FIN435 Class Web

Page, Spring '24

Jacksonville

University

Instructor:

Maggie Foley

The Syllabus Overall Grade calculator

Exit Exam Questions (will be posted in week 10 on blackboard)

Term Project (on efficient

frontier, updated, due with final)

Weekly SCHEDULE, LINKS, FILES and Questions

|

Week |

Coverage, HW, Supplements -

Required |

|

Reading Materials |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Week 1 |

Marketwatch Stock Trading Game (Pass code: havefun) Risk Tolerance Test https://jufinance.com/risk_tolerance.html

1. URL for your game: 2. Password for this private game: havefun. 3. Click on the 'Join Now' button to get

started. 4. If you are an existing MarketWatch member, login. If you are a new user,

follow the link for a Free account - it's easy! 5. Follow the instructions and start trading! 6. Game will be over

on 4/22/2022 How to Use Finviz Stock

Screener (youtube, FYI)

How To Win The MarketWatch Stock

Market Game (youtube, FYI)

How Short Selling Works (Short

Selling for Beginners) (youtube, FYI)

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

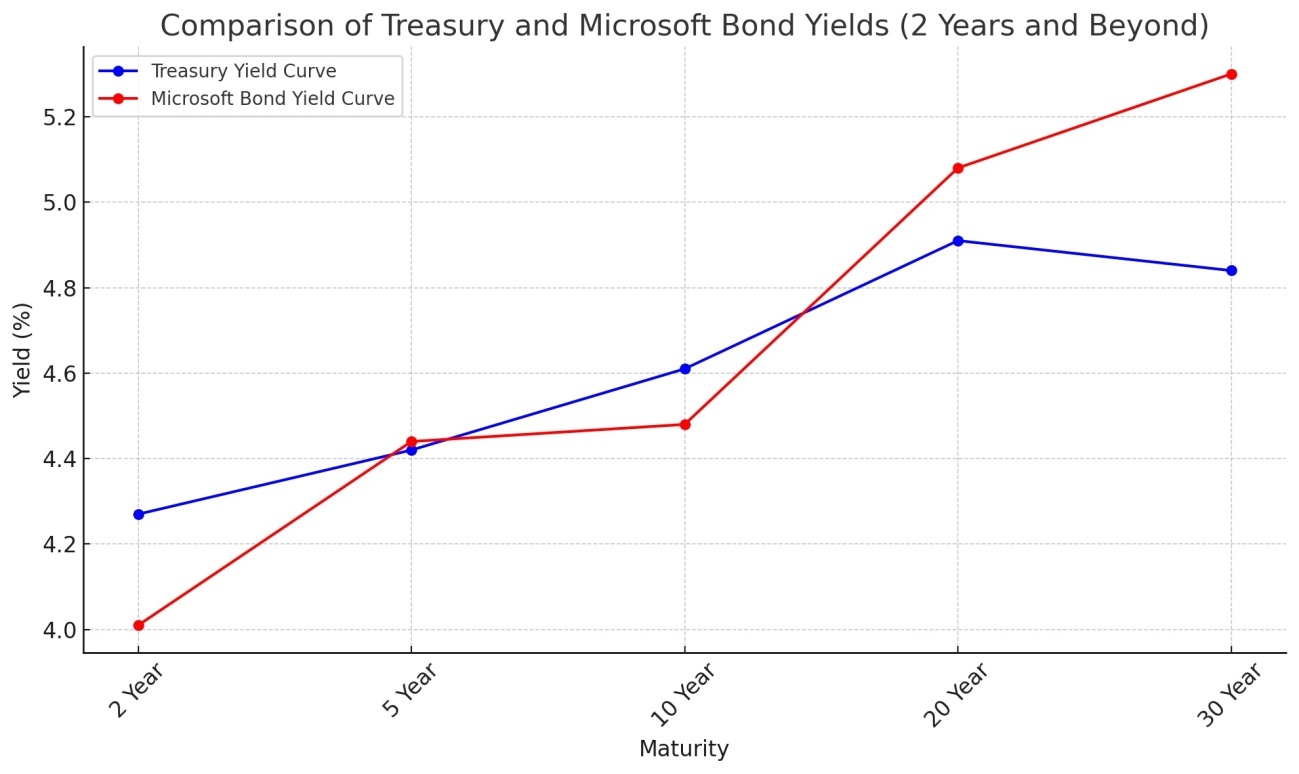

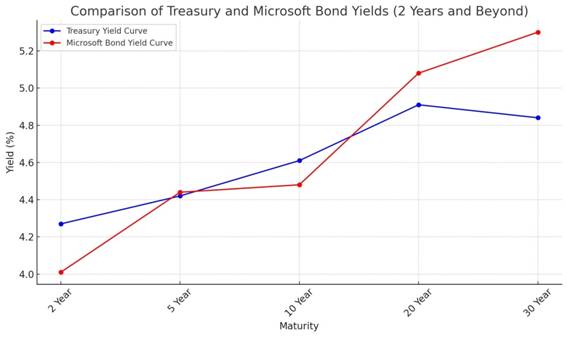

Chapter 6 Interest rate Chapter summary 1) Shape of Yield Curve i) Inverted Yield Curve Indicates Recession:

The shape of the yield curve, particularly when inverted, serves as a

significant indicator of an impending recession. 2) Expectation Theory 3) Interest Rate Breakdown i) Breaking down interest rates involves

considering various components: Real Interest

Rate Inflation

Premium: Default

Premium: Liquidity

Premium:

Maturity Premium: For

class discussion: Interest Rate Volatility: ·

What factors could explain the recent

spike in interest rates compared to a year ago? Economic Conditions and

Rates: ·

How do economic indicators like inflation,

unemployment, and GDP growth contribute to the determination of interest

rates? Central Banks' Role: ·

What role do central banks play in setting

and adjusting interest rates, and how does their decision-making impact the

economy? Global Economic Influence: ·

How do international economic conditions

and events contribute to fluctuations in domestic interest rates? Impact on Borrowers and

Savers: ·

Discuss the effects of high interest rates

on borrowers and savers, both at the individual and business levels. Investor Behavior: ·

How does investor behavior respond to

changes in interest rates, and what role does sentiment play in influencing

rate movements? Part I: Who determines interest rates in the US? Market data website: Market watch on Wall Street Journal has daily yield curve and

interest rate information.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Date |

1 Mo |

2 Mo |

3 Mo |

4 Mo |

6 Mo |

1 Yr |

2 Yr |

3 Yr |

5 Yr |

7 Yr |

10 Yr |

20 Yr |

30 Yr |

|

01/02/2024 |

5.55 |

5.54 |

5.46 |

5.41 |

5.24 |

4.80 |

4.33 |

4.09 |

3.93 |

3.95 |

3.95 |

4.25 |

4.08 |

|

01/03/2024 |

5.54 |

5.54 |

5.48 |

5.41 |

5.25 |

4.81 |

4.33 |

4.07 |

3.90 |

3.92 |

3.91 |

4.21 |

4.05 |

|

01/04/2024 |

5.56 |

5.48 |

5.48 |

5.41 |

5.25 |

4.85 |

4.38 |

4.14 |

3.97 |

3.99 |

3.99 |

4.30 |

4.13 |

|

01/05/2024 |

5.54 |

5.48 |

5.47 |

5.41 |

5.24 |

4.84 |

4.40 |

4.17 |

4.02 |

4.04 |

4.05 |

4.37 |

4.21 |

|

01/08/2024 |

5.54 |

5.48 |

5.49 |

5.39 |

5.24 |

4.82 |

4.36 |

4.11 |

3.97 |

3.99 |

4.01 |

4.33 |

4.17 |

|

01/09/2024 |

5.53 |

5.46 |

5.47 |

5.38 |

5.24 |

4.82 |

4.36 |

4.09 |

3.97 |

4.00 |

4.02 |

4.33 |

4.18 |

In class exercise – based on the above table,

·

Draw yield curve on 1/2/2024, and 1/9/2024.

·

Why do interest rates change on a daily basis?

1. What is the term structure

of interest rates based on the provided yield curve data?

A) Inverted

B) Flat

C) Normal

Answer: A

Explanation: An inverted yield curve often suggests

market expectations of economic downturn.

2. Which maturity shows the

highest interest rate in the data?

A) 1 month

B) 10 Years

C) 30 Years

Answer: A

Explanation: The yield for the 1-month maturity is

5.5%, the highest among the options.

3. What does a

downward-sloping yield curve suggest about market expectations?

A) Economic expansion

B) Economic contraction

C) Stable economic

conditions

Answer: B

Explanation: An inverted yield curve often indicates

expectations of economic downturn.

4. How does the yield for

the 10-year maturity compare to the 1-year maturity on 01/05/2024?

A) Higher

B) Lower

C) Equal

Answer: B

Explanation: The yield for the 10-year maturity

(4.05%) is lower than the 1-year maturity (4.84%).

5. Based on the data, what

can be inferred about market confidence in the short term?

A) High confidence

B) Low confidence

C) Stable confidence

Answer: B

Explanation: Short-term yields are relatively high,

indicating potential uncertainty or risk. Remember: Price and yield tend to

move in opposite direction.

6. If the yield for the

3-month maturity decreases significantly, what might this signal about

short-term economic expectations?

