FIN545/FIN534

Class Web Page, Summer '21

Jacksonville

University

Instructor:

Maggie Foley

Weekly SCHEDULE,

LINKS, FILES and Questions

|

Week |

Coverage, HW, Supplements -

Required |

|

Miscellaneous |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Live session URL: 5/15/2021: https://us.bbcollab.com/guest/fa8d5d72f162411eada7a689044e2503 6/5/2021: https://us.bbcollab.com/guest/c60cd30c208a40c68a8b1f2e595ae6a8

6/26 on zoom: Join Zoom Meeting Weekly Q&A Saturday 7-8

pm URL: https://us.bbcollab.com/guest/00ca5f10d7664a389c1a6b612a05f2d5 5/15/2021 Morning

8:30 – 12:00 - DCOB #159 or take it

online - chapters 2, 3: class video url (https://www.jufinance.com/video/fin534_2021_summer_5_15.mp4) - set up marketwatch.com game and start trading stocks like a pro. - Term project assignment. Term project due by 6/26/2021 - Case Study of chapters 2 and 3, due by 6/5/2021 (help video: https://www.jufinance.com/video/fin534_case1_2021_spring.mp4) – posted - First Discussion Board Assignments due by 6/5/2021, posted on blackboard under discussion 6/5/2021 Morning

8:30-12:00 - DCOB #159 or take it online - chapters 1, 4, 5: class video url https://www.jufinance.com/video/fin534_2021_summer_6_5_1.mp4 https://www.jufinance.com/video/fin534_2021_summer_6_5_2.mp4 - Homework of chapter 4 (see attached, and solution attached FYI, updated), due by 7/11/2021 - Case Study of Chapter 5, due by 7/11/2021 (help video part i: https://www.jufinance.com/video/fin534_case2_2021_spring_part_1.mp4) --- Posted (help video part ii: https://www.jufinance.com/video/fin534_case2_2021_spring_part_2.mp4) --- Posted Afternoon 1:15 – 4:30 - DCOB #159 or take it online (updated) - chapters 6: class video url https://www.jufinance.com/video/fin534_2021_summer_6_5_3.mp4) https://www.jufinance.com/video/fin534_2021_summer_6_5_4.mp4) - Case study assignment of chapter 6, due by 7/11/2021 (help video: https://www.jufinance.com/video/fin534_case3_2021_spring.mp4) --- Posted - Second Discussion Board Assignment, due by 7/11/2021, posted on blackboard under discussion Mid Term Exam (from 6/11 – 6/20 on blackboard, short answer questions and multiple choice question, T/F) midterm review: https://www.jufinance.com/video/fin534_week4_2021_spring.mp4 6/26/2021 Morning

8:30-12:00 - DCOB #159 or take it

online (updated) - Chapters 7: class video url (https://www.jufinance.com/video/fin534_2021_summer_6_26_1.mp4) - Chapters 9: class video url (https://www.jufinance.com/video/fin534_2021_summer_6_26_2.mp4) - Case study assignment of chapter 7, due by 7/11/2021 (help video: https://www.jufinance.com/video/fin534_case_4_2021_spring.mp4) – Posted

Afternoon1:15

– 4:30 - DCOB #159 or take it online

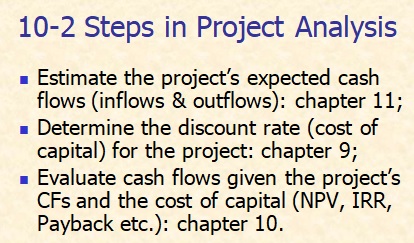

(updated) - Chapters 10: class video url (https://www.jufinance.com/video/fin534_2021_summer_6_26_3.mp4) - Chapters 11: class video url (https://www.jufinance.com/video/fin534_2021_summer_6_26_4.mp4) - Case study assignment of chapter 10, due by 7/11/2021 (help video: https://www.jufinance.com/video/fin534_case_6_2021_spring.mp4) – Posted

- Third Discussion Board Assignment, due by 7/11/2021, posted on blackboard under discussion -

Final Exam (take home exam, non-cumulative, chapters 7, 9, 10, 11, from 6/27 – 7/4) (study guide è)

Notes about live sessions: Each live session will start as scheduled.

Students are encouraged to attend the class on campus in DCOB #159. If students cannot

come, they could watch the video for what they miss. Extra

credit opportunity

Interested

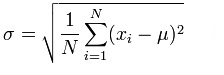

in earning extra credits? Please calculate the average returns, standard

deviation, stock correlations, and betas for the three stocks in your term

project. The CAPM part is not required. The excel template is available at https://www.jufinance.com/risk-return/. Just

turn it in before final. And

then I will add 20 points to your midterm exam grade (or final grade). A

help video is available at https://www.jufinance.com/video/fin534_excel_template_spring_2021.mp4 Term

Project due by 7/11/2021 |

|

Term Project General Requirements --- due by 7/11/2021

·

Word document of

about 10 pages (including

cover page and appendix), Times New Roman font size 12 for the main body ·

Sample firms’ financial statements should be attached as an appendix to

the report ·

Tables or graphs

for ratio analysis should be inserted in appropriate sections ·

Instructions 1.

Preparation: Read Chapters 2 and 3 and the corresponding PPTs for

Chapters 2 and 3 and the corresponding sections in the textbook. 2.

Pick the firms: Select a common theme (industry) for your project and

choose three companies in that industry. Describe briefly the industry and

company profiles, and analyze the firms’ competitive

positions in that industry. 3.

Collect data: Download the financial statements (balance sheet and

income statement) of those companies for the last three years from the same

source to ensure data consistency (e.g. Zacks

Investment Research). Describe the data briefly in your report. 4.

Perform ratio analysis: Calculate the various financial ratios discussed in

Chapter 3, including liquidity ratios, asset management ratios, debt

management ratios, profitability ratios, and market value ratios; also use

the DuPont equation to calculate ROEs. Present the results in an organized

way in your report. (All ratios in Table 3-1 on p. 119 should be included in

your report; other ratios mentioned in the textbook are optional.) 5.

Analyze the results: Conduct trend analysis (time-series) and comparative

analysis (cross-section) for the various ratios to interpret the results and

identify potential problems for sample firms. (Common size analysis and

percentage change analysis are not required.) 6.

Recommend changes: Propose possible changes to address the identified

problems to achieve competitive advantages. 7.

Term project sample study FYI only Final Exam Study Guide – FYI - Help

Video Short

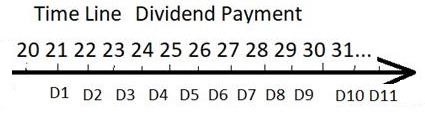

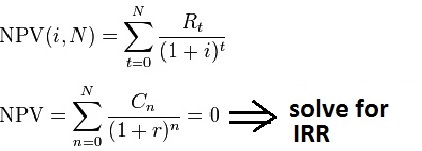

answer questions 1-10 (total 70 points) 1. Calculate stock returns based on dividend growth model, assuming dividend will grow at the constant rate. 2.

Given

D0, dividend growth rate from year 1-3, and the constant dividend growth rate

after year 3, required rate of return , calculate P0 3.

Given

D0, dividend growth rate from year 1-3, and the constant dividend growth rate

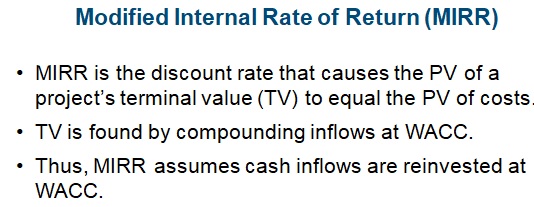

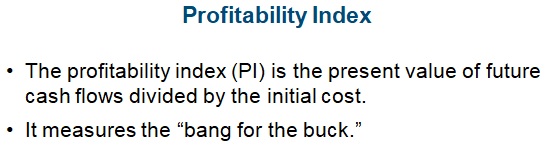

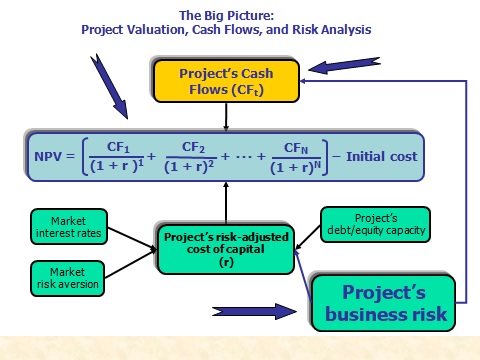

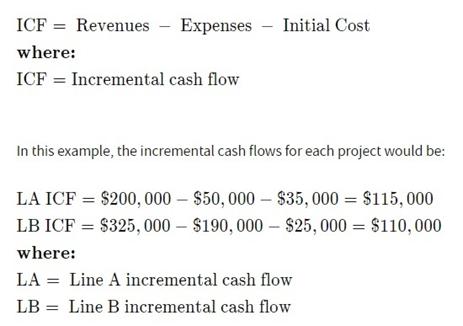

after year 3, required rate of return , calculate P0 4. Calculate stock price based on dividend growth model, assuming dividend will grow at the constant rate. The required rate of return is not given. Need to calculate based on CAPM. 5. Given capital structure. Calculate before tax cost of debt, cost of equity, and WACC 6. Give cash flows of two projects, and calculate NPV, IRR, crossover rate, and make investment decisions for given cost of capital 7. Given cash flows, cost of capital = financing costs, reinvestment rate, calculate MIRR, discount payback, PI 8. Calculate initial investment outlay, given cost of equipment, initial requirement for capital, R&D costs, depreciation, and selling price of the equipment by the end of the project. 9. Calculate the equipment salvage value given original cost, how much has been depreciated, the selling price, and the tax rate. 10. Given sales, cost of goods sold, depreciation expenses, and tax rate. Calculate operation cash flows.

