI) SHORT-TERM interest rates have

been inching up faster than long-term rates, a condition called a

"flattening yield curve" that for decades has predicted recessions

and put investors into a quandary. What should

investors do? The options range from nothing to changing holdings to

employing strategies to either grow or protect the portfolio, to putting

money on the sidelines for safe keeping. "The yield

curve is one of the single most effective recession indicators available to

us as investors, it is almost never wrong," says Patrick R. McDowell,

investment analyst at Arbor Wealth Management in Miramar Beach, Florida.

"We believe the yield curve will invert in the next 12 months," he

says. "Every U.S.

recession in the past 60 years was preceded by …. an inverted yield

curve," the Federal Reserve Bank of San Francisco says in a March 2018

study, adding that inverted curves have been followed by recessions in all

but one instance over that period. The yield curve is a

graph with bond

maturities on the horizontal axis and yields on the vertical

one. Most of the time short-term bonds have lower yields than long-term ones,

because investors demand more for tying their money up longer and exposing

their holdings to the unknown. The curve starts in the lower left and rises

steadily to the right as maturities and yields go up. But every so often

the gap between short- and long-term yields shrinks to almost nothing, and

sometimes the curve "inverts" so that short-term yields are higher.

The curve flattens rather than rising, or heads down instead of up. This tends to happen

when the Federal

Reserve pushes up the short-term interest rates it can

control while investors push down long-term yields because they expect the

Fed to reduce short-term yields in the future to stimulate the economy in a

downturn or recession. (Lower interest rates make it cheaper to borrow,

increasing spending to perk up the economy.) Long-term yields are

governed by supply and demand in the bond market and represent the combined

wisdom of vast numbers of bond investors. Currently, the

10-year Treasury note yields 2.9 percent, not much more than the two-year's 2.66

percent. Two years ago the rates were 1.55 percent and 0.74 percent.

Shrinking the gap from 0.81 to 0.24 may not seem earth shaking but is a red

flag on the economy. Though a recession

is likely if the curve inverts, this is not necessarily a bad time for

investors, says Craig Thompson, president of Asset Solutions in Lafayette,

Louisiana. "The yield

curve has not inverted yet and even when it does the lead time for a stock

market peak can be considerable," Thompson says. "Yet, it is

something to monitor given we are at the end of the current period of

economic expansion. So, yes, we are in a bull market and should be invested

in stocks. However, the bull market will not last forever and we are probably

at the tail end." Investors can react

in various ways depending on how much risk they

like to take. For income-oriented bond

investors the safe course is to load up on shorter-term bonds in the belief

long-term bonds no longer offer the extra income needed to justify the risk

of bad things happening before the bond matures. Compared to a two-year note,

a 10-year note entails much more risk that the economy could collapse, the

bond issuer could default, or that rising interest rates could make existing

bonds lose value as investors prefer newer ones that pay more. The damage from

rising rates is much more severe for long-term bonds because the consequences

last so much longer. Bond risk can be

measured with duration, a figure that indicates how much value a bond or bond

fund could lose for every one-percentage point rise in prevailing interest

rates. A bond with a 10-year duration could lose 10 percent, while one with a

two-year duration only 2 percent. "Investors

should continue to keep duration low and [hold] high-quality investment-grade

bonds … to help hedge against rising rates in the future," says Jordan

Niefeld, planner with Raymond James & Associates in Aventura, Florida. He

also recommends keeping cash on the sidelines to weather market jolts. "An individual

investor should look at the bonds they own and make sure they mature within

three to five years," says Alan J. Conner, president of NovaPoint

Capital in Atlanta. "These bonds will provide the best combination of

relatively high interest rates and lower interest-rate risk, allowing

investors to wait out this transition period, and perhaps invest at higher

rates as the yield curve normalizes." On the other hand,

investors who move quickly enough can bet that long-term yields will fall

further as the curve flattens even more and then inverts. Falling interest

rates push existing bond prices up because investors would rather have older

bonds that pay more than newer ones. What Is a Flattening Yield

Curve? "People think

shortening their duration exposure is the appropriate response to a

flattening yield curve when in fact the opposite is true," McDowell

says. "If you could execute it seamlessly, you'd want to be shorting

short-term bonds and buying long-term bonds to bet on that type of yield curve

inversion, even though on an absolute [income-paying] basis short-term bonds

are much more attractive." The ultimate play,

he says, is to buy long-duration zero-coupon

bonds, which deliver their accumulated interest earnings only when

the bond matures. These bonds are extremely sensitive to interest rate

changes and can be very profitable if rates fall – but are big losers if

rates go up. Betting on price changes

from changing yields is speculative, perhaps not the best option, many

experts say, for investors using bonds for income or to reduce the ups and

downs of a portfolio that also has stocks. As for equities, a

flattening yield curve may forecast a slower economy, which can hurt

corporate earnings and stock prices, but that doesn't necessarily mean

stockholders should run for the exits, says Brenda Wenning, principal of

Wenning Investments in Newton, Mass "The stock

market has produced gains in four of the last five periods when the yield

curve inverted," she says. "Going back to 1978, the S&P 500 has

risen about 16 percent in the 18 months following an inversion, according to

a new analysis by Credit Suisse. Over 24 months following an inversion, stocks

rose an average of 14 percent and over 30 months, they rose an average of 9.5

percent." The likely reason:

stocks are a bet on the future and investors bid up prices when they

anticipate higher corporate profits after a recession ends. The anxious stock investor's

most obvious choice is to play it safe in uncertain times by trimming stock

holdings and putting the proceeds on the sidelines as cash. But advisors

generally warn against betting on short-term market swings and instead hanging on to

stocks through a recession to enjoy the rebound that follows. Wenning says

investors should not be alarmed. "While other

factors point to a potential slowdown in the fourth quarter, it appears that

a recession remains far away, even if the yield curve inverts," she

says. Opinion: Fed

officials are playing with fire if they deliberately invert the yield curve

(FYI) Published: Sept 18, 2018 4:22 p.m. ET By Carline Baum The converts are lining up. First it was John Williams, who left his perch atop the

Federal Reserve Bank of San Francisco in June to assume the presidency of the

New York Fed. In April, Williams acknowledged that an inverted yield curve

is “a powerful signal of

recessions,” based on a significant body of research,

including that by staff economists at his former bank. By September, Williams was already disavowing that signal. “I don’t see the flat yield curve or inverted yield curve as

being the deciding factor in terms of where we should go with policy,”

Williams said following a speech in Buffalo on Sept. 6. Next up was Fed Gov. Lael Brainard. She broke new ground in a speech last

week when she said she expects the short-run neutral rate of interest — the

unobservable interest rate that keeps the economy growing at its potential —

to rise above the Fed’s projected long-run equilibrium rate of about 3% as a

result of fiscal stimulus. Then she invoked the four most dangerous words in finance —

“this time is different” — and applied them to the prospect of an inverted

yield curve.

The spread between the 10-year Treasury note and the federal

funds rate is still positive, but further rate hikes by the Fed could push

the fed funds rate higher than the 10-year yield, inverting the yield curve

and signaling a recession. While “attentive to the historical observation” that

inversions of the term structure of interest rates had a reliable track

record of preceding recessions in the U.S., Brainard implied that this time

is different because: 1) long-term rates are much lower now than they were

during previous economic expansions; and 2) the term premium is very low.

(The term premium is the extra compensation investors demand for holding a

long-term Treasury security such as a 10-year note TMUBMUSD10Y, -1.28%

instead of one that matures in months.) San Francisco Fed economists Michael Bauer and Thomas Mertens

shot down the term-premium argument, finding “no clear

evidence” that it affects the predictive power of an inverted curve. And the

low level of long-term rates was a popular excuse for why “this time was

different” when the term spread inverted in mid-2006. The significance of an inverted yield curve was even a topic of

discussion at the Fed’s July 31-Aug. 1

meeting. “Several participants” advised paying attention

to the curve in assessing the economic and policy outlook. “Other

participants” said it was inappropriate to infer “causality from statistical

correlations.” Forget statistical correlations. What’s important is the

intuition behind the yield curve: What it says, and why it works. The juxtaposition of

an artificially pegged short-term rate and a market-determined long-term rate

is a succinct expression of the stance of monetary policy. (For simplicity’s

sake, I will ignore interest on excess reserves, which the Fed also sets, and

focus on the Fed’s old-fashioned system of reserve management.) The overnight interbank lending rate is set by the Fed, which

adjusts the supply of reserves to meet the banking system’s demand. (Banks are required to hold reserves as vault cash or as

deposits at a Fed bank on demand deposits and checking accounts.) If the Fed

supplies fewer/more reserves than the banking system demands, the funds rate

will rise/fall. Imagine a situation where the economy is strong, market rates

are rising across the curve and the fed funds rate is steady. It’s fair to

assume that increased demand for credit would be pushing up the overnight

rate as well were it not for the Fed’s largesse. In other words, a steeper

curve equates with an expansionary monetary policy. Similarly, if the Fed is raising the funds rate — restricting

the supply of credit — and market rates begin to decline, eventually

breaching the overnight rate, one can be pretty sure that the Fed is running

a restrictive monetary policy. Recession is the result. These two interest rates encapsulate the stance of monetary

policy. As an indicator, it’s about as simple as it gets. It’s available 24/7

to anyone who is interested and is never revised. The term spread was pretty much ignored in previous business

cycles. Now, it’s the talk of the town, in all its permutations. Any two market rates — 2s/10s, 5s/30s — are game even though

those spreads lack the intellectual rigor of the fed funds/10-year spread or,

using a proxy for the overnight rate, the 3-month/10-year spread, which Bauer

and Mertens say works best. Many of the Fed district bank presidents — including St. Louis’s James Bullard,Atlanta’s

Raphael Bostic, Dallas’ Robert Kaplan, Philadelphia’s Patrick

Harker and Minneapolis’ Neel Kashkari — have expressed

confidence in the predictive power of the yield curve. In recent months, all

of them have said they want to avoid precipitating an inversion of the curve. We have yet to hear anything definitive from Fed Chairman Jay