A) Economic expansion

B) Economic contraction

C) Stable economic

conditions

Answer: A

Explanation: A decrease in short-term yields could

suggest increased confidence in economic growth.

Treasury Inflation Protected Securities (TIPS)

|

NAME |

COUPON |

PRICE |

YIELD |

1 MONTH |

1 YEAR |

TIME (EST) |

|

GTII5:GOV 5 Year |

2.38 |

102.79 |

1.76% |

-32 |

+25 |

2:46 AM |

|

GTII10:GOV 10 Year |

1.38 |

96.48 |

1.78% |

-21 |

+40 |

2:46 AM |

|

GTII20:GOV 20 Year |

0.75 |

80.63 |

2.03% |

-8 |

+48 |

2:46 AM |

|

GTII30:GOV 30 Year |

1.50 |

89.28 |

1.99% |

-3 |

+51 |

2:46 AM |

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

·

Expected

Inflation=5-year Treasury yield rate − 5-year

TIPS rate

In this

formula, the 10-year Treasury yield rate is indeed expected to be higher than

the 10-year TIPS rate. The rationale is that the nominal Treasury yield

includes both the real interest rate and the market's expectation for

inflation, while the TIPS rate provides the real interest rate. Therefore,

subtracting the TIPS rate from the Treasury yield gives an estimate of the

market's expectation for inflation over the specified period.

In

Class Exercise:

·

What is TIPs?

Who Determines Interest Rates?

https://www.investopedia.com/ask/answers/who-determines-interest-rates/

By NICK K.

LIOUDIS Updated Aug 15, 2019

Interest rates are the cost

of borrowing money. They represent what creditors earn for lending you money.

These rates are constantly changing, and differ based on the lender, as well

as your creditworthiness. Interest rates not only keep the economy

functioning, but they also keep people borrowing, spending, and lending. But

most of us don't really stop to think about how they are implemented or who

determines them. This article summarizes the three main forces that control

and determine interest rates.

KEY TAKEAWAYS

- Interest rates are the cost of

borrowing money and represent what creditors earn for lending money.

- Central banks raise or lower

short-term interest rates to ensure stability and liquidity in the

economy.

- Long-term interest rates are affected

by demand for 10- and 30-year U.S. Treasury notes.

- Low demand for long-term notes leads

to higher rates, while higher demand leads to lower rates.

- Retail banks also control rates based on the market,

their business needs, and individual customers.

Short-Term Interest Rates: Central Banks

In countries using a centralized

banking model, short-term interest rates are determined by central banks. A

government's economic observers create a policy that helps ensure stable

prices and liquidity. This policy is routinely checked so the supply of money

within the economy is neither too large, which causes prices to increase, nor

too small, which can lead to a drop in prices.

In the U.S., interest rates

are determined by the Federal Open Market

Committee (FOMC), which consists

of seven governors of the Federal Reserve Board and five Federal Reserve Bank

presidents. The FOMC meets eight times a year to determine the near-term

direction of monetary policy and interest rates. The actions of central banks

like the Fed affect short-term and variable interest rates.

If the monetary policymakers

wish to decrease the money supply, they will raise the interest rate, making

it more attractive to deposit funds and reduce borrowing from the central

bank. Conversely, if the central bank wishes to increase the money supply,

they will decrease the interest rate, which makes it more attractive to

borrow and spend money.

The Fed funds rate affects the prime rate—the rate banks charge their

best customers, many of whom have the highest credit rating possible. It's

also the rate banks charge each other for overnight loans.

The U.S.

prime rate remained at 3.25% between Dec. 16, 2008 and Dec. 17, 2015, when it

was raised to 3.5%.

Long-Term

Interest Rates: Demand for Treasury Notes

Many of these rates are independent of the Fed funds rate,

and, instead, follow 10- or 30-year Treasury note yields. These yields depend on demand after the U.S. Treasury

Department auctions them off on the market. Lower demand tends to result in high interest rates. But when there

is a high demand for these notes, it can push rates down lower.

If you have a long-term

fixed-rate mortgage, car loan, student loan, or any similar non-revolving consumer

credit product, this is where it falls. Some credit card annual percentage

rates are also affected by these notes.

These rates are generally

lower than most revolving credit products but are higher than the prime rate.

Many savings account rates are also determined by long-term

Treasury notes.

Other

Rates: Retail Banks

Retail banks are also partly responsible for controlling interest

rates. Loans and mortgages they offer may

have rates that change based on several factors including their needs, the

market, and the individual consumer.

For example, someone with a

lower credit score may be at a higher risk of default, so they pay a higher

interest rate. The same applies to credit cards. Banks will offer different

rates to different customers, and will also increase the rate if there is a

missed payment, bounced payment, or for other services like balance transfers

and foreign exchange.

In class exercise:

1.

Who

is responsible for determining short-term interest rates in a centralized

banking model?

A) Commercial Banks

B) Central Banks

C) Government Agencies

Answer: B

Explanation: In countries with a centralized banking model,

short-term interest rates are determined by central banks.

2.

What

committee in the U.S. is responsible for setting interest rates and monetary

policy?

A) Federal Trade Commission

(FTC)

B) Federal Reserve Act

Committee (FRAC)

C) Federal Open Market Committee

(FOMC)

Answer: C

Explanation: The FOMC, consisting of governors of the

Federal Reserve Board and Federal Reserve Bank presidents, determines the

near-term direction of monetary policy and interest rates in the U.S.

3.

How

does a central bank decrease the money supply in the economy?

A) Increasing interest rates

B) Lowering interest rates

C) Printing more money

Answer: A

Explanation: Raising interest rates makes it more

attractive to deposit funds, reducing borrowing and decreasing the money

supply.

4.

Which

factor primarily influences the yields of 10- or 30-year Treasury notes?

A) Federal Reserve decisions

B) Market demand

C) Commercial bank policies

Answer: B

Explanation: The yields of Treasury notes depend on

demand in the market after auctions by the U.S. Treasury Department.

5.

What

happens to interest rates when there is high demand for Treasury notes?

A) Rates increase

B) Rates decrease

C) Rates remain unchanged

Answer: B

Explanation: High demand for Treasury notes tends to push

interest rates down.

6.

Who

determines interest rates on loans and mortgages offered by retail banks?

A) Government agencies

B) Central banks

C) Retail banks

Answer: C

Explanation: Retail banks control the interest rates

on the loans and mortgages they offer.

7.

Why might an individual with a lower credit

score be charged a higher interest rate?

A) Higher credit risk

B) Lower credit risk

C) Government regulations

Answer: A

Explanation: Individuals with lower credit scores are

considered higher risk, leading to higher interest rates.

Part II: Shapes of Yield Curve

For class

discussion: What

factors contributed to the shifts in yield curve shapes in 2023?

Data:

|

Date |

1 Mo |

2 Mo |

3 Mo |

6 Mo |

1 Yr |

2 Yr |

3 Yr |

5 Yr |

7 Yr |

10 Yr |

20 Yr |

30 Yr |

|

1/6/2020 |

1.54 |

1.54 |

1.56 |

1.56 |

1.54 |

1.54 |

1.56 |

1.61 |

1.72 |

1.81 |

2.13 |

2.28 |

|

1/6/2021 |

0.09 |

0.09 |

0.09 |

0.09 |

0.11 |

0.14 |

0.2 |

0.43 |

0.74 |

1.04 |

1.6 |

1.81 |

|

1/6/2022 |

0.04 |

0.05 |

0.1 |

0.23 |

0.45 |

0.88 |

1.15 |

1.47 |

1.66 |

1.73 |

2.12 |

2.09 |

|

1/6/2023 |

4.32 |

4.55 |

4.67 |

4.79 |

4.71 |

4.24 |

3.96 |

3.69 |

3.63 |

3.55 |

3.84 |

3.67 |

|

1/5/2024 |

5.54 |

5.48 |

5.47 |

5.24 |

4.84 |

4.4 |

4.17 |

4.02 |

4.04 |

4.05 |

4.37 |

4.21 |

Monday 1/15/2020

For daily yield curve, please visit https://www.gurufocus.com/yield_curve.php

Understanding the yield curve (video)

Introduction to the yield curve (khan academy)

Summary of Yield Curve Shapes and Explanations

Normal Yield Curve

When bond investors expect the economy to hum along at normal rates of growth

without significant changes in inflation rates or available capital, the

yield curve slopes gently upward. In the absence of economic disruptions,

investors who risk their money for longer periods expect to get a bigger

reward — in the form of higher interest — than those who risk their money for

shorter time periods. Thus, as maturities lengthen, interest rates get

progressively higher and the curve goes up.

Steep Curve –

Economy is improving

Typically the yield on 30-year Treasury bonds is three percentage points

above the yield on three-month Treasury bills. When it gets wider than that —

and the slope of the yield curve increases sharply — long-term bond holders

are sending a message that they think the economy will improve quickly in the

future.

Inverted Curve –

Recession is coming

At first glance an inverted yield curve seems like a paradox. Why would

long-term investors settle for lower yields while short-term investors take

so much less risk? The answer is that long-term investors will settle for

lower yields now if they think rates — and the economy — are going even lower

in the future. They're betting that this is their last chance to lock in

rates before the bottom falls out.

Flat

or Humped Curve

To become inverted, the yield curve

must pass through a period where long-term yields are the same as short-term

rates. When that happens the shape will appear to be flat or, more commonly,

a little raised in the middle.