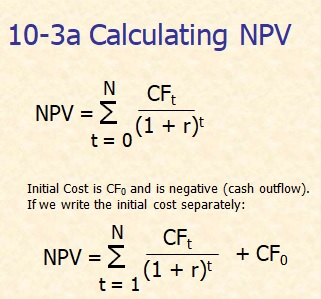

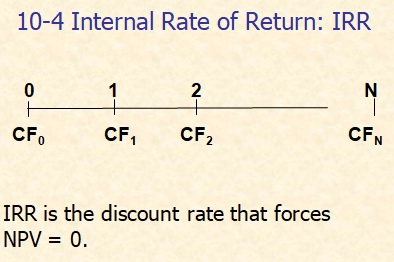

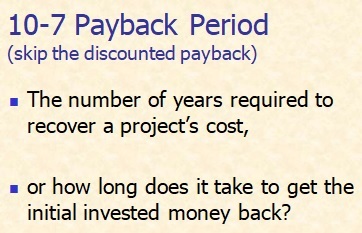

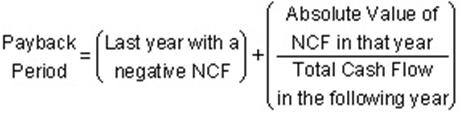

Conceptual

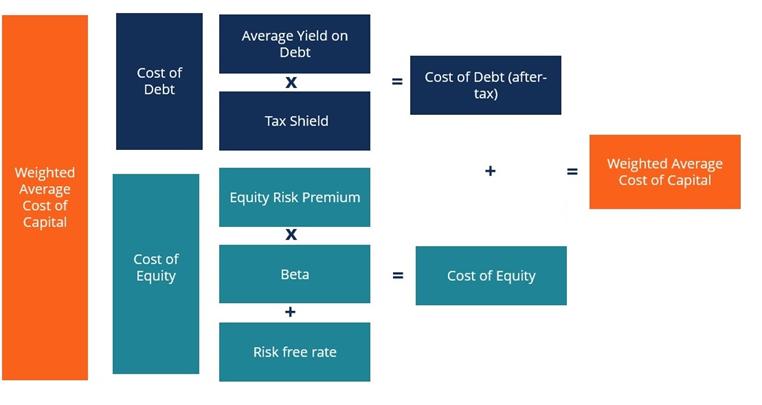

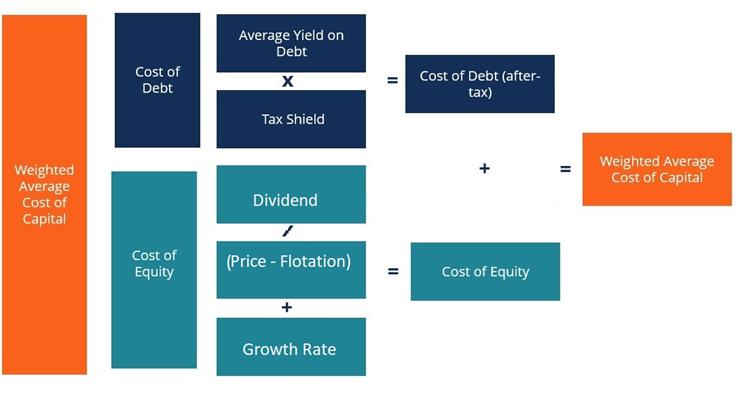

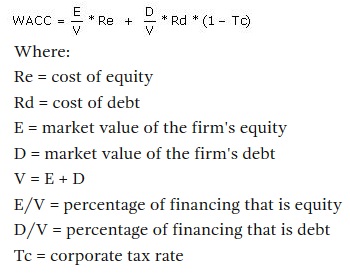

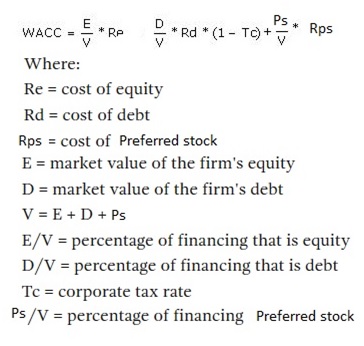

Questions (total of 50 points) 1. What is WACC? What are the components of WACC? Which one is higher? Which is lower? 2. What is preferred stock? 3. What is NPV? What is IRR? What is the rule used to make decision on project acceptance. 4. Why is there a multi-irr problem? 5. What is capital structure? What is the optimal capital structure? 6. What calculating operating cash flows, which item should be included? Which should not? 7. Terminal year cash flow: What should be included and what should not? 8. Flotation costs comparison between selling equity and selling debt 9. What does dividend growth rate mean?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

5/15 Morning |

Marketwatch Stock Trading Game (Pass code: havefun) 1. URL for your game: 2. Password for this private game: havefun. 3. Click on the 'Join Now' button to get started. 4. If you are an existing MarketWatch member, login. If you are a new user, follow the link for

a Free account - it's easy! 5. Follow the instructions and start trading! Chapter 2 Financial

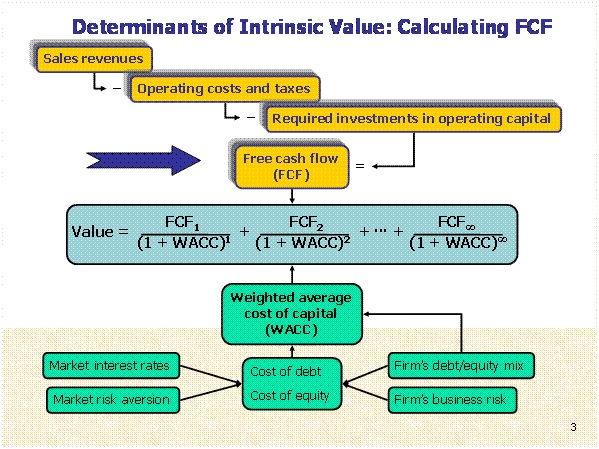

Statements Topics in Chapter 2: ·

Introduction

of Financial Statement ·

Firm’s

Intrinsic Value ·

Balance

Sheet ·

Income

Statement ·

Cash

Flow Statement ·

Free

Cash Flow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||

|

Amount |

||

|

Sales |

$785 |

|

|

Total cost of goods sold |

$460 |

|

|

Gross profit (EBITDA) |

$325 |

|

|

Depreciation |

$210 |

|

|

Operating expenses |

$0 |

|

|

Operating income (EBIT) |

$115 |

|

|

Interest expenses |

$35 |

|

|

Taxable income (EBT) |

$80 |

|

|

Taxes on income |

$28 |

|

|

Net income |

$52 |

• What is the cash flow from investment for 2015? ($57)

• What is the cash flow from operating for 2015? ($360)

• What is the cash flow from financing for 2015? ($-412)

Answer: https://www.jufinance.com/10k/cf/

|

Cash Flow Statement Template |

|

|

Cash at the beginning of the

year |

70 |

|

Cash

from operation |

|

|

net income |

52 |

|

plus depreciation |

210 |

|

-/+ AR |

61 |

|

-/+

Inventory |

22 |

|

+/- AP |

15 |

|

net

change in cash from operation |

360 |

|

Cash

from investment |

|

|

-/+ (NFA+depreciation) |

57 |

|

net

change in cash from investment |

57 |

|

Cash

from financing |

|

|

+/- long term debt |

70 |

|

+/- common stock |

-465 |

|

- dividend |

-17 |

|

net

change in cash from investment |

-412 |

|

Total

net change of cash |

5 |

|

Cash

at the end of the year |

75 |

Chapter 3 Analysis

of Financial Statements

Topics in Chapter 3:

1.

Ratio

analysis

2.

DuPont

equation

3.

Benchmarking

for ratio analysis

4.

Limitations

of ratio analysis

5.

Qualitative

factors

Ratio Analysis template

https://www.jufinance.com/ratio

Finviz.com/screener for ratio

analysis (https://finviz.com/screener.ashx

Financial ratio analysis (VIDEO)

****** DuPont Identity

*************

ROE = (net income / sales) *

(sales / assets) * (assets / shareholders' equity)

This equation for ROE breaks it

into three widely used and studied components:

ROE = (net profit margin) * (asset

turnover) * (equity multiplie)

In

class exercise

Firm AAA’s total asset = $720,000. This company has no debt, so its debt/equity ratio = 0%. Now the CEO wants to raise the debt/assets ratio to 40%. How much must the firm borrow to achieve this goal?

a. $273,600

b. $288,000

c. $302,400

d. $327,100

answer: Total assets $720,000

Target debt ratio 40%

Debt to achieve target ratio = Amount borrowed = Target % × Assets = $288,000

Week 1 case study – chapters 2 and 3 (due by 6/5/2021)

Help video url: https://www.jufinance.com/video/fin534_case1_2021_spring.mp4 -- posted

How much does Amazon worth?” --- FYI only: Amazon.com Inc. (AMZN) https://www.stock-analysis-on.net/NASDAQ/Company/Amazoncom-Inc/DCF/Present-Value-of-FCFF

Present

Value of Free Cash Flow to the Firm (FCFF)

In

discounted cash flow (DCF) valuation techniques the value of the stock is

estimated based upon present value of some measure of cash flow. Free cash

flow to the firm (FCFF) is generally described as cash flows after direct

costs and before any payments to capital suppliers.