Powell on whether he would view an inverted curve as a form of “forward

guidance” in setting policy. We know he’s not married to the model, an least

an econometric one. In his speech at Jackson Hole

last month, he said that setting monetary policy based on

unknowable and ever-changing metrics — the natural rate of unemployment, the

neutral rate of interest — is challenging. Short of any break-out of

inflation expectations or unforeseen crisis, gradualism remains Powell’s

preferred approach. What we have yet to learn is whether Fed gradualism will be

aborted if and when it runs into resistance from long-term rates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 4 |

Midterm Exam |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 4 |

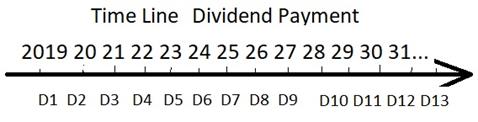

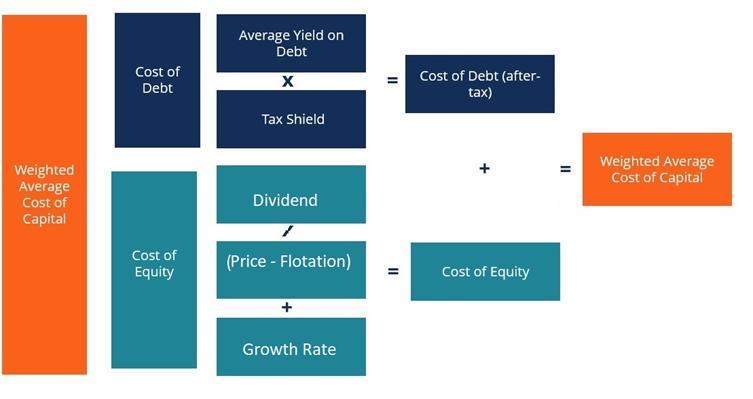

Chapter 7 Valuation of Stocks and Corporations For class discussion: ·

What is dividend growth model? Why can we

use dividend to estimate a firm’s intrinsic value? ·

Are future dividends predictable? ·

Refer to the following table for WMT’s

dividend history http://stock.walmart.com/investors/stock-information/dividend-history/default.aspx

Can you estimate the expected dividend in

2019? And in 2020? And on and on…

Can you write down the math equation

now? WMT stock price = ? Can you calculate now? It is hard

right because we assume dividend payment goes to infinity. How can we

simplify the calculation? We can assume that dividend grows at

certain rate, just as the table on the right shows. Discount rate is r (based on Beta and

CAPM learned in chapter 6) Details

about how to derive the model mathematically (FYI) The Gordon growth model is a simple discounted cash flow (DCF)

model which can be used to value a stock, mutual fund, or even the entire

stock market. The model is named after Myron Gordon who first published

the model in 1959. The Gordon model assumes that

a financial security pays a periodic dividend (D) which

grows at a constant rate (g). These growing dividend payments are

assumed to continue forever. The future dividend payments are discounted at

the required rate of return (r) to find the price (P) for the stock

or fund. Under these

simple assumptions, the price of the security is given by this equation:

In this equation, I’ve used the “0”

subscript on the price (P) and the “1” subscript on the dividend (D) to indicate that the price

is calculated at time zero and the dividend is the expected dividend at the

end of period one. However, the equation is commonly written with these

subscripts omitted. Obviously, the assumptions

built into this model are overly simplistic for many real-world

valuation problems. Many companies pay no dividends, and, for those that

do, we may expect changing payout ratios or growth rates as the

business matures. Despite these limitations, I

believe spending some time experimenting with the Gordon model can help

develop intuition about the relationship between valuation and return. Deriving the Gordon Growth Model

Equation

The Gordon growth model

calculates the present value of the security by summing an infinite series of

discounted dividend payments which follows the pattern shown here:

Multiplying both sides of the

previous equation by (1+g)/(1+r) gives:

We can then subtract the

second equation from the first equation to get:

Rearranging and simplifying:

Finally, we can simplify

further to get the Gordon growth model equation dividend growth model:

Refer to http://www.calculatinginvestor.com/2011/05/18/gordon-growth-model/ ·

Now let’s apply this Dividend growth model in problem solving. Dividend Growth Model calculator (www.jufinance.com/stock) Homework

of Chapter 7 (due with final) n Questions

on P333: 7-1(aefgh), 7-3; n Problems on P334: 7-2, 7-3, 7-4, 7-8, 7-9,

7-14. *****Q&A Session***** |

|

P/E Ratio Summary by industry (FYI) (http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 5 |

Thanksgiving holiday. No class this week.