Unfortunately, not all flat or humped curves

turn into fully inverted curves. Otherwise we'd all get rich plunking our

savings down on 30-year bonds the second we saw their yields start falling

toward short-term levels.

On the other hand, you shouldn't discount a

flat or humped curve just because it doesn't guarantee a coming recession.

The odds are still pretty good that economic slowdown and lower interest

rates will follow a period of flattening yields.

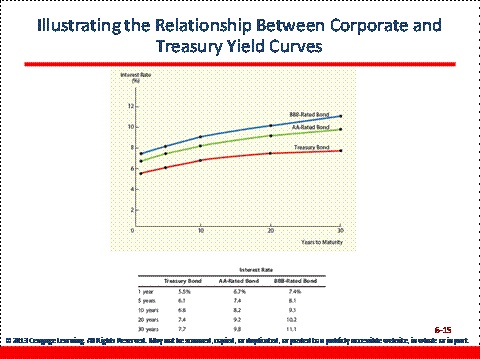

Formula --- Break down of interest rate

r = r* + IP + DRP + LP + MRP

r = required return on a debt security

r* = real risk-free rate of interest

IP = inflation premium

DRP = default risk premium

LP = liquidity premium

MRP = maturity risk premium

MRPt = 0.1% (t – 1)

DRPt + LPt = Corporate spread * (1.02)(t−1)

Understanding the yield curve:

Why economists use it to predict recessions

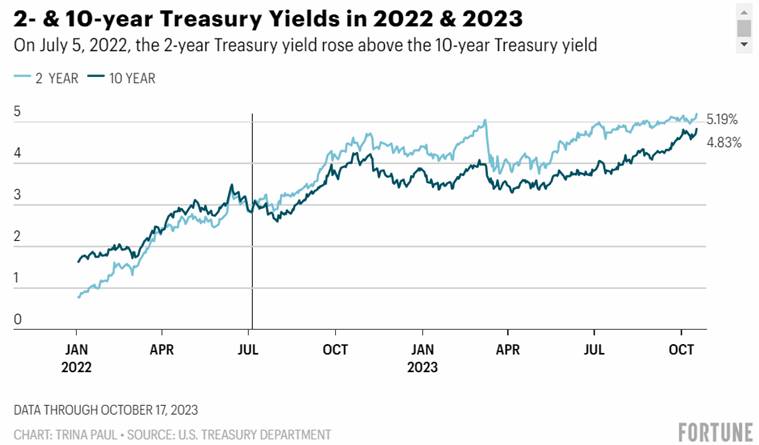

BYTRINA PAUL October 23, 2023 at 1:03 PM EDT

https://fortune.com/recommends/investing/the-inverted-yield-curve-recession/

The inverted yield curve

has predicted nearly every recession in the past few decades. It’s been inverted since last year but where’s

the recession?

For the past year, you’ve probably

heard that a recession is on the horizon. Though economists have been

predicting a downturn for months, a recession seems nowhere in sight: the

labor market is strong, the stock market is thriving, and inflation has

cooled since last year. So, where is the recession, and why do people still

think it will happen?

To predict a recession, economists look at certain

indicators with a solid track record of signaling a downturn. One of those

indicators is the yield curve. And right now, the yield curve is flashing

red.

What is the yield curve?

The yield curve is a line

that plots yields, or interest rates, of bonds with different maturities and

equal credit quality. Though yield curves can be plotted with bonds of any

maturity, some of the most common yield curves used are the spreads between

either the three-month treasury bill or two-year and ten-year Treasury notes,

which are used to indicate the spread between short-term and long-term

Treasury securities.

Generally, a yield curve

is upward-sloping, with short-term bonds offering lower yields and long-term

bonds providing higher yields. In other words, you should be compensated with

a higher yield when you tie up your money for longer periods.

Sometimes a yield curve

can invert and start sloping downward. When this happens, short-term bonds

have higher yields than long-term bonds, and investors are not rewarded for

parting with their money for longer periods.

Why is the yield curve

used to predict recessions?

When the yield curve

inverts, investors expect the Fed to reduce its benchmark rate—the federal funds rate—in the

future, which drives down yields for longer-term bonds.

According to Jeanette

Garretty, chief economist and managing director at Robertson Stephens, a

wealth-management company based in California, an inverted yield curve is

used to predict recessions because it indicates what investors think the Fed

will do with its benchmark rate in the future.

“What tends to happen before recessions is the Fed is

raising interest rates, [or] setting that policy rate at the short end, and

you have market participants getting more pessimistic, and they’re betting that interest rates are going to fall in the

future,” says Andrew Patterson, senior international

economist at Vanguard. “So you have a situation where

you could have the short end of the yield curve having higher yields than

longer-dated maturities.”

If the economy is

currently experiencing high inflation and low unemployment rates, the Fed

will raise interest rates to reduce demand and tamp down on inflation. Once rate hikes affect

the economy—by cooling inflation and causing

unemployment to rise—the Fed may need to cut rates to

encourage consumers and businesses to spend again.

So how long does it take

after the yield curve inverts for a recession to occur? Both Garretty and

Patterson estimate that it takes around six to 12 months before a downturn

happens.

Even though economists frequently rely on the yield curve

to predict recessions, it’s not always a fool-proof

indicator.

“Every recession that we’ve seen has

been preceded by an inverted yield curve,” says

Garretty. “That’s not to say

that every inverted yield curve has pointed to a recession.”

The yield curve has only had one false positive since 1955:

In 1966, there was an inversion of the yield curve that was not followed by a

recession, according to a 2018 San Francisco Federal Reserve Bank report from

2018.

What is the yield curve

telling us right now?

On July 5, 2022, the

yield curve between the two-year and ten-year Treasury notes inverted, and it’s stayed that way since then. It’s

been more than one year since the yield curve inverted, and the economy is

still humming along—unemployment is at 3.8%,

inflation has cooled to 3.7% year-over-year, and consumers are still

spending.

“The U.S. is not in a

recession,” says Garretty. “The labor market

is generating a lot of income for people—they are getting

real gains in their wages…Nobody's happy with these

price increases, but they have the income that allows them to manage it.”

Though it seems like the economy and consumers have yet to

feel the impact of the Fed’s rate hikes—which have risen from near-zero to more than 5% in the

past 18 months—Patterson doesn’t

rule out the possibility of a recession occurring just yet.

“Even though a yield curve of this duration has typically

resulted in a recession in the past, there's good reason to believe a recession

has been delayed for reasons like the housing market remaining resilient and

the strength of the labor market,” says Patterson. “Recession remains our base case. Sometime in 2024.”

Only time will tell whether the recent yield curve

inversion accurately predicts a recession.

“If forecasting recessions was as easy as looking at the

yield curve…you would see a lot more economists

saying things like on November 16 at two o'clock, there will be a recession—it’s clearly not that easy,” says Garretty.

The takeaway

The current inverted yield curve tells us what investors

think will happen to the economy in the future: The Fed will need to cut

interest rates because of a recession. However, when the yield curve inverts,

it’s not always an indicator of an economic downturn—even if it has been in the past.

Regardless of whether a recession occurs, it never hurts to

be ready for one, whether it’s by adding to your

emergency fund or paying off high-interest rate debt.

In

class exercise:

1.

Why

is an inverted yield curve considered a predictor of a future recession?

A) It suggests future

interest rate cuts by the Fed

B) It indicates high

inflation rates

C) It reflects strong

labor market conditions

Answer: A

2.

What is the current status of the yield

curve between the two-year and ten-year Treasury notes?

A) It is upward-sloping

B) It is flat

C) It is inverted

Answer: C

Explanation: As

of July 5, 2022, the yield curve between the two-year and ten-year Treasury

notes is inverted.

3.

What

has been the trend in the U.S. labor market despite the inverted yield curve?

A) High unemployment

rates

B) Stagnant wages

C) Strong job market and

income gains

Answer: C

Explanation:

The labor market is strong, and people are experiencing real gains in their

wages.

4.

How

long does it typically take, according to Garretty and Patterson, for a

recession to occur after the yield curve inverts?

A) 1-3 months

B) 6-12 months

C) 18-24 months

Answer: B

Explanation:

Both Garretty and Patterson estimate it takes around six to 12 months for a

downturn to happen after the yield curve inverts.

5.

What happened in 1966 that is discussed as

an exception egarding the yield curve and recessions?

A) The yield curve

remained inverted without a recession

B) The yield curve

accurately predicted a recession

C) The yield curve did

not invert despite a recession

Answer: A

Explanation: In

1966, there was an inversion of the yield curve that was not followed by a

recession.

6.

Why

does Patterson mention a potential delay in the occurrence of a recession

despite the inverted yield curve?

A) Due to a resilient

housing market

B) Due to low inflation

C) Due to stock market

performance

Answer: A

Explanation:

Patterson suggests that factors like the resilient housing market and the

strength of the labor market may delay a recession.

7.

What has been the trend in the Fed's

benchmark interest rate in the past 18 months, as mentioned in the text?

A) Decreased to

near-zero

B) Remained unchanged

C) Increased to more

than 5%

Answer: C

Explanation:

The article notes that the Fed's benchmark interest rate has risen from

near-zero to more than 5% in the past 18 months.

8.

What is the current stance of the U.S.

economy, according to Garretty?