- Intrinsic Stock Value

(Valuation Summary)

- Weighted Average Cost of

Capital (WACC)

- FCFF Growth Rate (g)

Intrinsic Stock Value (Valuation Summary)

Amazon.com

Inc., free cash flow to the firm (FCFF) forecast

|

Year |

Value |

FCFFt or Terminal value (TVt) |

Calculation |

Present

value at 16.17% |

|

01 |

FCFF0 |

(4,286) |

||

|

1 |

FCFF1 |

– |

= (4,286) ×

(1 + 0.00%) |

– |

|

2 |

FCFF2 |

– |

= – ×

(1 + 0.00%) |

– |

|

3 |

FCFF3 |

– |

= – ×

(1 + 0.00%) |

– |

|

4 |

FCFF4 |

– |

= – ×

(1 + 0.00%) |

– |

|

5 |

FCFF5 |

– |

= – ×

(1 + 0.00%) |

– |

|

5 |

Terminal value (TV5) |

– |

= – ×

(1 + 0.00%) ÷ (16.17%

– 0.00%) |

– |

|

Intrinsic value of Amazon.com's capital |

– |

|||

|

Less: Debt (fair value) |

45,696 |

|||

|

Intrinsic value of Amazon.com's common stock |

– |

|||

|

Intrinsic value of Amazon.com's common stock (per share) |

$– |

|||

|

Current share price |

$1,642.81 |

|||

1

Weighted Average Cost of Capital (WACC)

Amazon.com

Inc., cost of capital

|

Value1 |

Weight |

Required

rate of return2 |

Calculation |

|

|

Equity (fair value) |

803,283 |

0.95 |

16.97% |

|

|

Debt (fair value) |

45,696 |

0.05 |

2.10% |

= 2.99%

× (1 – 29.84%) |

1 USD $ in millions

Equity (fair value) = No. shares

of common stock outstanding × Current share price

= 488,968,628 × $1,642.81 =

$803,282,551,764.68

Debt (fair value). See Details »

2 Required rate of return on equity

is estimated by using CAPM. See Details »

Required rate of return on debt. See Details »

Required rate of return on debt

is after tax.

Estimated (average) effective

income tax rate

= (20.20% + 36.61%

+ 60.59% + 0.00%

+ 31.80%) ÷ 5 = 29.84%

WACC

= 16.17%

FCFF Growth Rate (g)

FCFF growth rate

(g) implied by PRAT model

Amazon.com

Inc., PRAT model

|

Average |

Dec

31, 2017 |

Dec

31, 2016 |

Dec

31, 2015 |

Dec

31, 2014 |

Dec

31, 2013 |

||

|

Selected

Financial Data (USD $ in millions) |

|||||||

|

Interest expense |

848 |

484 |

459 |

210 |

141 |

||

|

Net income (loss) |

3,033 |

2,371 |

596 |

(241) |

274 |

||

|

Effective income tax rate

(EITR)1 |

20.20% |

36.61% |

60.59% |

0.00% |

31.80% |

||

|

Interest expense, after tax2 |

677 |

307 |

181 |

210 |

96 |

||

|

Interest expense (after tax)

and dividends |

677 |

307 |

181 |

210 |

96 |

||

|

EBIT(1 – EITR)3 |

3,710 |

2,678 |

777 |

(31) |

370 |

||

|

Current portion of long-term

debt |

100 |

1,056 |

238 |

1,520 |

753 |

||

|

Current portion of capital

lease obligation |

5,839 |

3,997 |

3,027 |

2,013 |

955 |

||

|

Current portion of finance

lease obligations |

282 |

144 |

99 |

67 |

28 |

||

|

Long-term debt, excluding

current portion |

24,743 |

7,694 |

8,235 |

8,265 |

3,191 |

||

|

Long-term capital lease

obligations, excluding current portion |

8,438 |

5,080 |

4,212 |

3,026 |

1,435 |

||

|

Long-term finance lease

obligations, excluding current portion |

4,745 |

2,439 |

1,736 |

1,198 |

555 |

||

|

Total stockholders' equity |

27,709 |

19,285 |

13,384 |

10,741 |

9,746 |

||

|

Total capital |

71,856 |

39,695 |

30,931 |

26,830 |

16,663 |

||

|

Ratios |

|||||||

|

Retention rate (RR)4 |

0.82 |

0.89 |

0.77 |

– |

0.74 |

||

|

Return on invested capital

(ROIC)5 |

5.16% |

6.75% |

2.51% |

-0.12% |

2.22% |

||

|

Averages |

|||||||

|

RR |

0.80 |

||||||

|

ROIC |

3.31% |

||||||

|

Growth rate of FCFF (g)6 |

0.00% |

||||||

2017

Calculations

2 Interest expense, after tax =

Interest expense × (1 – EITR)

= 848 × (1 – 20.20%)

= 677

3 EBIT(1 – EITR) = Net income

(loss) + Interest expense, after tax

= 3,033 + 677 = 3,710

4 RR = [EBIT(1 – EITR) – Interest

expense (after tax) and dividends] ÷ EBIT(1 – EITR)

= [3,710 – 677]

÷ 3,710 = 0.82

5 ROIC = 100 × EBIT(1 – EITR) ÷

Total capital

= 100 × 3,710 ÷ 71,856 = 5.16%

6 g = RR × ROIC

= 0.80 × 3.31%

= 0.00%

FCFF growth rate

(g) forecast

Amazon.com

Inc., H-model

|

Year |

Value |

gt |

|

1 |

g1 |

0.00% |

|

2 |

g2 |

0.00% |

|

3 |

g3 |

0.00% |

|

4 |

g4 |

0.00% |

|

5 and thereafter |

g5 |

0.00% |

where:

g1 is implied by PRAT model

g5 is implied by single-stage model

g2, g3 and g4 are calculated using linear interpoltion between g1 and g5

Calculations

g2 = g1 + (g5 – g1) × (2 – 1) ÷ (5 – 1)

= 0.00% + (0.00%

– 0.00%) × (2 – 1) ÷ (5 – 1) = 0.00%

g3 = g1 + (g5 – g1) × (3 – 1) ÷ (5 – 1)

= 0.00% + (0.00%

– 0.00%) × (3 – 1) ÷ (5 – 1) = 0.00%

g4 = g1 + (g5 – g1) × (4 – 1) ÷ (5 – 1)

= 0.00% + (0.00%

– 0.00%) × (4 – 1) ÷ (5 – 1) = 0.00%

6/5 -1

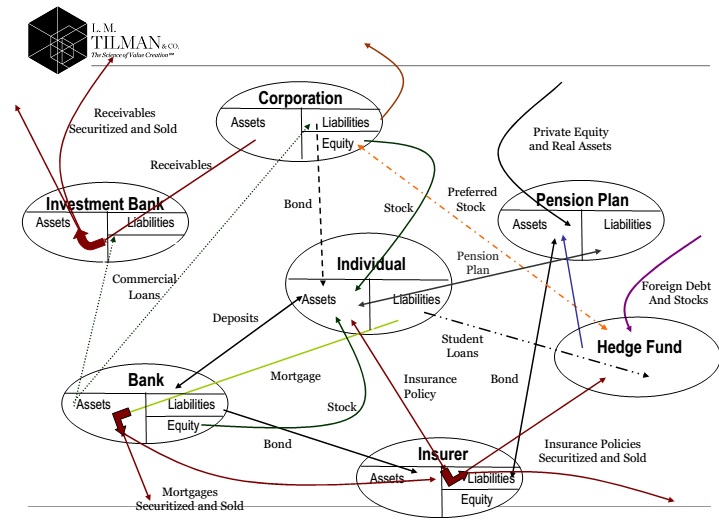

Chapter 1 An

Overview of Financial Management

Chapter overview:

This chapter provides a basic idea of what financial

management/managerial finance/corporate finance is all about, including an

overview of the financial environment (financial markets, institutions, and

securities/instruments) in which

corporations operate.

Note:

Flow of funds describes the

financial assets flowing from various sectors through financial

intermediaries for the purpose of buying physical or financial assets.

*** Household, non-financial business,

and our government

Financial institutions facilitate

exchanges of funds and financial products.

*** Building blocks of a financial

system. Passing and transforming funds and risks during transactions.

*** Buy and sell, receive and

deliver, and create and underwrite financial products.

*** The transferring of funds and

risk is thus created. Capital utilization for individual and for the whole

economy is thus enhanced.

Negative interest rate

How

do negative interest rates work? | CNBC Explains

Chapter 4 Time

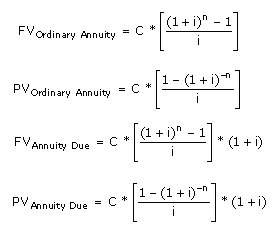

Value of Money

(review)

Topics:

·

Future Value and Compounding

·

Present Value and Discounting

·

Rates of Return/Interest Rates

·

Number of periods

·

Amortization

Amortization Table example:

- Develop an amortization

schedule in Excel for a five-year car loan of $30,000 with APR of 3%

(use the home mortgage loan as an example)

Hint: In excel, find amortization

template.

Calculator:

https://www.jufinance.com/tvm/

--- TVM calculator

https://www.jufinance.com/nfv/ --- net future value calculator

Equations:

FV = PV *(1+r)^n

PV = FV / ((1+r)^n)

N = ln(FV/PV) / ln(1+r)

Rate = (FV/PV)1/n -1

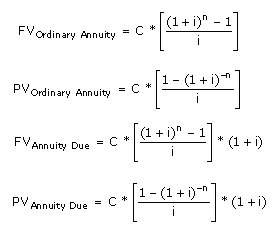

Annuity:

N

= ln(FV/C*r+1)/(ln(1+r))

Or

N = ln(1/(1-(PV/C)*r)))/

(ln(1+r))

Excel

Formulas

To get FV, use FV

function.