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 6 |

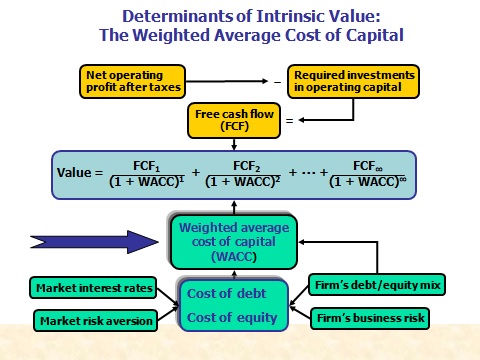

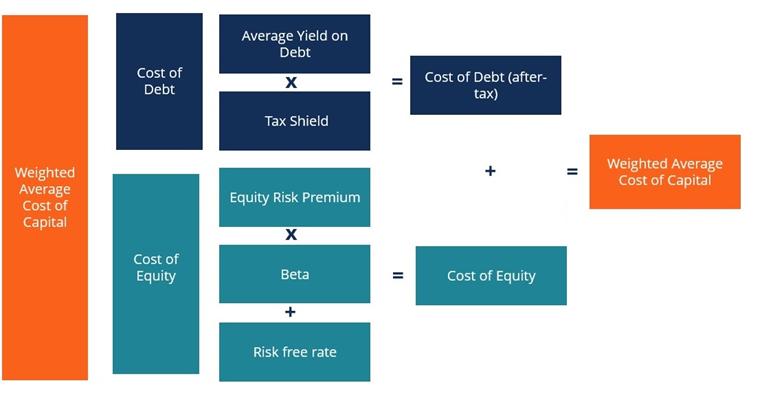

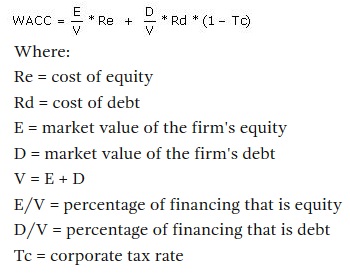

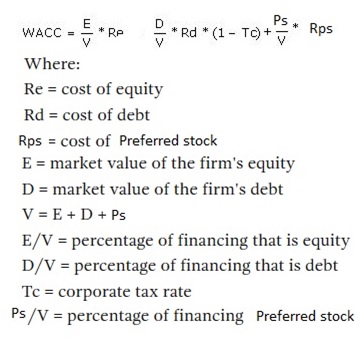

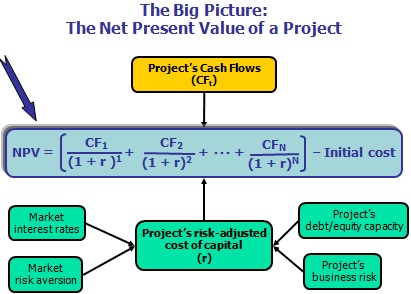

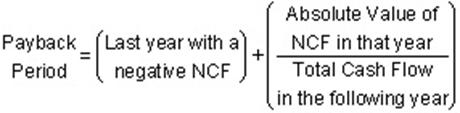

Chapter 9 The Cost of Capital For class discussion: What is WACC? Why is it important? WACC increases, good or bad to

stock holders? How to apply WACC to figure

out firm value? What is DCF?

One option (if beta is

given)

Another option (if

dividend is given):

WACC Formula

WACC calculator (without

preferred stock) (www.jufinance.com/wacc)

WACC calculator (with

preferred stock) (www.jufinance.com/wacc_1) Homework

of Chapter 9 (due with final) ·

Questions on Page 406: 9-1, 9-2. ·

Mini Case on Page 411: a, b, c, d,

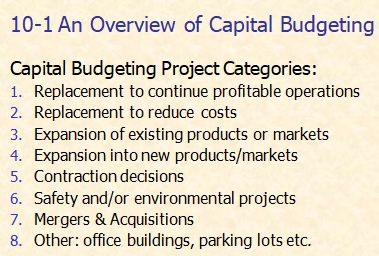

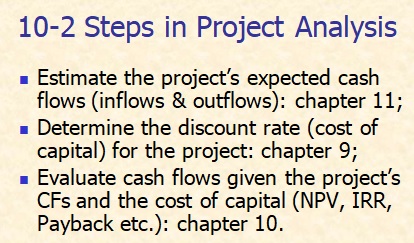

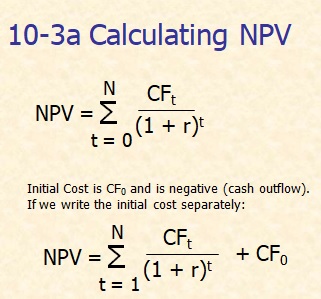

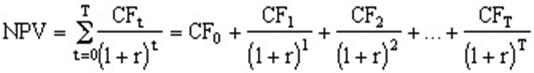

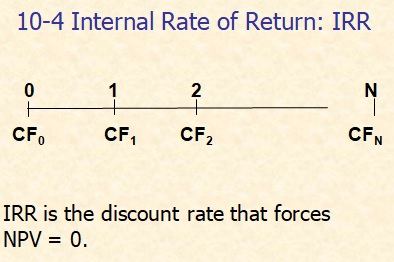

e(1&2), f, g, h, i, n, o(1). Chapter 10 The Basics of Capital Budgeting

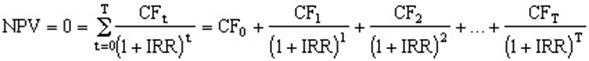

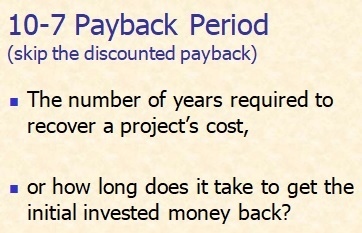

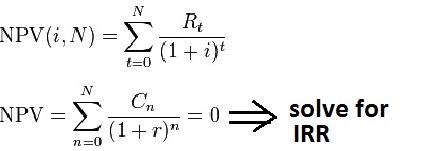

Math

equation:

Math

equation:

Math

equation:

NPV,

IRR, Payback Period calculator (www.jufinance.com/npv) Homwork

of Chapter 10 (due with final) · Questions on P442: 10-1 a(skip discounted payback

period), b, c(skip profitability index), f; 10-2. · Problems on P443: 10-1, 10-2, 10-5, 10-9. |

|

FYI As of today,

Walmart Inc's weighted average cost of capital is 5.54%. Walmart

Inc's ROIC % is 11.05% (calculated

using TTM income statement data). Walmart Inc generates higher returns on

investment than it costs the company to raise the capital needed for that

investment. It is earning excess returns. A firm that expects to continue

generating positive excess returns on new investments in the future will see

its value increase as growth increases. https://www.gurufocus.com/term/wacc/WMT/WACC/Walmart%2BInc Amazon.com

Inc (NAS:AMZN) WACC %:14.27% As of Today As of today,

Amazon.com Inc's weighted average cost of capital is 14.27%.

Amazon.com Inc's ROIC % is 31.08% (calculated

using TTM income statement data). Amazon.com Inc generates higher returns on

investment than it costs the company to raise the capital needed for that

investment. It is earning excess returns. A firm that expects to continue

generating positive excess returns on new investments in the future will see

its value increase as growth increases. https://www.gurufocus.com/term/wacc/AMZN/WACC-Percentage/Amazon.com%20Inc Apple

Inc (NAS:AAPL) WACC %:9.34% As of Today As of today,

Apple Inc's weighted average cost of capital is 9.34%. Apple

Inc's ROIC % is 34.64% (calculated

using TTM income statement data). Apple Inc generates higher returns on

investment than it costs the company to raise the capital needed for that

investment. It is earning excess returns. A firm that expects to continue

generating positive excess returns on new investments in the future will see

its value increase as growth increases. https://www.gurufocus.com/term/wacc/AAPL/WACC/Apple%2Binc

http://people.stern.nyu.edu/adamodar/New_Home_Page/datafile/wacc.htm

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 7 |

Chapter 11 Cash Flow Estimation and Risk Analysis

11-2: an expansion project Detail: Project L is the application of a

radically new liquid nano-coating technology to a new type of solar water

heater module, which will be manufactured under a 4-year license from a

university. In this section, we show how these cash flows are estimated (we

only show this for Project L here). It’s not clear how well the water heater

will work, how strong demand for it will be, how long it will be before the

product becomes obsolete, or whether the license can be renewed after the

initial 4 years. Still, the water heater has the potential for being

profitable, though it could also fail miserably. GPC is a relatively large

company and this is one of many projects, so a failure would not bankrupt the

firm but would hurt profits and the stock’s price. Information given as blow: ·

Units sold at year 1: 10,000; increase by 15% after year 1; ·

Unit sales price at year 1: $1.50; increase by 4% after year

1; ·

Variable cost per unit at year 1: $1.07; increase by 3% after

year 1; ·

Fixed cost at year 1: $2,120; increase by 3% after year 1; ·

Net working capital requirement o

NWCt = 15%(Salest+1) ·

Tax rate = 40%. ·

Project cost of capital (WACC) = 10%.

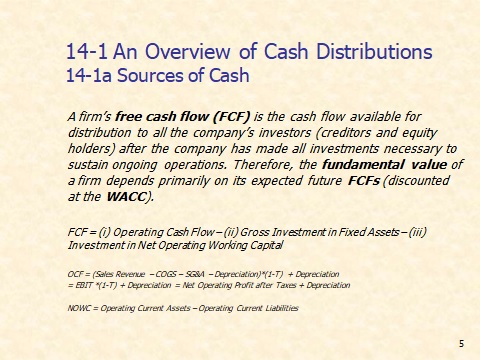

Questions for discussion: How to calculate OCF (operating cash

flow)? OCF = (Sales Revenue – COGS –

SG&A – Depreciation)*(1-T) + Depreciation = EBIT *(1-T) + Depreciation = Net Operating Profit after Taxes +

Depreciation What is incremental cash flow? What is sunk cost? Example? Included in

the cash flow? What is opportunity cost? Example?