A) In a recession

B) Generating a lot of

income and experiencing wage gains

C) Experiencing high

inflation and unemployment

Answer: B

Explanation:

Garretty mentions that the U.S. is not in a recession and that the labor

market is generating income for people.

9.

What does the articel suggest about using

the yield curve to predict recessions?

A) It is foolproof and

always accurate

B) It is unreliable and

never accurate

C) It has been a

reliable indicator, but not without exceptions.

Answer: C

Explanation:

While the yield curve has historically predicted recessions, there has been

one false positive in

1966.

Chapter 6 Interest rate Part II: Term Structure of Interest rate

Question for discussion: If

a% and b% are both known to investors, such as the bank rates, how much is

the future interest rate, such as c%?

(1+a)^N

= (1+b)^m *(1+c)^(N-M)

Either

earning a% of interest rate for N years,

or

b% of interest rate for M years, and then c% of interest rate for (N-M)

years,

investors

should be indifferent. Right?

Then,

(1+a)^N = (1+b)^m *(1+c)^(N-M)è c = ((1+a)^N / (1+b)^m)^(1/(N-M))-1

Or

approximately,

N*a

= M*b +(N-M)*(c)è c = (N*a – M*b) /(N-M)

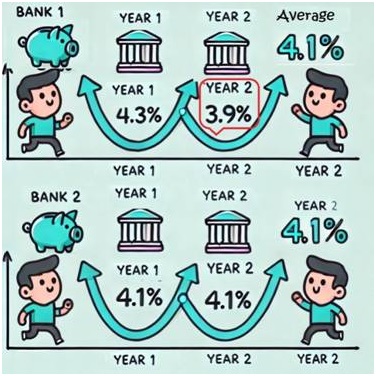

What Is Expectations Theory (video)

Expectations theory attempts to predict what

short-term interest rates will be in the future based on current

long-term interest rates. The theory suggests that an investor earns the same

amount of interest by investing in two consecutive one-year bond

investments versus investing in one two-year bond today. The theory is also

known as the "unbiased expectations theory.”

Understanding Expectations Theory

The expectations theory aims to help investors make

decisions based upon a forecast of future interest rates. The theory uses

long-term rates, typically from government bonds, to forecast the rate for

short-term bonds. In theory, long-term rates can be used to indicate where

rates of short-term bonds will trade in the future (https://www.investopedia.com/terms/e/expectationstheory.asp)

Expectations Theory

By CHRIS B. MURPHY Updated Apr 21, 2019

Example of Calculating Expectations Theory

Let's say that the

present bond market provides investors with a two-year bond that

pays an interest rate of 20% while a one-year bond pays an interest rate of

18%. The expectations theory can be used to forecast the interest rate of a

future one-year bond.

- The first step of the

calculation is to add one to the two-year bond’s

interest rate. The result is 1.2.

- The next step is to

square the result or (1.2 * 1.2 = 1.44).

- Divide the result by

the current one-year interest rate and add one or ((1.44 / 1.18) +1 =

1.22).

- To calculate the

forecast one-year bond interest rate for the following year,

subtract one from the result or (1.22 -1 = 0.22 or 22%).

In this example, the investor is earning an equivalent return

to the present interest rate of a two-year bond. If the investor chooses to

invest in a one-year bond at 18% the bond yield for the following year’s bond would need to increase to 22% for this investment

to be advantageous.

- Expectations theory

attempts to predict what short-term interest rates will be in the

future based on current long-term interest rates

- The theory suggests

that an investor earns the same amount of interest

by investing in two consecutive one-year bond investments

versus investing in one two-year bond today

- In theory, long-term rates can be

used to indicate where rates of short-term bonds will trade in the

future

Expectations theory aims to help investors make decisions by

using long-term rates, typically from government bonds, to forecast the rate

for short-term bonds.

Disadvantages of Expectations Theory

Investors should be aware

that the expectations theory is not always a reliable tool. A common problem with using the

expectations theory is that it sometimes overestimates future short-term

rates, making it easy for investors to end up with an inaccurate

prediction of a bond’s yield curve.

Another limitation of the

theory is that many factors impact short-term and long-term bond yields. The

Federal Reserve adjusts interest rates up or down, which impacts bond yields

including short-term bonds. However, long-term yields might not be as

impacted because many other factors impact long-term yields including

inflation and economic growth expectations. As a result, the expectations theory doesn't take into account the outside forces

and fundamental macroeconomic factors that drive interest rates and

ultimately bond yields.

Chapter 6 In class exercise

1 You read

in The Wall Street Journal that 30-day T-bills are currently

yielding 5.5%. Your brother-in-law, a broker at Safe and Sound Securities,

has given you the following estimates of current interest rate premiums:

- Inflation premium = 3.25%

- Liquidity premium = 0.6%

- Maturity risk premium = 1.8%

- Default risk premium = 2.15%

On the

basis of these data, what is the real risk-free rate of return? (answer:

2.25%)

Solution:

General

equation: Rate = r* + Inflation + Default + liquidity + maturity

30-day

T-bills = short term Treasury Security è Default = liquidity = maturity = 0

So

30-day T-bills = 5.5% = r* + inflation =r* + 3.25%

2 The real

risk-free rate is 3%. Inflation is expected to be 2% this year and 4% during

the next 2 years. Assume that the maturity risk premium is zero. What is the

yield on 2-year Treasury securities? What is the yield on 3-year Treasury

securities?(answer: 6%, 6.33%)

Solution:

General

equation: Rate = r* + Inflation + Default + liquidity + maturity

2-year

T-notes = intermediate term Treasury Security è Default = liquidity = 0, maturity=0 as given

Inflation

= average of inflations from year 1 to year 2 = (2% + 4%)/2 = 3%

So

2-year T-notes = r* + inflation = 3% + 3% = 6%

3-year

T-notes = short term Treasury Security è Default = liquidity = 0, maturity=0 as given

Inflation

= average of inflations from year 1 to year 2 = (2% + 4% +4%)/3 = 3.33%

So

2-year T-notes = r* + inflation = 3% + 3.33% = 6.33%

3

A Treasury bond that matures in 10

years has a yield of 6%. A 10-year corporate bond has a yield of 8%. Assume

that the liquidity premium on the corporate bond is 0.5%. What is the default

risk premium on the corporate bond? (answer: 1.5%)

Solution:

General

equation: Rate = r* + Inflation + Default + liquidity + maturity

10 year

T-notes = intermediate term Treasury Security è Default = liquidity = 0, maturity is not zero

So

10-year T-notes = r* + inflation +

maturity = 6%

10 year

corporate bond rate = r* + Inflation +

Default + liquidity + maturity = 8%

Its

liquidity = 0.5%, its maturity = 10-year-notes’ maturity.

Comparing

10 year T-notes and 10 year corporate bonds, we get default = 8%-6%-0.5%=1.5%

|

r* |

inflation |

default |

liquity |

maturity |

|

|

10 - year- T-notes = 6% |

Same |

same |

0 |

0 |

same |

|

10 year corp bonds = 8% |

Same |

same |

? |

1.50% |

same |

4 The real risk-free rate is 3%, and inflation

is expected to be 3% for the next 2 years. A 2-year Treasury

security yields 6.2%. What is the maturity risk premium for the 2-year

security? (answer: 0.2%)

General

equation: Rate = r* + Inflation + Default + liquidity + maturity

2-year

T-notes = intermediate term Treasury Security è Default = liquidity = 0, maturity=?

2-year

T-notes = 6.2% = r* + inflation + maturity = 3% + 3% + maturity

5 One-year Treasury securities yield 5%. The market

anticipates that 1 year from now, 1-year Treasury securities will yield 6%.

If the pure expectations theory is correct, what is the yield today for

2-year Treasury securities? (answer: 5.5%)

Or,

Real Interest rate in the US from 2000-2022

https://fred.stlouisfed.org/series/REAINTRATREARAT1YE

Three Month

T-Bill rate (a proxy of the risk free rate)