=abs(fv(rate, nper, pmt, pv))

To get PV, use PV

function

= abs(pv(rate, nper, pmt, fv))

To get r, use rate function

= rate(nper, pmt, pv, -fv)

To get number of years,

use nper function

= nper(rate, pmt, pv,

-fv)

To get annuity payment, use PMT

function

= abs(pmt(rate, nper, pv,

-fv))

In Class Exercise:

1. You want to retire early

so you know you must start saving money. Thus, you have decided to save

$4,500 a year, starting at age 25. You plan to retire as soon as you can

accumulate $500,000. If you can earn an average of 11 percent on your

savings, how old will you be when you retire? (49.74 years)

Answer: nper(11%, 4500, 0,

-500000)+25

2. Fred was persuaded to open a credit card account and now owes $5,150

on this card. Fred is not charging any additional purchases because he wants

to get this debt paid in full. The card has an APR of 15.1 percent. How much

longer will it take Fred to pay off this balance if he makes monthly payments

of $70 rather than $85? (93.04 months)

Answer: nper(15.1%/12, 70, -5150,

0) - nper(15.1%/12, 85, -5150, 0)

3. At the end of this month, Bryan will start saving $80 a month for

retirement through his company's retirement plan. His employer will

contribute an additional $.25 for every $1.00 that Bryan saves. If he is

employed by this firm for 25 more years and earns an average of 11 percent on

his retirement savings, how much will Bryan have in his retirement account 25

years from now? ($157,613.33)

Answer: Bryan’s monthly contribution: 80+80*0.25 = 100

Fv(11%/12, 25*12, 100, 0))

4. Sky Investments offers an

annuity due with semi-annual payments for 10 years at 7 percent interest. The

annuity costs $90,000 today. What is the amount of each annuity

payment? ($6,118.35)

Answer: pmt(7%/2, 10*2, 90000,

0,1)

5. Mr. Jones just won a lottery prize that will pay him $5,000 a year

for thirty years. If Mr. Jones can

earn 5.5 percent on his money, what are his

winnings worth to him today? ($72,668.73)

Answer: pv(5.5%, 30, 5000, 0)

Chapter 5 Bond,

Bond Valuation and Interest Rates

Topics in Chapter 5:

·

Key features of bonds

·

Bond valuation

·

Measuring yield

·

Assessing risk

Market data website:

1. FINRA

http://finra-markets.morningstar.com/BondCenter/Default.jsp (FINRA

bond market data)

2. WSJ

Market watch on Wall Street Journal has daily yield curve

and bond yield information.

http://www.marketwatch.com/tools/pftools/

https://www.youtube.com/watch?v=yph8TRldW6k

3. Bond Online

http://www.bondsonline.com/Todays_Market/

Simplified Balance

Sheet of WalMart

|

In Millions of USD |

As of 2020-01-31 |

|

Total Assets |

236,495,000 |

|

Total Current

Liabilities |

16,203,000 |

|

Long Term Debt |

64,192,000 |

|

Total Liabilities |

154,943,000 |

|

Total Equity |

81,552,000 |

|

Total Liabilities

& Shareholders' Equity |

236,495,000 |

https://www.wsj.com/market-data/quotes/WMT/financials/annual/balance-sheet

FINRA – Bond market

information

http://finra-markets.morningstar.com/BondCenter/Default.jsp

WAL-MART

STORES INC

http://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C104227&symbol=WMT.GP

Coupon

Rate

7.550

%

Maturity

Date

02/15/2030

Symbol

WMT.GP |

CUSIP

931142BF9 |

Next Call Date

— |

Callable

— |

Last Trade Price

$146.28 |

Last Trade Yield

1.776% |

Last Trade Date

06/04/2021 |

US Treasury Yield

— |

|

|

Credit

and Rating Elements

|

Moody's® Rating |

Aa2 (5/9//2018) |

|

Standard & Poor's

Rating |

AA (02/10/2000) |

|

TRACE Grade |

Investment Grade |

|

Default |

— |

|

Bankruptcy |

N |

|

Insurance |

— |

|

Mortgage Insurer |

— |

|

Pre-Refunded/Escrowed |

— |

|

Additional Description |

Senior Unsecured Note |

Classification Elements

|

Bond Type |

US Corporate Debentures |

|

Debt Type |

Senior Unsecured Note |

|

Industry Group |

Industrial |

|

Industry Sub Group |

Retail |

|

Sub-Product Asset |

CORP |

|

Sub-Product Asset Type |

Corporate Bond |

|

State |

— |

|

Use of Proceeds |

— |

|

Security Code |

— |

Special

Characteristics

|

Medium Term Note |

N |

Issue Elements

|

*dollar

amount in thousands |

|

|

Offering Date |

02/09/2000 |

|

Dated Date |

02/15/2000 |

|

First Coupon Date |

08/15/2000 |

|

Original Offering* |

$1,000,000.00 |

|

Amount Outstanding* |

$1,000,000.00 |

|

Series |

— |

|

Issue Description |

— |

|

Project Name |

— |

|

Payment Frequency |

Semi-Annual |

|

Day Count |

30/360 |

|

Form |

Book Entry |

|

Depository/Registration |

Depository Trust Company |

|

Security Level |

Senior |

|

Collateral Pledge |

— |

|

Capital Purpose |

— |

Bond Elements

|

*dollar

amount in thousands |

|

|

Original Maturity Size* |

1,000,000.00 |

|

Amount Outstanding Size* |

1,000,000.00 |

|

Yield at Offering |

7.56% |

|

Price at Offering |

$99.84 |

|

Coupon Type |

Fixed |

|

Escrow Type

|

|

·

The attached Wal-mart Bond prospects says:

“We are offering $500,000,000 of our 1.000% notes due 2017 (symbol WMT4117476),

$1,000,000,000 of our 3.300% notes due 2024 (symbol WMT4117477) and

$1,000,000,000 of our 4.300% notes due 2044 (symbol WMT4117478)

Risk of Bonds

Class discussion: Is bond market risky?

Bond

risk (video)

Bond

risk – credit risk (video)

Bond

risk – interest rate risk (video)

Bond

risk – how to reduce your risk (video)

1. AAA

firm’s bonds’ market value is

$1,120, with 15 years maturity and coupon of $85. What is YTM? (7.17%, rate(15, 85, -1120, 1000))

2. Sadik

Inc.'s bonds currently sell for $1,180 and have a par value of

$1,000. They pay a $105 annual coupon

and have a 15-year maturity, but they can be called in 5 years at

$1,100. What is their yield to call (YTC)? (7.74%, rate(5, 105, -1180, 1100))

3. Assume

that you are considering the purchase of a 20-year, noncallable bond with an

annual coupon rate of 9.5%. The bond has a face value of $1,000,

and it makes semiannual interest payments. If you require an 8.4%

nominal yield to maturity on this investment, what is the maximum price you

should be willing to pay for the bond? ($1,105.69, abs(pv(8.4%/2,

20*2, 9.5%*1000/2, 1000)) )

4. McCue

Inc.'s bonds currently sell for $1,250. They pay a $90 annual coupon, have a

25-year maturity, and a $1,000 par value, but they can be called in 5 years

at $1,050. Assume that no costs other than the call premium would

be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with

rates expected to remain at current levels on into the

future. What is the difference between this bond's YTM and its

YTC? (Subtract the YTC from the YTM; it is possible to get a

negative answer.) (2.62%, YTM = rate(25, 90, -1250, 1000), YTC = rate(5, 90, -1250, 1050))

5. A

25-year, $1,000 par value bond has an 8.5% annual payment

coupon. The bond currently sells for $925. If the yield

to maturity remains at its current rate, what will the price be 5 years from

now? ($930.11, rate(25, 85, -925, 1000), abs(pv( rate(25, 85, -925, 1000),

20, 85, 1000))

Assignments

(due with the mid-term exam)

part 1 (help video: https://www.jufinance.com/video/fin534_case2_2021_spring_part_1.mp4) – posted

part 2 (help video: https://www.jufinance.com/video/fin534_case2_2021_spring_part_2.mp4) – posted

2.

Develop an amortization schedule in

Excel for a five-year car loan of $30,000 with APR of 3%

(hint: use amortization loan template

in excel)

3.

Chapter 4 End of Chapter Problems

(not questions): 1, 2, 3, 4, 16, 17, 19, 27 (chapter 4 homework solution all inclusive fyi only)

Chapter 4 Homework assignments – Spring 2021

Page 186:

4-1: If you deposit $10,000 in a bank account that pays 10% interest annually. How much will be in your account after 5 years?

4-2: What is the present value of a security that will pay $5000 in 20 years if securities of equal risk pay 7% annually.

4-3: Your parents will retire in 18 years. They currently have $250,000 and they think they will need $1 million at retirement. What annual interest rate must they earn to reach their goal, assuming they do not save any additional funds?

4-4: If you deposit money today in an account that pays 6.5% annual interest, how long will it take to double your money?

4-16: Find the amount to which $500 will grow under each of the following conditions.

a. 12% compounded annually for 5 years.

b. 12% compounded semiannually for 5 years.

c. 12% compounded quarterly for 5 years.

d. 12% compounded monthly for 5 years.

4-17: Find the present value of $500 due in the future under each of the following conditions.

a. 12% nominal rate, semiannual compounding, discounted back 5 years

b. 12% nominal rate, quarterly compounding, discounted back 5 years

c. 12% nominal rate, monthly compounding, discounted back 5 years

4-19: Universal bank

pays 7% interest, compounded annually, on time deposits. Regional

bank pays 6% interest, compounded quarterly.

a.

Based on effective interest rates, in

which bank would you prefer to deposit your money?

b.

Could your choice of banks be influenced

by the fact that you might want o withdraw your funds during the year as

opposed to at the end of the year? In answering this question, assume that

funds must be left on deposit during an entire compounding period in order

for you to receive any interest.

4-27:

What is the present value of a perpetuity of $100

per year if the appropriate discount rate is 7%? If interest rates in general

were to double and the appropriate discount rate rose to 14%, what would

happen to the present value of the perpetuity?

Updated

Feb 26, 2021

What Are Negative Interest Rates? (FYI)

Negative

interest rates occur when borrowers are credited interest rather than paying

interest to lenders. While this is a very unusual scenario, it is most likely

to occur during a deep economic recession when monetary efforts and market

forces have already pushed interest rates to their nominal zero bound.

Typically,

a central bank will charge commercial banks on their reserves as a form of

non-traditional expansionary monetary policy, rather than crediting them interest.

This extraordinary monetary policy tool is used to strongly encourage

lending, spending, and investment rather than hoarding cash, which will lose

value to negative deposit rates. Note that individual depositors will not be

charged negative interest rates on their bank accounts.

KEY

TAKEAWAYS

• Negative interest rates occur when

borrowers are credited interest rather than paying interest to lenders.

• With negative interest rates,

central banks charge commercial banks on reserves in an effort to incentivize

them to spend rather than hoard cash positions.

• With negative interest rates,

commercial banks are charged interest to keep cash with a nation's central

bank, rather than receiving interest. Theoretically, this dynamic should

trickle down to consumers and businesses, but commercial banks have been

reluctant to pass negative rates onto their customers.

Understanding

a Negative Interest Rate

While

real interest rates can be effectively negative if inflation exceeds the

nominal interest rate, the nominal interest rate is, theoretically, bounded

by zero. Negative interest rates are often the result of a desperate and

critical effort to boost economic growth through financial means.