Included in the cash flow? Do you prefer companies that are stingy to

give back to investors, to those that

are generous? Homework

of Chapter 11 Questions

on P487: 11-1abc, 11-2, 11-3, 11-4, 11-5, 11-7, 11-8, 11-9. Chapter

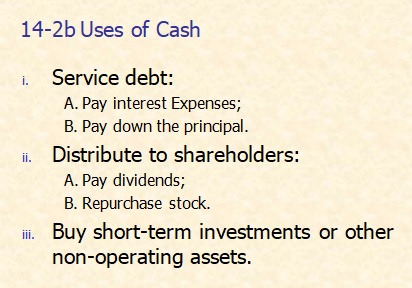

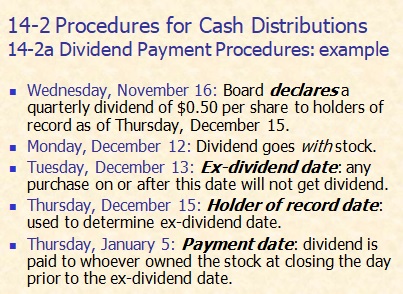

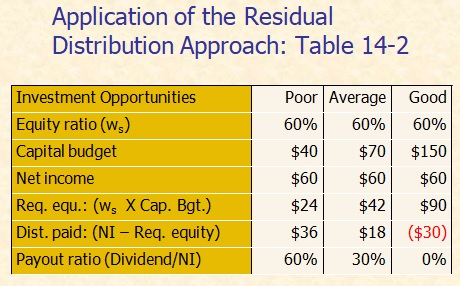

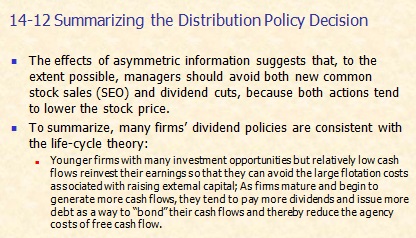

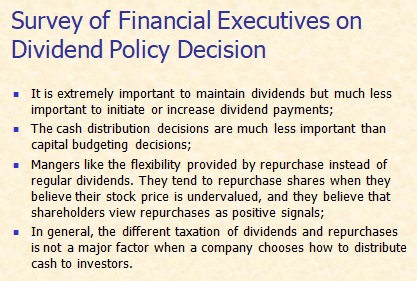

14 Distribution to Shareholders:

Dividends and Repurchases

IMPORTANT MUST

KNOW DIVIDEND DATES! | Dividend Investing 101 (video)

https://www.nasdaq.com/symbol/wmt/dividend-history Ex-dividend dates

for December 05, 2018

https://www.nasdaq.com/dividend-stocks/dividend-calendar.aspx?date=2018-Dec-05

Homework

of Chapter 14 Questions

on P600: 14-1 (except f), 14-3, 14-5 (except c); Problems

on P602: 14-5, 14-7, 14-9. |

|

Battle of

Dividends: McDonald's vs. Walmart (FYI) It's a close battle,

but one comes out ahead. Daniel Sparks Sep 19, 2018 at 11:47AM Unlike many growth stocks, dividend stocks can provide

investors returns in two ways. Like a growth stock, the per-share value can appreciate

over time. But what makes a good dividend stock different from the typical

growth stock is its meaningful dividend payments. Through the day-to-day,

month-to-month, and even year-to-year volatility that stocks often see, good

dividend stocks continue paying solid dividends through thick and thin. Two companies that exemplify

consistency in their dividend payments are Walmart (NYSE:WMT)and McDonald's (NYSE:MCD).

These two iconic dividend stocks have not only paid dividends for more than

four decades, they've also increased their dividend payments every year since

declaring their first dividends. But which of these two dividend

stocks is a better bet for investors' money today? Read on to find out. Walmart

DATA

SOURCE: REUTERS AND MORNINGSTAR AND REUTERS. TABLE BY AUTHOR. Walmart's dividend is solid no

matter how you look at it. Not only does the company have a meaningful

dividend yield of 2.2%, but the company is notably only paying out 34% of its

free cash flow in dividends. This means Walmart's already juicy dividend

has plenty of room for growth. Then there's Walmart's impressive

dividend history. The company has paid dividends every year since its first

dividend in 1974. Further, Walmart has increased its dividend on an annual

basis since its first dividend was paid. Walmart continues to make dividend

increases a priority, boosting its payout by an average of 5.1% every year

over the past five years. The company's most recent dividend increase,

however, was very small. Walmart increased its dividend by just 2% last

year. Fortunately for dividend

investors, Walmart has recently been serving up strong underlying business

growth -- growth that can easily support further dividend increases.

Highlighting Walmart's healthy business, adjusted earnings per share rose 19% year over year in the

company's most recent quarter. McDonald's

DATA

SOURCE: REUTERS AND MORNINGSTAR AND REUTERS. TABLE BY AUTHOR. The one area McDonald's dividend doesn't

live up to Walmart's is when it comes to the percentage of cash it is paying

out in dividends. The fast-food company is already paying out 88% of free

cash flow, leaving less breathing room for its dividend. But McDonald's dividend is more