https://www.cnbc.com/quotes/US3M

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Ave |

|

2023 |

6.4 |

6 |

5 |

4.9 |

4 |

3 |

3.2 |

3.7 |

3.7 |

3.2 |

3.1 |

3 |

4 |

|

2022 |

7.5 |

7.9 |

8.5 |

8.3 |

8.6 |

9.1 |

8.5 |

8.3 |

8.2 |

7.7 |

7.1 |

6.5 |

8 |

|

2021 |

1.4 |

1.7 |

2.6 |

4.2 |

5 |

5.4 |

5.4 |

5.3 |

5.4 |

6.2 |

6.8 |

7 |

4.7 |

|

2020 |

2.5 |

2.3 |

1.5 |

0.3 |

0.1 |

0.6 |

1 |

1.3 |

1.4 |

1.2 |

1.2 |

1.4 |

1.2 |

|

2019 |

1.6 |

1.5 |

1.9 |

2 |

1.8 |

1.6 |

1.8 |

1.7 |

1.7 |

1.8 |

2.1 |

2.3 |

1.8 |

|

2018 |

2.1 |

2.2 |

2.4 |

2.5 |

2.8 |

2.9 |

2.9 |

2.7 |

2.3 |

2.5 |

2.2 |

1.9 |

2.4 |

|

2017 |

2.5 |

2.7 |

2.4 |

2.2 |

1.9 |

1.6 |

1.7 |

1.9 |

2.2 |

2 |

2.2 |

2.1 |

2.1 |

|

2016 |

1.4 |

1 |

0.9 |

1.1 |

1 |

1 |

0.8 |

1.1 |

1.5 |

1.6 |

1.7 |

2.1 |

1.3 |

|

2015 |

-0.1 |

0 |

-0.1 |

-0.2 |

0 |

0.1 |

0.2 |

0.2 |

0 |

0.2 |

0.5 |

0.7 |

0.1 |

|

2014 |

1.6 |

1.1 |

1.5 |

2 |

2.1 |

2.1 |

2 |

1.7 |

1.7 |

1.7 |

1.3 |

0.8 |

1.6 |

|

2013 |

1.6 |

2 |

1.5 |

1.1 |

1.4 |

1.8 |

2 |

1.5 |

1.2 |

1 |

1.2 |

1.5 |

1.5 |

|

2012 |

2.9 |

2.9 |

2.7 |

2.3 |

1.7 |

1.7 |

1.4 |

1.7 |

2 |

2.2 |

1.8 |

1.7 |

2.1 |

|

2011 |

1.6 |

2.1 |

2.7 |

3.2 |

3.6 |

3.6 |

3.6 |

3.8 |

3.9 |

3.5 |

3.4 |

3 |

3.2 |

|

2010 |

2.6 |

2.1 |

2.3 |

2.2 |

2 |

1.1 |

1.2 |

1.1 |

1.1 |

1.2 |

1.1 |

1.5 |

1.6 |

|

2009 |

0 |

0.2 |

-0.4 |

-0.7 |

-1.3 |

-1.4 |

-2.1 |

-1.5 |

-1.3 |

-0.2 |

1.8 |

2.7 |

-0.4 |

|

2008 |

4.3 |

4 |

4 |

3.9 |

4.2 |

5 |

5.6 |

5.4 |

4.9 |

3.7 |

1.1 |

0.1 |

3.8 |

|

2007 |

2.1 |

2.4 |

2.8 |

2.6 |

2.7 |

2.7 |

2.4 |

2 |

2.8 |

3.5 |

4.3 |

4.1 |

2.8 |

|

2006 |

4 |

3.6 |

3.4 |

3.5 |

4.2 |

4.3 |

4.1 |

3.8 |

2.1 |

1.3 |

2 |

2.5 |

3.2 |

|

2005 |

3 |

3 |

3.1 |

3.5 |

2.8 |

2.5 |

3.2 |

3.6 |

4.7 |

4.3 |

3.5 |

3.4 |

3.4 |

|

2004 |

1.9 |

1.7 |

1.7 |

2.3 |

3.1 |

3.3 |

3 |

2.7 |

2.5 |

3.2 |

3.5 |

3.3 |

2.7 |

|

2003 |

2.6 |

3 |

3 |

2.2 |

2.1 |

2.1 |

2.1 |

2.2 |

2.3 |

2 |

1.8 |

1.9 |

2.3 |

|

2002 |

1.1 |

1.1 |

1.5 |

1.6 |

1.2 |

1.1 |

1.5 |

1.8 |

1.5 |

2 |

2.2 |

2.4 |

1.6 |

|

2001 |

3.7 |

3.5 |

2.9 |

3.3 |

3.6 |

3.2 |

2.7 |

2.7 |

2.6 |

2.1 |

1.9 |

1.6 |

2.8 |

|

2000 |

2.7 |

3.2 |

3.8 |

3.1 |

3.2 |

3.7 |

3.7 |

3.4 |

3.5 |

3.4 |

3.4 |

3.4 |

3.4 |

https://www.usinflationcalculator.com/inflation/current-inflation-rates/#google_vignette

Chapter 6 – Assignments –

(FYI: Videos: www.jufinance.com/video/fin435_chapter_6_case_video_1.mp4 (1/18/2023)

www.jufinance.com/video/fin435_chapter_6_case_video_2.mp4 (1/23/2023))

·

Chapter six case study (due with

first mid term exam)

·

Critical thinking question 1: What factors contributed

to the shifts in yield curve shapes in 2023?

·

Critical thinking question 2: Do you think we will

enter a recession as predicted by the inverted yield curve?

·

Critical

thinking question 3: Do you endorse the notion of the Federal Reserve lowering interest

rates in 2024? Why or why not?

Chapter 7 Bond Valuation

For discussion: https://jufinance.com/risk_tolerance.html

|

Bond Type |

Characteristics |

Suitability |

Risk |

|

Short-Term Bonds |

Quick maturity, Low risk,

Lower returns |

Conservative, Need

liquidity |

Reinvestment Risk |

|

Long-Term Bonds |

Higher returns, High

risk |

Long-term, High risk

tolerance |

Default Risk; Market

interest rate risk |

|

Corporate Bonds |

Higher yields, Higher risk,

Company influence |

Seeking returns, Accepting

higher risk |

Default Risk; Market interest rate risk (assuming long

maturity) |

|

Treasury Securities |

Low risk, Steady income,

Different maturities |

Conservative, Stable income

requirement |

Market interest rate risk

(assuming long maturity) |

|

Municipal Bonds |

Tax advantages, Credit

risk |

Tax-efficient income, Higher

tax bracket |

Default Risk; Market interest rate risk (assuming long

maturity) |

·

Among the aforementioned bonds, do you have a preference? If so, what

factors influence your choice?

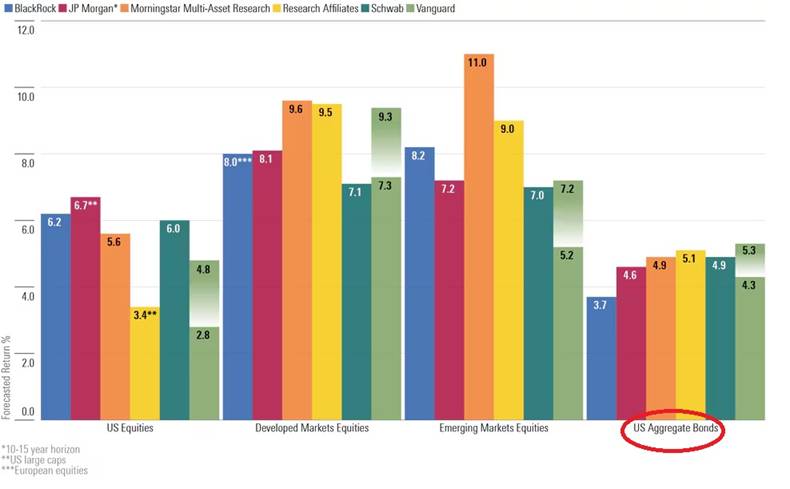

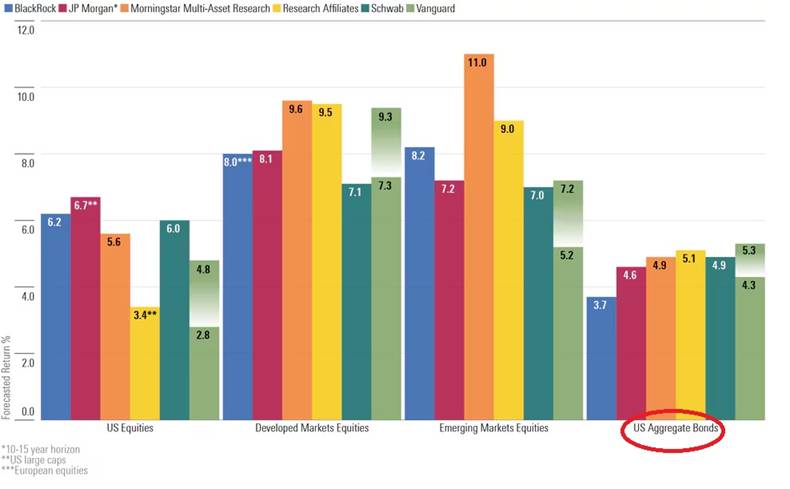

Outlook

for Investing in Bonds in 2024

After starting the year recommending that investors focus on

the middle of the yield curve, we began to advise investors to lengthen their

duration in our midyear bond

market update. According to our forecasts, we continue to think investors will be best served in longer-duration bonds and locking in the currently high interest

rates. https://www.morningstar.com/markets/where-invest-bonds-2024

Market data website:

FINRA: https://www.finra.org/finra-data/fixed-income (FINRA bond

market data)

Relationship

between bond prices and interest rates (Khan academy)

In class exercise

1)

What is the face value (par value) of the bond?

a. $500

b. $1,000

c. $1,500

2)

How often are coupon payments made on the bond?

a. Annually

b. Semi-annually

c. Quarterly

3)

If the bond has a two-year maturity, what is the total number of

coupon payments made over its life?

a. 2

b. 4

c. 6

4)

If interest rates rise after the bond is purchased, what happens

to its price?

a. Increases

b.

Decreases

c. Remains unchanged

5)

If interest rates go down, what is the likely impact on the

bond's price?

a.

Increases

b. Decreases

c. Remains unchanged

6)

For a zero-coupon bond with a face value of $1,000 and a

two-year maturity, what is the price if the expected return is 10% per year?

a. $823

b. $1,000

c. $1,100

7)

In the scenario of increased expectations, if the expected

return is now 15% for the same zero-coupon bond, what happens to its price?

a. Increases

b.