The

zero-bound refers to the lowest level that interest rates can fall to; some

forms of logic would dictate that zero would be that lowest level. However,

there are instances where negative rates have been implemented during normal

times. Switzerland is one such example; as of mid-2020, its target interest

rate was -0.75%.1 Japan adopted a similar policy, with a mid-2020 target rate

of -0.1%.2

Negative

interest rates may occur during deflationary periods. During these times,

people and businesses hold too much money—instead of

spending money—with the expectation that a dollar

will be worth more tomorrow than today (i.e., the opposite of inflation).

This can result in a sharp decline in demand, and send prices even lower.

Often,

a loose monetary policy is used to deal with this type of situation. However,

when there are strong signs of deflation factoring into the equation, simply

cutting the central bank's interest rate to zero may not be sufficient enough

to stimulate growth in both credit and lending.

In a

negative interest rate environment, an entire economic zone can be impacted

because the nominal interest rate dips below zero. Banks and financial firms

have to pay to store their funds at the central bank, rather than earn

interest income.

Consequences

of Negative Rates

A

negative interest rate environment occurs when the nominal interest rate

drops below zero percent for a specific economic zone. This effectively means

that banks and other financial firms have to pay to keep their excess

reserves stored at the central bank, rather than receiving positive interest income.

A

negative interest rate policy (NIRP) is an unusual monetary policy tool.

Nominal target interest rates are set with a negative value, which is below

the theoretical lower bound of zero percent.

During

deflationary periods, people and businesses tend to hoard money, instead of

spending money and investing. The result is a collapse in aggregate demand,

which leads to prices falling even further, a slowdown or halt in real

production and output, and an increase in unemployment.

A loose

or expansionary monetary policy is usually employed to deal with such

economic stagnation. However, if deflationary forces are strong enough,

simply cutting the central bank's interest rate to zero may not be sufficient

to stimulate borrowing and lending.

Example

of a Negative Interest Rate

In

recent years, central banks in Europe, Scandinavia, and Japan have

implemented a negative interest rate policy (NIRP) on excess bank reserves in

the financial system. This unorthodox monetary policy tool is designed to

spur economic growth through spending and investment; depositors would be

incentivized to spend cash rather than store it at the bank and incur a

guaranteed loss.

It's

still not clear if this policy has been effective in achieving this goal in

those countries, and in the way it was intended. It's also unclear whether or

not negative rates have successfully spread beyond excess cash reserves in

the banking system to other parts of the economy.

Frequently

Asked Questions

How can

interest rates turn negative?

Interest

rates tell you how valuable money is today compared to the same amount of

money in the future. Positive interest rates imply that there is a time value

of money, where money today is worth more than money tomorrow. Forces like

inflation, economic growth, and investment spending all contribute to this

outlook. A negative interest rate, by contrast, implies that your money will

be worth more in the future, not less.

What do negative interest rates mean for

people?

Most instances of negative interest rates

only apply to bank reserves held by central banks; however, we can ponder the

consequences of more widespread negative rates. First, savers would have to

pay interest instead of receiving it. By the same token, borrowers would be

paid to do so instead of paying their lender. Therefore, it would incentivize

many to borrow more and larger sums of money and to forgo saving in favor of

consumption or investment. If they did save, they would save their cash in a

safe or under the mattress, rather than pay interest to a bank for depositing

it. Note that interest rates in the real world are set by the supply and

demand for loans (despite central banks setting a target). As a result, the

demand for money in-use would grow and quickly restore a positive interest

rate.

Where

do negative interest rates exist?

Some

central banks have set a negative interest rate policy (NIRP) in order to

stimulate economic growth in the financial sector, or else to protect the

value of a local currency against exchange-rate increases due to large

inflows of foreign investment. Countries including Japan, Switzerland,

Sweden, and even the ECB (eurozone) have adopted NIRPs at various points over

the past two decades.

Why

would a central bank adopt a NIRP to stimulate the economy?

Monetary

policymakers are often afraid of falling into a deflationary spiral. In harsh

economic times, such as deep economic recessions or depressions, people and

businesses tend to hold on to their cash while they wait for the economy to

improve. This behavior, however, can weaken the economy further as a lack of

spending causes further job losses, lowers profits, and prices to drop—all of which reinforces people’s

fears, giving them even more incentive to hoard. As spending slows even more,

prices drop again, creating another incentive for people to wait as prices

fall further. And so on. When central banks have already lowered interest

rates to zero, the NIRP is a way to incentivize corporate borrowing and

investment and discourage hoarding of cash.

https://www.investopedia.com/terms/n/negative-interest-rate.asp

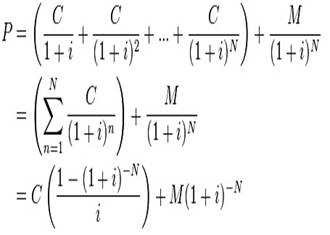

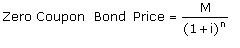

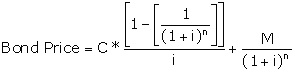

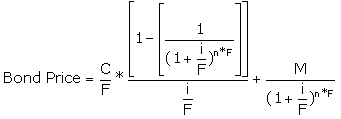

Bond Pricing Formula (FYI)

![]()

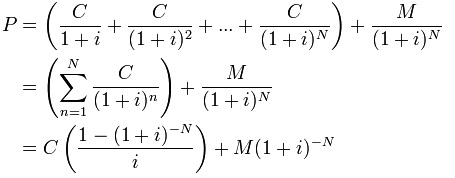

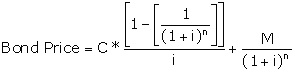

Bond Pricing Excel Formula

To calculate bond

price in EXCEL (annual coupon bond):

Price=abs(pv(yield to maturity, years

left to maturity, coupon rate*1000, 1000)

To calculate yield

to maturity (annual coupon bond)::

Yield to maturity = rate(years left to

maturity, coupon rate *1000, -price, 1000)

To calculate bond

price (semi-annual coupon bond):

Price=abs(pv(yield to maturity/2,

years left to maturity*2, coupon rate*1000/2, 1000)

To calculate yield

to maturity (semi-annual coupon bond):

Yield to maturity = rate(years left to

maturity*2, coupon rate *1000/2, -price, 1000)*2

Function Description

The Excel Price

function calculates the price, per $100 face value of a security that pays

periodic interest.

The syntax of the

function is:

PRICE( settlement, maturity, rate, yld, redemption, frequency, [basis] )

The Excel YIELD

function calculates the Yield of a security that pays periodic interest.

The syntax of the

function is:

YIELD( settlement, maturity, rate, pr, redemption, frequency, [basis] )

Where the arguments

are as follows:

|

pr |

- |

The security's price

per $100 face value. |

|

settlement |

- |

The settlement date of

the security (i.e. the date that the coupon is purchased). |

||||||||||||

|

maturity |

- |

The maturity date of

the security (i.e. the date that the coupon expires). |

||||||||||||

|

Rate |

- |

The security's

annual coupon rate. |

||||||||||||

|

Yld |

- |

The annual yield of

the security. |

||||||||||||

|

redemption |

- |

The security's

redemption value per $100 face value. |

||||||||||||

|

frequency |

- |

The number of coupon payments per year. This

must be one of the following:

|

||||||||||||

|

[basis] |

- |

An optional integer

argument which specifies the financial day count basis that is used by the

security. Possible values are: |

||||||||||||

|

||||||||||||||

|

The financial day

count basis rules are explained in detail on the Wikipedia Day Count

Convention page |

||||||||||||||

https://www.excelfunctions.net/excel-price-function.html

https://www.excelfunctions.net/excel-yield-function.html

Function Description

The Excel Accrint

function returns the accrued interest for a security that pays periodic

interest.

The syntax of the

function is:

ACCRINT( issue, first_interest, settlement, rate, [par], frequency, [basis], [calc_method] )

Where the arguments

are as follows:

|

issue |

- |

The issue date of

the security. |

|

first_interest |

- |

The security's first

interest date. |

|

settlement |

- |

The security's

settlement date. |

|

rate |

- |

The security's

annual coupon rate. |

|

[par] |

- |

The security's par value. If omitted, [par] takes the

default value of 1,000. |

|

frequency |

- |

The number of coupon

payments per year (must be equal to 1, 2 or 4). |

|

[basis] |

- |

An optional argument, that specifies the day

count basis to be used in the calculation. |

|

|

Chapter 6 Risk

and Return

Topics in Chapter 6:

·

Basic return and risk concepts

·

Stand-alone risk

·

Risk in a Portfolio Context

·

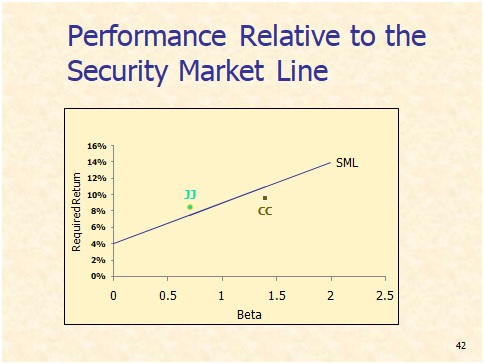

Risk and return: CAPM/SML

·

Market equilibrium and market efficiency

Please use the

following Excel file to learn how to estimate how risky those securities are.