attractive when it comes to dividend yield and recent dividend growth. At

2.6%, McDonald's dividend yield is well ahead of Walmart's. In addition,

McDonald's average five-year growth rate for its dividend of 5.9% slightly

outpaces Walmart's dividend growth during this period. Similarly, the

fast-food king's 7% dividend increase last year is above Walmart's most

recent increase of 2%. In addition, McDonald's

longer-term dividend history is just as impressive as Walmart's, with

dividend payments and consecutive annual increases dating back to the

company's first dividend in 1976. Finally, McDonald's business is

growing nicely as well. The fast-food restaurant's adjusted earnings per

share increased 15% year over year in the company's most recent

quarter. The verdict Both of these dividend stocks

represent enduring companies with strong underlying businesses and

dividend-friendly capital allocation practices, making them each worth

further consideration. But

Walmart's recent stronger earnings momentum, combined with the greater wiggle

room for its dividend thanks to the fact that it is paying out just 34% of

free cash flow in dividends, makes the supermarket retailer's dividend

slightly more attractive. Sure, McDonald's has a higher dividend yield. But

there's less risk in Walmart's dividend ever taking a hit since the company

is paying out a lower portion of its annualized free cash flow in dividends. That

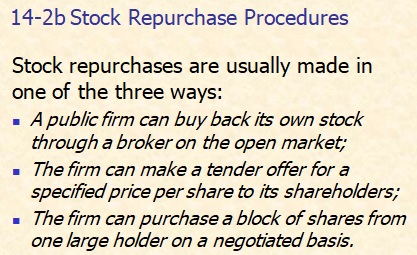

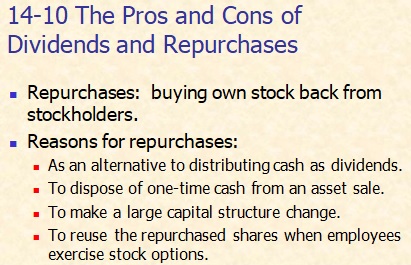

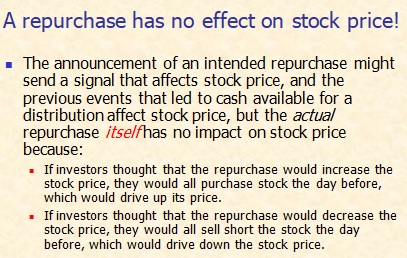

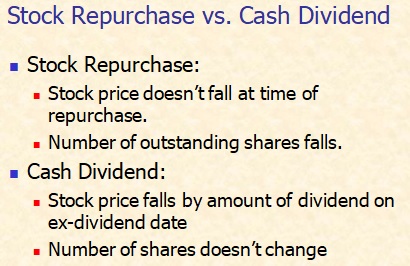

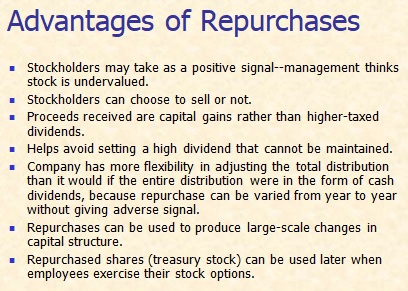

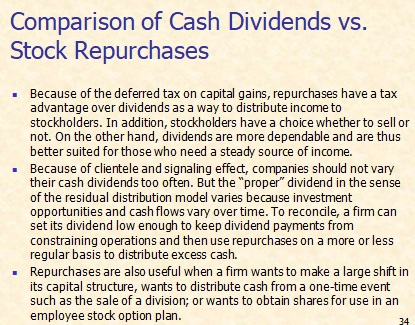

said, this was a close battle. https://www.fool.com/investing/2018/09/19/battle-of-dividends-mcdonalds-vs-walmart.aspx *** stock repurchase” For discussion: Shareholders will be better off

with a cash dividend or a stock buyback plan? What about the company?

Useful

website (FYI): https://www.wallstreetmojo.com/share-repurchase-buyback-guide/ Wal-Mart's buyback is huge, but here's why you should not be chasing buybacks

(FYI) ·

Wal-Mart

is part of an elite group of large-cap companies I call "buyback

monsters" who have bought back huge amounts of their stock in the last

decade or so. Their ranks include IBM, Microsoft, Kohl's, Target, and Boeing. ·

What's

it mean? It means that these companies have dramatically boosted their

earnings, not by selling more stuff, but by buying back stock. ·

The

lesson: stock buybacks can boost earnings, but without underlying

fundamentals, it's not worth chasing them. Published 5:38 PM ET Tue, 10 Oct

2017 Updated 7:25 PM ET Tue, 10 Oct 2017CNBC.com Wal-Mart trading

volume was huge today, more than three times normal as investors love the

emphasis on e-commerce and another massive $20 billion buyback. You can buy a lot of Wal-Mart stock for $20 billion. It's

about 8 percent of the shares outstanding at the current price, but it

doesn't even come close to the biggest buybacks ever announced: Biggest buybacks ever GE (2015)