Decreases

c. Remains unchanged

8)

If the expected return decreases to 5% for the same zero-coupon

bond, what is the new price?

a. $822

b. $905

c. $1,000

9)

What does a bond trading at a premium mean?

a. Its price is below par

b. Its price is

above par

c. Its price is equal to par

10)

What does a bond trading at a discount mean?

a. Its price is

below par

b. Its price is above par

c. Its price is equal to par

11)

If interest rates are lower than expected, how does it affect

the price of a bond?

a. Increases

b. Decreases

c. Increases

12)

What is the primary reason for a bond trading at a discount?

a. High coupon rate

b. Low market interest rates

c. Low coupon

rate

13)

In the context of bond pricing, what is the present value?

a. Future value of cash flows

b. Current value

of future cash flows

c. Face value of the bond

14)

Why does the price of a bond decrease when interest rates rise?

a. Increase in coupon payments

b. Decrease in market expectations

c. Decrease in

present value of future cash flows

15)

What does a bond trading at par mean?

a. Its price is below par

b. Its price is above par

c. Its price is

equal to par

Reading

material:

·

Interest rate risk — When

Interest rates Go up, Prices of Fixed-rate Bonds Fall, issued by SEC at https://www.sec.gov/files/ib_interestraterisk.pdf

·

·

Higher market interest rates è lower fixed-rate bond prices è higher fixed-rate bond

yields

·

Lower fixed-rate bond coupon rates

è higher interest rate risk

·

Higher fixed-rate bond coupon rates è lower interest rate risk

·

Lower market interest rates è higher fixed-rate bond prices è lower fixed-rate bond yields èhigher interest rate risk to rising market

interest rates

·

Longer maturity è higher interest rate risk è higher coupon rate

·

Shorter maturity è lower interest rate risk è lower coupon rate

From https://www.sec.gov/files/ib_interestraterisk.pdf

In class exercise: True / False

1)

Higher

market interest rates lead to higher fixed-rate bond yields.

True

Explanation: Higher market interest rates result in lower fixed-rate bond prices and, consequently, higher fixed-rate bond yields.

2)

Lower

fixed-rate bond coupon rates decrease interest rate risk.

False

Explanation: When a bond has a lower fixed-rate coupon, the bondholder receives less interest income. In a rising interest rate environment, new bonds with higher coupon rates become more attractive to investors, leading to a decrease in the market value of existing bonds with lower coupon rates. Therefore, lower fixed-rate bond coupon rates make the bond more sensitive to changes in interest rates, resulting in higher interest rate risk.

3)

Higher

fixed-rate bond coupon rates lead to higher interest rate risk.

False

Explanation: Higher coupon rates lower interest rate risk for fixed-rate bonds. See above for further explanation.

4)

Lower

market interest rates result in higher fixed-rate bond yields.

False

Explanation: Lower market interest rates lead to higher fixed-rate bond prices and lower fixed-rate bond yields.

5)

Longer

maturity is associated with lower interest rate risk and a lower coupon rate.

False

Explanation: Longer maturity is associated with higher interest rate risk and a higher coupon rate. In terms of coupon rates, there is a general tendency for longer-maturity bonds to have higher coupon rates. This is because investors typically demand higher compensation for the increased interest rate risk associated with longer-term investments.

6)

Shorter

maturity reduces interest rate risk and increases the coupon rate.

False

Explanation: Shorter maturity is associated with lower interest rate risk and a lower coupon rate.

7)

Rising

market interest rates decrease fixed-rate bond prices and increase interest

rate risk.

True

Explanation: Rising market interest rates lead to lower fixed-rate bond prices and higher interest rate risk.

8)

Lower

fixed-rate bond coupon rates result in higher fixed-rate bond prices.

False

Explanation: Lower fixed-rate bond coupon rates generally result in lower demand and, consequently, lower bond prices, since when a bond has a lower coupon rate, it becomes less attractive to investors seeking higher yields. As a result, the bond's market price tends to decrease.

9)

Shorter

maturity is associated with higher interest rate risk and a higher coupon

rate.

False.

Explanation: Shorter maturity is associated with lower interest rate risk, not higher. When a bond has a shorter maturity, it means that the time until the bond's principal is repaid is shorter. In such cases, changes in interest rates have a lesser impact on the bond's price. The correct statement should be “Shorter maturity is associated with lower interest rate risk and a lower coupon rate”.

Bond Pricing Excel Formula

To calculate bond price in EXCEL (annual coupon

bond):

Price=abs(pv(yield to maturity, years left to maturity, coupon

rate*1000, 1000)

To calculate yield to maturity (annual coupon bond)::

Yield to maturity = rate(years left to maturity, coupon rate

*1000, -price, 1000)

To calculate bond price (semi-annual coupon bond):

Price=abs(pv(yield to maturity/2, years left to maturity*2,

coupon rate*1000/2, 1000)

To calculate yield to maturity (semi-annual coupon bond):

Yield to maturity = rate(years left to maturity*2, coupon

rate *1000/2, -price, 1000)*2

In Class Exercise (could be used to prepare for the

first midterm exam)

Excel Solution Video-Part 1 Video-Part 2

1.

AAA firm’ bonds will mature in eight years, and coupon is $65.

YTM is 8.2%. Bond’s market value? ($903.04, abs(pv(8.2%, 8, 65, 1000))

·

Rate 8.2%

·

Nper 8

·

Pmt 65

·

Pv ?

·

FV 1000

2. AAA firm’s bonds’ market value is $1,120, with

15 years maturity and coupon of $85. What is YTM? (7.17%,

rate(15, 85, -1120, 1000))

·

Rate ?

·

Nper 15

·

Pmt 85

·

Pv -1120

·

FV 1000

3. Sadik

Inc.'s bonds currently sell for $1,180 and have a par value of

$1,000. They pay a $105 annual coupon

and have a 15-year maturity, but they can be called in 5 years at

$1,100. What is their yield

to call (YTC)? (7.74%, rate(5, 105, -1180, 1100)) What is

their yield to maturity (YTM)? (8.35%, rate(15,

105, -1180, 1000))

·

Rate ?

·

Nper 15

·

Pmt 105

·

Pv -1180

·

FV 1000

4. Malko

Enterprises’ bonds currently sell for $1,050. They have a 6-year

maturity, an annual coupon of $75, and a par value of $1,000. What

is their current yield? (7.14%,

75/1050)

5. Assume

that you are considering the purchase of a 20-year, noncallable bond with an

annual coupon rate of 9.5%. The bond has a face value of $1,000,

and it makes semiannual interest payments. If you require an 8.4%

nominal yield to maturity on this investment, what is the maximum price you

should be willing to pay for the bond? ($1,105.69, abs(pv(8.4%/2, 20*2, 9.5%*1000/2, 1000)) )

·

Rate 8.4%/2

·

Nper 20*2

·

Pmt 95/2

·

Pv ?

·

FV 1000

6. Grossnickle

Corporation issued 20-year, non-callable, 7.5% annual coupon bonds at their

par value of $1,000 one year ago. Today, the market interest rate

on these bonds is 5.5%. What is the current price of the bonds,

given that they now have 19 years to maturity? ($1,232.15, abs(pv(5.5%, 19, 75, 1000)))

·

Rate 7.5%/2

·

Nper 19

·

Pmt 75

·

Pv ?

·

FV 1000

7. McCue

Inc.'s bonds currently sell for $1,250. They pay a $90 annual coupon, have a

25-year maturity, and a $1,000 par value, but they can be called in 5 years

at $1,050. Assume that no costs other than the call premium would

be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with

rates expected to remain at current levels on into the

future. What is the difference between this bond's YTM and its

YTC? (Subtract the YTC from the YTM; it is possible to get a

negative answer.) (2.62%, YTM = rate(25, 90,

-1250, 1000), YTC = rate(5, 90, -1250, 1050))

·

Rate ? ------------ ?

·

Nper 25 ------------- 5

·

Pmt 90 ------------ 90

·

Pv -1250 ------------ -1250

·

FV 1000 ------------ 1000

8. Taussig

Corp.'s bonds currently sell for $1,150. They have a 6.35% annual

coupon rate and a 20-year maturity, but they can be called in 5 years at

$1,067.50. Assume that no costs other than the call premium would

be incurred to call and refund the bonds, and also assume that the yield

curve is horizontal, with rates expected to remain at current levels on into

the future. Under these conditions, what rate of return should an

investor expect to earn if he or she purchases these bonds? (4.2%, rate(5, 63.5, -1150, 1067.5))

9. A

25-year, $1,000 par value bond has an 8.5% annual payment

coupon. The bond currently sells for $925. If the yield

to maturity remains at its current rate, what will the price be 5 years from

now? ($930.11, rate(25, 85, -925, 1000),

abs(pv( rate(25, 85, -925, 1000), 20, 85, 1000))

Assignments of Chapter 7:

1)

Chapter 7 Case Study – Due

with first midterm exam (updated)

Case study video in class 1/30/2024

(video. Thanks, Chris)

2)

Critical

Thinking Challenge –

Just choose one of the two questions as follows from https://www.cnbc.com/2023/11/01/fixed-income-back-in-the-spotlight-how-investors-can-take-advantage.html:

Option 1 -

The Impact of Rising Interest Rates on Bond Investments:

a.