WMT,

Tesla, Apple, and S&P500 stock prices April 2016 ~ May 2021

(solution. Updated for S&P on 6/4/2021)

Summary of Excel

functions:

Mean --- average

function

Risk (standard

deviation) --- stdev function

Correlation between

two stocks --- correl function

Covariance between two

stocks --- covar function

Beta (risk) --- slope

function

A Single Stock, like WMT

Example:

1. Realized return

Holding period return (HPR) = (Selling price – Purchasing price

+ dividend)/ Purchasing price

HPR calculator (www.jufinance.com/hpr)

2. Expected return of this stock and its standard

deviation

Expected return and risk

(standard deviation) calculator (www.jufinance.com/return)

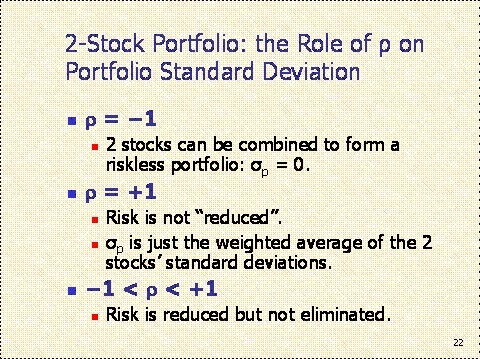

A portfolio of two stocks, like WMT and Amazon

Portfolio Calculator (www.jufinance.com/portfolio) – see equations

below

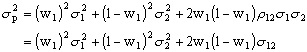

Equation:

![]()

W1 and W2 are the

percentage of each stock in the portfolio.

![]()

- σ12 = the correlation

coefficient between the returns on stocks 1 and 2,

- Cov12 = the

covariance between the returns on stocks 1 and 2,

- σ1 = the standard

deviation on stock 1, and

- σ2 = the standard

deviation on stock 2.

![]()

- σ12 = the covariance

between the returns on stocks 1 and 2,

- N = the number of states,

- pi = the

probability of state i,

- R1i = the

return on stock 1 in state i,

- E[R1] = the

expected return on stock 1,

- R2i = the

return on stock 2 in state i, and

- E[R2] = the

expected return on stock 2.

A portfolio of three stocks, like WMT, Amazon, and APPLE

Three stocks is the

sum of three pairs of two-stock-portfolio. So same as above but repeat it

three times.

A diversified portfolio with 25 stocks and more

As more stocks are

added, each new stock has a smaller risk-reducing impact on the portfolio.

sp falls very slowly after about

40 stocks are included. The lower limit for sp is

about 20% = sM (M: market portfolio).

By forming well-diversified portfolios,

investors can eliminate about half the risk of owning a single stock.

Market risk is that part of a security’s stand-alone

risk that cannot be eliminated by diversification.

Firm-specific, or diversifiable, risk is that

part of a security’s stand-alone risk that can be eliminated by

diversification.

CAPM model (CAPM calculator)

1. What is Beta? Where to find Beta?

2. Why can we use beta as measure for risk?

3. What is three month Treasurye bill’s beta?

S&P500 index’s beta? WMT’s beta? Amazon’s beta? Why are they different?

4. Use CAPM to calculate the expected return of

the above stocks

5. Find those stocks in SML

6. What is market efficiency? Do you agree with the

hypothesis that market is efficient? Do you have any evidence to disapprove

it? What Is the Efficient

Market Hypothesis? (youtube)

Assignment of chapter

6: Chapter 6 Case study (due with mid term exam)

(help video: https://www.jufinance.com/video/fin534_case3_2021_spring.mp4)

No other problem solving assignments for

chapter 6

How do you compute the Beta of a company

First, we need to have two samples of the

same size: The returns for a company, and the returns of the market

for the same period of time. Note: You need to provide

the returns and NOT the actual stock values in order for the calculations to

be correct.

Then, a linear regression is conducted

and the estimated slope of the regression model using the returns of the

company as the dependent variable and the returns of the market as the

independent variable will be the beta we are looking for.

Alternative

formulas to compute the beta https://mathcracker.com/beta-calculator

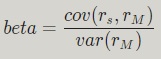

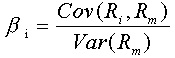

The actual definition of beta is :

This formula is less clear for many people

because the covariance is a less understood

measure and some people do not know how to compute it.

Ultimately, the calculation

of the beta as a slope coefficient of the regression between company and

market returns has a stronger intuitive appeal.

Beta Calculator Excel

Calculation beta in Excel is easy. You need to go to a

provider of historical prices, such as Yahoo finance. Then you clean all

you need to clean and leave only adjusted prices.

Your market data could be

the S&P 500 or any other market proxy. Then, by subtracting and dividing

by the base value, you will get the returns, for both your company and the

market.

Then, you will run a

regression with the company returns as the dependent variable, and the market

returns as the independent variable.

Finally, you will examine

your regression output, and select the estimated slope coefficient. That will

be the beta you are looking for.

Beta calculator and the CAPM

Why is it useful to compute the beta of a firm? Because it

gives a measure of how risky the firm's stock is with respect to the market,

and it tells us how much should be our expected return based ion that level

of risk, via de CAPM model.

RISK and Return General Template (standard deviation, correlation, beta)

In Class

Exercise

1. An investor currently holds the following portfolio: He

invested 30% of the fund in Apple with Beta equal 1.1. He also invested 40%

in GE with Beta equal 1.6. The rest of his fund goes to Ford, with Beta equal

2.2. Use the above information to answer the following questions.

1) The beta for the portfolio is? (1.63)

2) The three month Treasury bill rate (this is

risk free rate) is 2%. S&P500 index return is 10% (this is market

return). Now calculate the portfolio’s return. (15.04%)

Answer:

1) Portfolio beta = 0.3*1.1 + 0.4*1.6 +

(1-0.3-0.4)*2.2 = 1.63

2)

Portfolio return

= 2% + 1.63*(10%-2%) = 15.04%

2. Your current portfolio’s

BETA is about 1.2. Your total investment is worth around $200,000. You uncle

just gave you $100,000 to invest for him. With this $100,000 extra funds in

hand, you plan to invest the whole $100,000 in additional stocks to increase

your whole portfolio’s BETA to 1.5 (Your portfolio now worth $200,000 plus

$100,000). What is the average BETA of the new stocks to achieve your goal?

(hint: write down the equation of the portfolio’s Beta first) (2.1)

Answer:

·

Weight of

the original fund = 200000/(200000+100000) = 2/3

·

Weight of

new fund = 1-2/3 = 1/3

·

So protfolio

beta = 1.5 = (2/3)*1.2 + (1/3)* X è X=2.1

3. What is the coefficient of variation on

the company's stock?

Probability Stock's

State

of of

State

the

Economy Return

Boom 0.45 25%

Normal 0.50 15%

Recession 0.05 5%

ANSWER:

Or,

Probability

of Return Deviation Squared State

Prob.

This

state This

state from

Mean Deviation ×

Sq. Dev.

0.45 25.00% 6.00% 0.36% 0.1620%

0.50 15.00% -4.00% 0.16% 0.0800%

0.05 5.00% -14.00% 1.96% 0.0980%

Expected return = 19.00% 0.34% 0.3400% =

Expected variance

σ

= 5.83%

Coefficient

of variation = σ/Expected return = 0.3069

4. What's the

standard deviation?

Economic

Conditions Prob. Return

Strong 30% 32.0%

Normal 40% 10.0%

Weak 30% -16.0%

ANSWER:

Or,

Economic Return Dev.

from Squared Sqd.

dev.

Conditions Prob. This

state Mean Dev. × Prob

Strong 30% 32.0% 23.20% 5.38% 1.61%

Normal 40% 10.0% 1.20% 0.01% 0.01%

Weak 30% -16.0% -24.80% 6.15% 1.85%

100% 8.8% Variance 3.47%

σ = Sqrt of

variance 18.62% 18.62% by

Excel

5. returns

are shown below. What's the standard deviation of the firm's

returns? (Hint: This is a sample, not a complete population.

USE the sample standard deviation formula)

Year Return

2008 21.00%

2007 -12.50%

2006 25.00%

ANSWER: IN

EXCEL, STDEV SYNTAX.

Or,

Deviation Squared

Year Return from

Mean Deviation

2008 21.00% 9.83% 0.97%

2007 -12.50% -23.67% 5.60%

2006 25.00% 13.83% 1.91%

Expected

return 11.17% 8.48% Sum

sqd deviations

4.24% Sum/(N

− 1)

SQRT = σ =

20.59% 20.59% with

Excel

Mid Term Exam (on blackboard, 6/11 –

6/20)

Review: https://www.jufinance.com/video/fin534_week4_2021_spring.mp4

Chapter 7 Valuation of Stocks and

Corporations

Topics in Chapter 7:

· Features

of common stock

· Valuing

common stock

o

Dividend growth model

o

Market multiples

· Preferred

stock

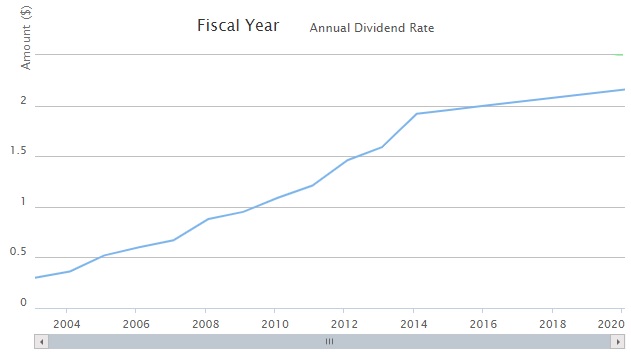

Part I: Dividends

For class discussion:

·

What

is dividend growth model? Why can we use dividend to estimate a firm’s

intrinsic value?

·

Are

future dividends predictable?