$50 billion Still, what's important is that Wal-Mart is part of an elite

group of large-cap companies I call "buyback monsters" that have

bought back huge amounts of their stock in the last decade or so. Their ranks

include IBM, Microsoft, Kohl's, Target, and Boeing: Buyback monsters Wal-Mart (since 2002) 30 percent What does it mean? It means that these companies have

dramatically boosted their earnings, not by selling more stuff, but by buying

back stock. It means that all other things being equal, Wal-Mart, for

example, has improved its earnings by 30 percent since 2002 just by buying

back stock. This sounds like a great deal for stock holders. But does

buying back stock really cause stock prices to outperform? If it really does

help boost earnings, why don't we just buy the companies that have bought

back the most stock? It's a tough question to answer, but, as with everything,

there's an ETF for that. And the evidence is it can be a big help, but

without improvement in fundamentals, investors are not going to be fooled. There are two ETFs that specialize in buybacks: The Powershares BuyBack Achievers Index (PKW)

is comprised of U.S. securities issued by corporations that have effected a

net reduction in shares outstanding of 5 percent or more in the trailing 12

months. And the SPDR Buyback Index (SPYB)

is designed to measure the performance of the top 100 stocks with the highest

buyback ratios in the S&P 500. OK, so far so good. What's the verdict? Buybacks vs. the markets S&P 500 up 13.8 percent Well, that's underwhelming. There is no outperformance. It's

the same if you go back two years. It's possible there are too many companies in the ETFs. Both

have over 100. But I think there's a bigger problem. Buybacks do not

guarantee stock price hikes. Just look at General Electric, which has bought back 15

percent of its stock just since the start of 2016. It's down 20 percent in

that same period. And look at Kohl's, Target, and IBM. Buyback monsters, all of

them, but the fundamentals are awful, and buybacks did not save them. All

three are down double-digits this year. In contrast, Apple's business has been great, as has

Microsoft. Both are also buyback monsters, and they are up huge this year. The lesson: Stock buybacks can boost earnings, but without

underlying fundamentals, it's not worth chasing them. Wal-Mart's buyback was

certainly a big help, but without the added bonus of additional investments

in the e-commerce business, it wouldn't have been a long-term boost. https://www.cnbc.com/2017/10/10/wal-marts-buyback-is-huge-but-dont-chase-buybacks.html |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 8 |

Final Exam Project due with final |

|

Summary of Equations FYI *** time value of

money*** FV = PV *(1+r)^n PV = FV /

((1+r)^n) N

= ln(FV/PV) / ln(1+r) Rate = (FV/PV)1/n -1 Annuity: N

= ln(FV/C*r+1)/(ln(1+r)) Or N

= ln(1/(1-(PV/C)*r)))/ (ln(1+r))

EAR = (1+APR/m)^m-1 APR = (1+EAR)^(1/m)*m Excel Formulas To get FV, use FV

function. =abs(fv(rate, nper,

pmt, pv)) To get PV, use PV

function = abs(pv(rate, nper,

pmt, fv)) To get r, use rate

function =

rate(nper, pmt, pv, -fv) To get number of years,

use nper function = nper(rate, pmt, pv,

-fv) To get annuity payment, use PMT

function = pmt(rate, nper, pv,

-fv) To get Effective rate (EAR), use

Effect

function =

effect(nominal_rate, npery) To get annual percentage rate

(APR), use nominal function = nominal(effective rate, npery) *** bond pricing *** Summary of bond pricing excel functions To calculate bond

price (annual coupon bond): Price=abs(pv(yield to

maturity, years left to maturity, coupon rate*1000, 1000) To calculate yield to

maturity (annual coupon bond):: Yield to maturity =

rate(years left to maturity, coupon rate *1000, -price, 1000) To calculate bond

price (semi-annual coupon bond): Price=abs(pv(yield to

maturity/2, years left to maturity*2, coupon rate*1000/2,

1000) To calculate yield to

maturity (semi-annual coupon bond): Yield to maturity =

rate(years left to maturity*2, coupon rate *1000/2, -price,

1000)*2 To calculate number of years left(annual coupon bond) Number of years

=nper(yield to maturity, coupon

rate*1000, -price, 1000) To calculate number of years left(semi-annual coupon bond) Number of years

=nper(yield to maturity/2, coupon

rate*1000/2, -price, 1000)/2 To calculate coupon (annual coupon bond) Coupon = pmt(yield to

maturity, number of years left, -price, 1000) Coupon rate = coupon /

1000 To calculate number of years left(semi-annual coupon bond) Number of years =

pmt(yield to maturity/2, number of years left*2, -price, 1000) Coupon rate = coupon /

1000

NPV and IRR

Return, Risk

Dividend Growth

Model Po=

D1/(r-g) or Po= Do*(1+g)/(r-g) R =

D1/Po+g = Do*(1+g)/Po+g D1=Do*(1+g); D2= D1*(1+g)… WACC WACC = weight of debt * cost of debt + weight of equity *( cost of equity) Wd= total debt / Total capital = total borrowed / total capital We= total equity/ Total capital Cost of debt = rate(nper, coupon, -(price

– flotation costs), 1000)*(1-tax rate) Cost of Equity = D1/(Po – Flotation

Cost) + g D1: Next period dividend; Po: Current

stock price; g: dividend growth rate Note: flotation costs = flotation

percentage * price Or if

beta is given, use CAPM model (refer to chapter 6) Cost of

equity = risk free rate + beta *(market return – risk free rate) Cost of

equity = risk free rate + beta * market risk premium |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||