Describe the recent shift in interest

rates and its impact on bond investments.

b.

Discuss the reasons behind the

dramatic increase in interest rates and how this shift has affected the bond

market.

Option 2 - The Role of Active

Fixed-Income Management in Volatile Markets:

a. Discuss the importance of

adopting an active approach to fixed-income management in the current

volatile market.

b. Explore how an active approach

allows for better returns and the flexibility to navigate challenging market

conditions.

3)

A quick quiz on the conceptual

comprehension of the bond chapter (FYI only, not required):

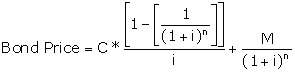

Bond Pricing Formula (FYI)

![]()

Bond Pricing Excel Formula

To calculate bond price in EXCEL (annual

coupon bond):

Price=abs(pv(yield to maturity, years left to maturity,

coupon rate*1000, 1000)

To calculate yield to maturity (annual coupon bond)::

Yield to maturity = rate(years left to maturity, coupon

rate *1000, -price, 1000)

To calculate bond price (semi-annual coupon bond):

Price=abs(pv(yield to maturity/2, years left to

maturity*2, coupon rate*1000/2, 1000)

To calculate yield to maturity (semi-annual coupon

bond):

Yield to maturity = rate(years left to maturity*2,

coupon rate *1000/2, -price, 1000)*2

Bond Duration Calculator

(FYI)

https://exploringfinance.com/bond-duration-calculator/

Op-ed: Fixed income is back

in the spotlight. Here’s how investors can take advantage

PUBLISHED WED, NOV 1

2023 9:00 AM EDT Christopher

Gunster, head of fixed income at Fidelis Capital

KEY POINTS

·

In recent quarters, we have

witnessed a dramatic shift higher in interest rates, a move that investors

should not fear but embrace. Bonds are now all the rage.

·

The current real yield on a

10-year Treasury is approaching 2.5%, a level that should excite bond

investors.

·

Return expectations are the

highest in years and, although markets could remain volatile, now is the

appropriate time to reassess your portfolio and consider an increase in your

fixed-income allocation.

Fixed-income investing is entering an exciting new era, and

investors should take notice. Decades

of low interest rates, engineered by global central banks, have suppressed

the bond market’s ability to generate attractive and

reliable returns.

But in recent quarters, we have witnessed a dramatic shift

higher in interest rates, a move that investors should not fear but embrace.

Bonds are now all the rage in investing circles and, although not as trendy

as Taylor Swift, their popularity has certainly risen in recent months

alongside interest rates.

Interest rates have increased dramatically since the beginning

of 2022. As an example, the yield-to-maturity on the benchmark U.S. 10-year

Treasury

is now nearing 5%, up

over 3.30%.

The yield on the 10-year and

other Treasury bonds is now the highest since the onset of the Great

Financial Crisis in 2007. In addition

to the rise in nominal interest rates, we have also experienced a similar

increase in real interest rates (rates adjusted for inflation).

If we use market-derived, forward-looking expectations of

inflation to adjust nominal yields, the current real yield on a 10-year

Treasury is approaching 2.5%, a level that should excite bond investors.

Granted, the journey to

higher yields has been painful to bond investors. In 2022, the total return of the Bloomberg Aggregate Bond

Index, a broad universe of U.S. taxable bonds, posted a return of -13.01%

(according to Bloomberg as of Dec. 31, 2022), the worst calendar year

performance for this index since its inception in 1976.

Other bond market sectors experienced similar distress, but with

the pain comes the gain. Higher rates

can now provide more total return and more stability in returns going

forward.

When calculating fixed-income returns for most bonds, there

are two components: price return and income return.

First time seeing Treasury yield move like this in 20-year

career, says Exante Data’s Jens Nordvig

At the start of 2022, there was little income being generated

from high-quality bonds. The negative total returns for the year were driven

by large price declines with a small positive contribution from income.

As an example, the Bloomberg Aggregate Bond Index posted a

price return of -15.3% and an income return of +2.3%. However, the

yield-to-maturity on the Bloomberg Aggregate Index is now 5.64% (according to

Bloomberg as of Oct. 17, 2023), over 3.5% higher than the beginning of 2022.

As a result, we would expect a much larger positive

contribution to future returns from income and a less negative contribution

from price return.

How can an investor take

advantage of the higher-yield environment?

We would suggest that

investors reassess their current bond allocation and marginally increase

their exposure in a manner consistent with their portfolio’s

current position, investment objectives and risk tolerance.

While we are not calling the top in near-term rate movements,

we do believe we are entering more of a range-bound yield market for longer

maturity bonds. This is consistent with our expectations of no additional

rate hikes from the Federal Reserve this cycle and a continued decline in

near-term inflation.

To efficiently capture the higher yields, we would advise a modest increase in longer-dated

maturity bonds as well as an allocation to shorter maturity bonds in a

barbell approach, while avoiding intermediate maturity where possible.

Given the inverted shape of

the yield curve, a barbell approach can help maximize the overall yield of

the portfolio and provide additional return should long-end rates move lower.

For non-taxable or investors

that are not tax-sensitive, we would prefer the use of higher-quality

corporate bonds, as we believe the market has not appropriately priced the

risk of a potential recession in lower-quality bonds.

Additionally, the agency

mortgage-backed securities market is a high-quality sector for investors to

consider. Year to date, this sector

has underperformed other investment grade sectors and now offers an

attractive risk-return profile.

For those investors in

high-income tax brackets, municipal bonds are attractive. Similar to our view

on taxable bonds, we would recommend a bias toward higher-quality bonds as a

potential recession could negatively impact lower-rated municipalities.

While we currently favor

municipal bonds for those high-tax investors, we would not eliminate

corporate bonds or other taxable securities from consideration. Certain

market conditions can favor taxable bonds on an after-tax, risk-adjusted

basis.

It’s important that investors select a

manager who can take advantage of those opportunities when they arise to

create a tax-efficient portfolio.

To the extent that interest rates move significantly higher,

counter to our expectations, we would view this as an opportunity for

investors to lock in even higher yields for longer. Under such a scenario, we

would not expect a repeat of 2022 bond market returns.

We estimate that interest rates would have to increase by

0.70% to 1.00% before forward-looking 12-month total returns would turn

negative for the major bond indexes.

We have little doubt that

the heightened level of market volatility will continue into 2024.

Opportunities present themselves when market volatility increases.

To that end, we recommend an

active approach to fixed-income management. Having the flexibility to successfully navigate and benefit

during challenging markets allows for better returns.

It is a new dawn for bonds and fixed-income investors. Return

expectations are the highest in years and, although markets could remain

volatile, now is the appropriate time to reassess your portfolio and consider

an increase in your fixed-income allocation.

— By Christopher Gunster, head of fixed income at Fidelis

Capital

In class exercise

1. What is the key

point emphasized in the op-ed regarding fixed income?

a.

Fixed income is losing popularity

b.

Investors should fear the recent shift in interest rates

c.

Fixed income is back in the spotlight

Answer: c.

Explanation:

The op-ed highlights the resurgence of fixed income in recent quarters.

2. What

is the current real yield on a 10-year Treasury, as mentioned in the op-ed?

a. 3.5%

b. 2.5%

c.

5.64%

Answer: b.

Explanation:

The op-ed states that the current real yield on a 10-year Treasury is

approaching 2.5%.

3. How

did the Bloomberg Aggregate Bond Index perform in 2022, according to the

op-ed?

a.

Positive return

b.

-15.3% return

c.

-13.01% return

Answer: c.

Explanation:

The op-ed mentions a negative total return of -13.01% for the Bloomberg

Aggregate Bond Index in 2022.

4. What

is suggested as a strategy to take advantage of the higher-yield environment?

a.

Increase bond exposure

b.

Reduce bond exposure

c.

Maintain the current bond allocation

Answer: a.

Explanation:

The op-ed suggests reassessing and marginally increasing bond exposure.

5. What

type of bond allocation is recommended for non-taxable or tax-insensitive

investors?

a.

Corporate bonds

b.

Municipal bonds

c.

Agency mortgage-backed securities

Answer: a.

Explanation:

Higher-quality corporate bonds are preferred for non-taxable or tax-insensitive

investors.

6. What

does the op-ed recommend for investors in high-income tax brackets?

a.

Municipal bonds

b.

Corporate bonds

c.

Agency mortgage-backed securities

Answer: a.

Explanation:

Municipal bonds are recommended for investors in high-income tax brackets.

7. What

does the op-ed suggest about the agency mortgage-backed securities market?

a. It

is not recommended for investment

b. It

has outperformed other investment grade sectors

c. It

is a high-risk sector

Answer: b.

Explanation:

The op-ed mentions that this sector has underperformed other investment grade

sectors.

8. What

is the recommended approach for capturing higher yields in a portfolio?

a.

Focus on intermediate maturity bonds

b.

Invest only in longer-dated maturity bonds

c. Use a

barbell approach with longer and shorter maturity bonds

Answer: c.

Explanation:

A barbell approach is advised to maximize overall portfolio yield.

9. What

is recommended for investors to consider in response to market volatility,

according to the op-ed?

a.

Adopt a passive approach

b.

Increase exposure to stocks

c. Take

an active approach to fixed-income management

Answer: c.