·

Refer

to the following table for WMT’s dividend history

http://stock.walmart.com/investors/stock-information/dividend-history/default.aspx

· Refer to the following table for Wal-mart (WMT’s dividend history)

http://stock.walmart.com/investors/stock-information/dividend-history/default.aspx

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 20, 2020 |

April 6, 2020 |

$0.54 |

Regular Cash |

|

May 8, 2020 |

June 1, 2020 |

$0.54 |

Regular Cash |

|

Aug. 14, 2020 |

Sept. 8, 2020 |

$0.54 |

Regular Cash |

|

Dec. 11, 2020 |

Jan. 4, 2021 |

$0.54 |

Regular Cash |

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 15, 2019 |

April 1, 2019 |

$0.53 |

Regular Cash |

|

May 10, 2019 |

June 3, 2019 |

$0.53 |

Regular Cash |

|

Aug. 9, 2019 |

Sept. 3, 2019 |

$0.53 |

Regular Cash |

|

Dec. 6, 2019 |

Jan. 2, 2020 |

$0.53 |

Regular Cash |

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 9, 2018 |

April 2, 2018 |

$0.52 |

Regular Cash |

|

May 11, 2018 |

June 4, 2018 |

$0.52 |

Regular Cash |

|

Aug. 10, 2018 |

Sept. 4, 2018 |

$0.52 |

Regular Cash |

|

Dec. 7, 2018 |

Jan. 2, 2019 |

$0.52 |

Regular Cash |

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 10, 2017 |

April 3, 2017 |

$0.51 |

Regular Cash |

|

May 12, 2017 |

June 5, 2017 |

$0.51 |

Regular Cash |

|

Aug. 11, 2017 |

Sept. 5, 2017 |

$0.51 |

Regular Cash |

|

Dec. 8, 2017 |

Jan. 2, 2018 |

$0.51 |

Regular Cash |

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 11, 2016 |

April 4, 2016 |

$0.50 |

Regular Cash |

|

May 13, 2016 |

June 6, 2016 |

$0.50 |

Regular Cash |

|

Aug. 12, 2016 |

Sep. 6, 2016 |

$0.50 |

Regular Cash |

|

Dec. 9, 2016 |

Jan. 3, 2017 |

$0.50 |

Regular Cash |

|

Record Dates |

Payable Dates |

Amount |

Type |

|

March 13, 2015 |

April 6, 2015 |

$0.490 |

Regular Cash |

|

May 8, 2015 |

June 1, 2015 |

$0.490 |

Regular Cash |

|

Aug. 7, 2015 |

Sep. 8, 2015 |

$0.490 |

Regular Cash |

|

Dec. 4, 2015 |

Jan. 4, 2016 |

$0.490 |

Regular Cash |

Stock Splits

Wal-Mart Stores, Inc. was incorporated on Oct. 31, 1969. On

Oct. 1, 1970, Walmart offered 300,000 shares of its common stock to the

public at a price of $16.50 per share. Since that time, we have had 11

two-for-one (2:1) stock splits. On a purchase of 100 shares at $16.50 per

share on our first offering, the number of shares has grown as follows:

|

2:1 Stock Splits |

Shares |

Cost per Share |

Market Price on Split Date |

Record Date |

Distributed |

|

On the Offering |

100 |

$16.50 |

|||

|

May 1971 |

200 |

$8.25 |

$47.00 |

5/19/71 |

6/11/71 |

|

March 1972 |

400 |

$4.125 |

$47.50 |

3/22/72 |

4/5/72 |

|

August 1975 |

800 |

$2.0625 |

$23.00 |

8/19/75 |

8/22/75 |

|

Nov. 1980 |

1,600 |

$1.03125 |

$50.00 |

11/25/80 |

12/16/80 |

|

June 1982 |

3,200 |

$0.515625 |

$49.875 |

6/21/82 |

7/9/82 |

|

June 1983 |

6,400 |

$0.257813 |

$81.625 |

6/20/83 |

7/8/83 |

|

Sept. 1985 |

12,800 |

$0.128906 |

$49.75 |

9/3/85 |

10/4/85 |

|

June 1987 |

25,600 |

$0.064453 |

$66.625 |

6/19/87 |

7/10/87 |

|

June 1990 |

51,200 |

$0.032227 |

$62.50 |

6/15/90 |

7/6/90 |

|

Feb. 1993 |

102,400 |

$0.016113 |

$63.625 |

2/2/93 |

2/25/93 |

|

March 1999 |

204,800 |

$0.008057 |

$89.75 |

3/19/99 |

4/19/99 |

Can you

estimate the expected dividend in 2022? And in 2023? And on and on…

Can you write down the

math equation now?

WMT stock price = ?

Can you calculate now? It

is hard right because we assume dividend payment goes to infinity. How can we

simplify the calculation?

We can assume that

dividend grows at certain rate.

Discount rate is r (based

on Beta and CAPM that we have learned in chapter 6)

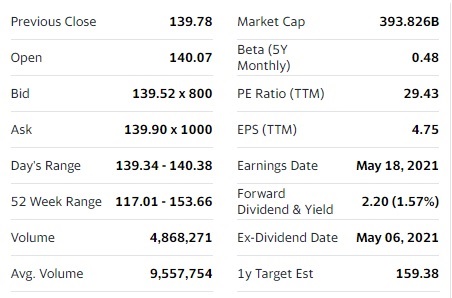

From finance.yahoo.com

What does each item indicate?

From finviz.com https://finviz.com/quote.ashx?t=WMT

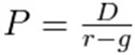

Part II: Constant

Dividend Growth-Dividend growth model

Calculate stock prices

1) Given next dividends and price

Po= ![]()

Po= ![]() +

+![]()

Po= ![]() +

+![]() +

+![]()

Po= ![]() +

+![]() +

+![]() +

+![]()

……

Refer to http://www.calculatinginvestor.com/2011/05/18/gordon-growth-model/

· Now let’s apply this

Dividend growth model in problem solving.

Constant dividend growth

model calculator (www.jufinance.com/stock)

Equations

·

Po= D1/(r-g) or Po= Do*(1+g)/(r-g)

·

r = D1/Po+g = Do*(1+g)/Po+g

·

g= r-D1/Po = r- Do*(1+g)/Po

·

·

Capital Gain yield = g

·

·

Dividend Yield = r – g = D1 / Po = Do*(1+g) / Po

·

D1=Do*(1+g); D2= D1*(1+g);

D3=D2*(1+g)…

Exercise:

1.

Consider the

valuation of a common stock that paid $1.00 dividend at the end of the last

year and is expected to pay a cash dividend in the future. Dividends are

expected to grow at 10% and the investors required rate of return is 17%. How

much is the price? How much is the dividend yield? Capital gain yield?

2.

The current market

price of stock is $90 and the stock pays dividend of $3 with a growth rate of

5%. What is the return of this stock? How much is the dividend yield? Capital

gain yield?

Part III:

Non-Constant Dividend Growth

Calculate stock prices

1) Given next dividends and price

Po= ![]()

Po= ![]() +

+![]()

Po= ![]() +

+![]() +

+![]()

Po= ![]() +

+![]() +

+![]() +

+![]()

……

Non-constant dividend growth model calculator (https://www.jufinance.com/dcf/)

Equations

Pn = Dn+1/(r-g) = Dn*(1+g)/(r-g), since

year n, dividends start to grow at a constant rate.

Where Dn+1= next dividend in year n+1;

Do = just paid dividend in year n;

r=stock return; g= dividend growth rate;

Pn= current market price in year n;

Po = npv(r, D1, D2, …, Dn+Pn)

Or,

Po = D1/(1+r) + D2/(1+r)2 + … +

(Dn+Pn)/(1+r)n

In class exercise for non-constant dividend growth model

1. You

expect AAA Corporation to generate the following free cash flows over the

next five years:

|

Year |

1 |

2 |

3 |

4 |

5 |

|

FCF

($ millions) |

75 |

84 |

96 |

111 |

120 |

Since year

6, you estimate that AAA's free cash flows will grow at 6% per year. WACC of

AAA = 15%

·

Calculate the enterprise

value for DM Corporation.

·

Assume that AAA has $500

million debt and 14 million shares outstanding, calculate its stock price.

Answer:

|

FCF grows at 6% ==>

could use dividend constant growth model to get the value at year 5 |

|

Value in year five = FCF

in year 6 /(WACC - g) |

|

FCF in year 6 = FCF in

year 5 *(1+g%), g=6% |

|

FCF in year 6 = 120

*(1+6%) |

|

value in year five = 120*(1+6%)/(15%-6%)

= 1433.13 |

|

value in year 0 (current

value) =1017.66 = npv(15%, 75, 84,

96, 111, 120+1433.13) |

|

Note: Po = D1/(r-g) ==> Firm value = FCF1/(WACC-g) = FCFo

*(1+g)/(WACC-g) |

|

Assume that

AAA has $500 million debt and 14 million shares outstanding, calculate its

stock price. |

|

equity value = 1017.66 -

500 = 517.66 millions |

|

stock price = 517.66 / 14 |

2. AAA pays no dividend currently.

However, you expect it pay an annual dividend of $0.56/share 2 years from now

with a growth rate of 4% per year thereafter. Its equity cost = 12%, then its

stock price=?

Answer:

Do=0

D1=0

D2=0.56

g=4% after year 2 è P2 = D3/(r-g), D3=D2*(1+4%) è P2 = 0.56*(1+4%)/(12%-4%) = 7.28

r=12%

Po=? Po = NPV(12%, D1, D2+P2), D2 = 0.56, P2=7.28. SO Po = NPV(12%,

0,0.56+7.28) = 6.25

(Note: for non-constant growth model,

calculate price when dividends start to grow at the constant rate. Then use

NPV function using dividends in previous years, last dividend plus price. Or

use calculator at https://www.jufinance.com/dcf/

)

3.

Required return =12%. Do = $1.00, and

the dividend will grow by 30% per year for the next 4 years. After t = 4, the dividend is expected to grow

at a constant rate of 6.34% per year forever.

What is the stock price ($40)?

Answer:

Do=1

D1 = 1*(1+30%) = 1.3

D2= 1.3*(1+30%) = 1.69

D3 = 1.69*(1+30%) = 2.197

D4 = 2.197*(1+30%) = 2.8561

D5 = 2.8561*(1+6.34%), g=6.34%

P4 = D5/(r-g) = 2.8561*(1+6.34%) /(12% - 6.34%)

Po = NPV(12%, 1.3, 1.69,

2.197, 2.8661+2.8561*(1+6.34%)) /(12% - 6.34%)) = 40

Or use calculator at https://www.jufinance.com/dcf/

Assignment (due by

7/11):

Case Study - Chapter 7 Case study

(help video: https://www.jufinance.com/video/fin534_case_4_2021_spring.mp4) - posted

Chapter 9 The Cost

of Capital

Topics in Chapter 9:

· Cost

of capital components

o

Debt

o

Preferred stock

o

Common equity

· WACC

· Factors

that affect WACC

For class discussion:

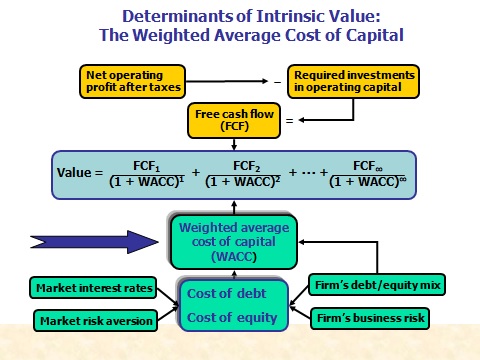

What is WACC?