Explanation:

The op-ed recommends an active approach to benefit during challenging

markets.

10.

What is described as the current state of return expectations for bonds and

fixed-income investors?

a. The

highest in years

b. The

lowest in years

c.

Stable and predictable

Answer: a.

Explanation:

The op-ed suggests that return expectations are the highest in years.

11.

What is the op-ed's suggestion regarding reassessing portfolios in the

current environment?

a. It

is not necessary to reassess portfolios

b.

Portfolios should be reassessed and fixed-income allocation increased

c.

Portfolios should be reassessed, but fixed-income allocation should be

decreased

Answer: b.

Explanation:

The op-ed suggests reassessing portfolios and considering an increase in

fixed-income allocation.

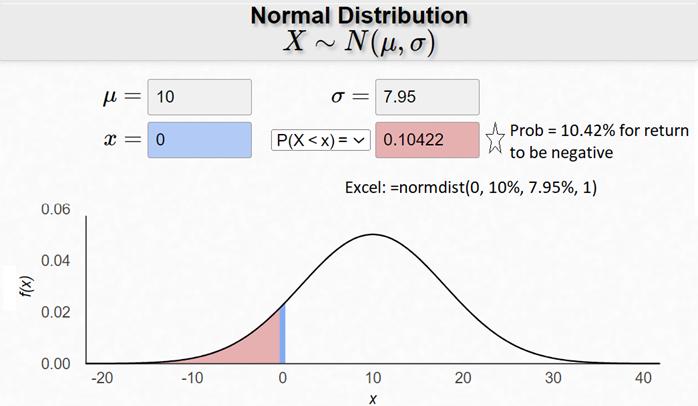

Chapter 8 Risk and Return

Equations

1. Expected return and standard deviation

Given

a probability distribution of returns, the expected return can be calculated

using the following equation:

where

- E[R] = the

expected return on the stock,

- N = the

number of states,

- pi =

the probability of state i, and

- Ri =

the return on the stock in state i.

Given

an asset's expected return, its variance can be calculated using the

following equation:

where

- N = the

number of states,

- pi =

the probability of state i,

- Ri =

the return on the stock in state i, and

- E[R] = the

expected return on the stock.

The

standard deviation is calculated as the positive square root of the variance.

http://www.zenwealth.com/businessfinanceonline/RR/MeasuresOfRisk.html

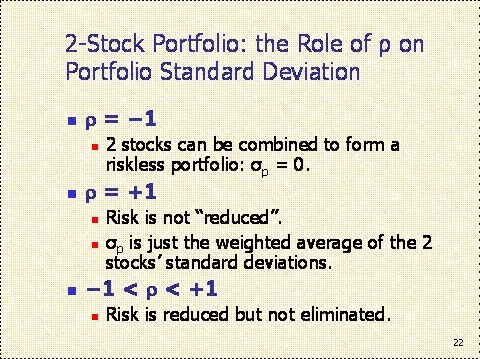

2. Two stock portfolio equations:

![]()

W1 and W2 are the

percentage of each stock in the portfolio.

Portfolio Variance Part 1

(youtube)

![]()

- r12 =

the correlation coefficient between the returns on stocks 1 and 2,

- s12 =

the covariance between the returns on stocks 1 and 2,

- s1 =

the standard deviation on stock 1, and

- s2 =

the standard deviation on stock 2.

![]()

- s12 =

the covariance between the returns on stocks 1 and 2,

- N = the

number of states,

- pi =

the probability of state i,

- R1i =

the return on stock 1 in state i,

- E[R1]

= the expected return on stock 1,

- R2i =

the return on stock 2 in state i, and

- E[R2]

= the expected return on stock 2.

3.. Historical returns

Holding period return (HPR) = (Selling price – Purchasing price

+ dividend)/ Purchasing price

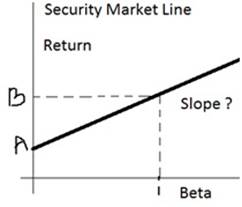

4. CAPM model

· What Is the Capital Asset Pricing Model?

The Capital Asset Pricing Model (CAPM)

describes the relationship between systematic risk and expected

return for assets, particularly stocks. CAPM is widely used throughout

finance for pricing risky securities and generating expected

returns for assets given the risk of those assets and cost of capital.

Ri = Rf + βi

*( Rm - Rf) ------ CAPM model

Ri = Expected return

of investment

Rf =

Risk-free rate

βi =

Beta of the investment

Rm =

Expected return of market

(Rm -

Rf) = Market risk premium

· What is Beta? Where to find Beta?

· SML – Security Market Line

RISK and Return General Template

In Class Exercise Video

|

1.

How to achieve the best investment results (low risk, high return)

(SOLUTION,

updated FYI) |

|||||

|

- Modern

Portfolio Theory |

|||||

|

Three stock portfolio: A, B,

C |

|||||

|

Year |

A |

B |

C |

|

|

|

1 |

10% |

4% |

12% |

|

|

|

2 |

5% |

6% |

5% |

|

|

|

3 |

4% |

8% |

7% |

|

|

|

4 |

7% |

10% |

8% |

|

|

|

5 |

1% |

5% |

14% |

|

|

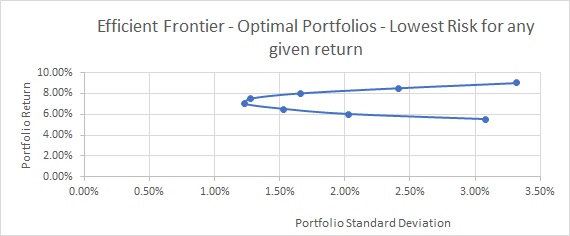

Assuming

you have $10,000, how should you allocate funds among the three stocks to

create an optimal portfolio with the highest return and lowest risk?

Steps

1.

Mean, risk for each stock

2.

Correlation between stocks: 3 correlations

3. Set

it up as a portfolio and get portfolio's mean and risk

Portfolio Return = w1*r1

+ w2*r2 + w3*r3

where: w1, w2, w3

are the weights of each stock in the portfolio, and r1,

r2, r3 are the returns of each stock in the

portfolio.

Portfolio Standard Deviation:

Portfolio Standard Deviation = sqrt(w12*σ12+ w22*σ22+ w32*σ32 + 2*w1*w2*ρ12*σ1*σ2 + 2*w1*w3*ρ13*σ1*σ3 + 2*w2*w3*ρ23*σ2*σ3)

where: σ1,

σ2,

σ3

are the standard deviations of each stock

in the portfolio. ρ12, ρ13, ρ23 are correlation coefficients between the stock returns. They

represent the pairwise correlations between the stocks in the portfolio.

For example, ρ12 represents

the correlation coefficient between the returns of stock 1 and stock 2, ρ23 represents

the correlation coefficient between the returns of stock 2 and stock.

4. Use

solver to find lowest risk (standard deviation) for any given return.

2. An investor currently holds the following portfolio: He invested

30% of the fund in Apple with Beta equal 1.1. He also invested 40% in GE with

Beta equal 1.6. The rest of his fund goes to Ford, with Beta equal 2.2. Use

the above information to answer the following questions.

1) The beta for the portfolio is? (1.63)

Solution:

0.3*1.1+0.4*1.6+(1-0.3-0.4)*2.2=1.63(weighted average of beta)

3.

The three month

Treasury bill rate (this is risk free rate) is 2%. S&P500 index return is

10% (this is market return). Now calculate the portfolio’s

return. 15.04%

Solution:

0.3*1.1+0.4*1.6+(1-0.3-0.4)*2.2=1.63--- This is beta and then

plug into the CAPM.

Return = 2% + 1.63*(10%-2%) = 15.04%

Refer to the following graph. The three month

Treasury bill rate (this is risk free rate) is 2%. S&P500 index return is

10% (this is market return).

1.

What is the value of A? 2%

Solution:

This is the intercept of the SML

2.

What is the value of B? 10%

Solution:

B is the market return, so 10%, since Beta =1

3.

How much is the slope of the above security market line? 8%

Solution:

Slope = rise/run = (10%-2%)/(1-0), just compare risk free rate

(Beta=0) and market return (beta=1)

4.

Your uncle bought Apple in January, year 2000 for $30. The

current price of Apple is $480 per share. Assume there are no dividend ever

paid. Calculate your uncle’s holding period return. 15 times

Solution:

Holding period return = (480-30)/30 =1500%=15

times

5.

Your current portfolio’s BETA is about 1.2. Your total

investment is worth around $200,000. You uncle just gave you $100,000 to

invest for him. With this $100,000 extra funds in hand, you plan to invest

the whole $100,000 in additional stocks to increase your whole portfolio’s

BETA to 1.5 (Your portfolio now worth $200,000 plus $100,000). What is the

average BETA of the new stocks to achieve your goal? (hint: write down the

equation of the portfolio’s Beta first) 2.10

Solution:

Total amount = 200000 + 100000=300000

New portfolio beta = 1.2*200000/300000 +

X*(100000/300000) = 1.5 è X=2.1

7.

Years Market

r Stock

A Stock

B

1 3% 16% 5%

2 -5% 20% 5%

3 1% 18% 5%

4 -10% 25% 5%

5 6% 14% 5%

· Calculate the average returns of the market r

and stock A and stock B. (Answer:

-1%, 18.6%, 5%)

· Calculate the standard deviations of the