· WACC

sets the lowest bar, or rate of return, a company needs to get over here.

Why is it important?

· It

tells the minimum rate of return to target for the investment.

· If

the rate of return of the investment < WACC, then the company is losing

value

· If

the rate of return of the investment > WACC, then it is creating value

above its cost of capital.

How to apply WACC to

figure out firm value?

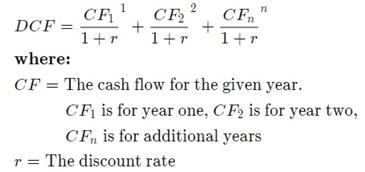

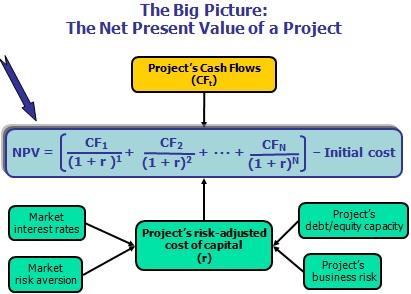

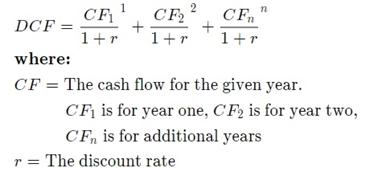

What is DCF?

One option (if beta is given)

Another option (if dividend is given):

WACC Formula

WACC calculator (with preferred stock, annual coupon bond)

(www.jufinance.com/wacc)

WACC calculator (with preferred stock, semi-annual coupon bond)

(www.jufinance.com/wacc_1)

Discount rate to

figure out the value of projects is called WACC (weighted average cost of

capital)

WACC = weight of debt

* cost of debt + weight of equity *( cost of equity)

Wd=

total debt / Total capital = total borrowed / total capital

We=

total equity/ Total capital

Cost of debt =

rate(nper, coupon, -(price – flotation costs), 1000)*(1-tax rate)

Cost of Equity =

D1/(Po – Flotation Cost) + g

D1: Next period dividend;

Po: Current stock price; g: dividend growth rate

Note:

flotation costs = flotation percentage * price

Or

if beta is given, use CAPM model (refer to chapter 6)

Cost

of equity = risk free rate + beta *(market return – risk free rate)

Cost

of equity = risk free rate + beta * market risk premium

In Class Exercise

1. Firm AAA sold a noncallable bond now has 20 years to

maturity. 9.25% annual coupon rate, paid semiannually, sells at a

price = $1,075, par = $1,000. Tax rate = 40%, 0% flotation fee, calculate

after tax cost of debt (5.08%)

Answer:

·

before

tax cost of debt = rate(20*2, 9.25%*1000/2, -(1075-0%*1075), 1000)*2

·

after

tax cost of debt = rate(20*2, 9.25%*1000/2, -(1075-0%*1075), 1000)*2*(1-40%)

= 5.08%

2.

Firm AAA’s equity condition

is as follows. D1 = $1.25; P0 = $27.50; g =

5.00%; and Flotation = 6.00% of price. Calculate cost of equity (9.84%)

Answer:

·

Cost

of equity = 1.25/(27.5-6%*27.5)+5% = 9.84%

3.

Firm

AAA raised 10m from the capital market. In it, 3m is from the debt market and

the rest from the equity market. Calculate WACC.

Answer:

WACC=

(3/10)*5.08% + (7/10)*9.84%

Template is available at https://www.jufinance.com/wacc_1/

Assignment (due with

final):

Case study 5 - Chapter 9 Case study

(due with final)

(help

video: https://www.jufinance.com/video/fin534_case_5_2021_spring.mp4)

- posted

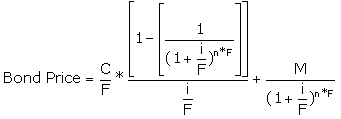

Details about how to derive the model mathematically

(FYI)

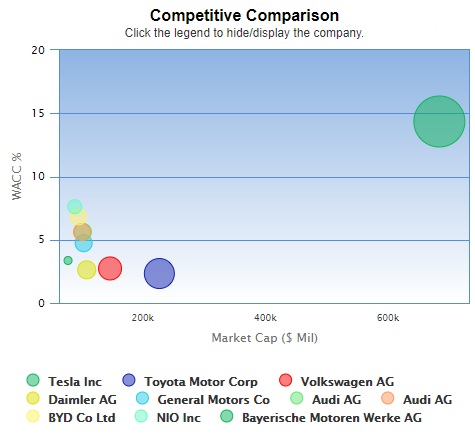

The Gordon growth model is a simple discounted cash flow (DCF)

model which can be used to value a stock, mutual fund, or even the entire

stock market. The model is named after Myron Gordon who first published

the model in 1959.

The Gordon model assumes that a financial security

pays a periodic dividend (D) which grows at a constant rate

(g). These growing dividend payments are assumed to continue forever.

The future dividend payments are discounted at the required rate of return

(r) to find the price (P) for the stock or fund.

Under these simple assumptions, the price of the

security is given by this equation:

![]()

In this equation, I’ve used the “0” subscript

on the price (P) and the “1” subscript on the dividend (D) to indicate

that the price is calculated at time zero and the dividend is the expected

dividend at the end of period one. However, the equation is commonly

written with these subscripts omitted.

Obviously, the assumptions built into this

model are overly simplistic for many real-world valuation problems. Many

companies pay no dividends, and, for those that do,

we may expect changing payout ratios or growth rates as the

business matures.

Despite

these limitations, I believe spending some time experimenting with the

Gordon model can help develop intuition about the relationship between

valuation and return.

Deriving

the Gordon Growth Model Equation

The Gordon growth model calculates the present value of

the security by summing an infinite series of discounted dividend payments

which follows the pattern shown here:

![]()

Multiplying both sides of the previous equation by

(1+g)/(1+r) gives:

![]()

We can then subtract the second equation from the first

equation to get:

![]()

Rearranging and simplifying:

![]()

![]()

Finally, we can simplify further to get the Gordon growth model

equation

dividend growth model:

Refer

to http://www.calculatinginvestor.com/2011/05/18/gordon-growth-model/

·

Now let’s apply this Dividend growth model in problem

solving.

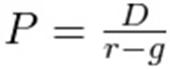

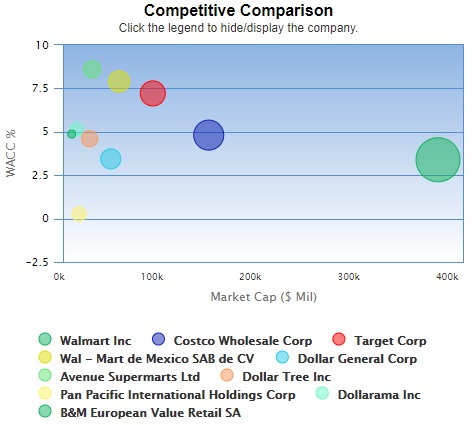

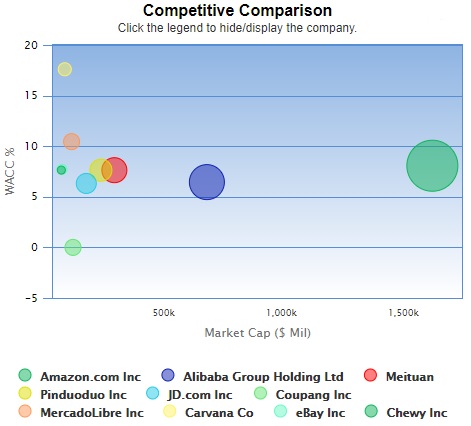

P/E Ratio Summary by

industry (FYI) --- Thanks to Dr Damodaran

Data Used: Multiple data services

Date of Analysis: Data used is as of January 2021

Download as an excel file instead: http://www.stern.nyu.edu/~adamodar/pc/datasets/pedata.xls

For global datasets: http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

|

Industry Name |

Number of firms |

Current PE |

Expected growth

- next 5 years |

PEG Ratio |

|

Advertising |

61 |

20.95 |

83.44% |

0.19 |

|

Aerospace/Defense |

72 |

291.56 |

5.78% |

3.55 |

|

Air Transport |

17 |

8.14 |

-14.27% |

NA |

|

Apparel |

51 |

22.38 |

13.60% |

1.63 |

|

Auto &

Truck |

19 |

164.37 |

18.80% |

8.87 |

|

Auto Parts |

52 |

27.43 |

12.42% |

2.92 |

|

Bank (Money

Center) |

7 |

8.46 |

5.27% |

2.83 |

|

Banks

(Regional) |

598 |

13.5 |

5.74% |

2.32 |

|

Beverage

(Alcoholic) |

23 |

45.64 |

17.53% |

2.06 |

|

Beverage (Soft) |

41 |

201.34 |

10.24% |

2.93 |

|

Broadcasting |

29 |

15.1 |

12.93% |

0.96 |

|

Brokerage &

Investment Banking |

39 |

21.14 |

8.88% |

1.81 |

|

Building

Materials |

42 |

28.19 |

15.28% |

1.43 |

|

Business &

Consumer Services |

169 |

38.25 |

12.28% |

3.28 |

|

Cable TV |

13 |

68.46 |

29.41% |

1.04 |

|

Chemical

(Basic) |

48 |

13.8 |

9.70% |

1.79 |

|

Chemical

(Diversified) |

5 |

13.89 |

5.55% |

2.35 |

|

Chemical

(Specialty) |

97 |

36.06 |

9.18% |

3.4 |

|

Coal &

Related Energy |

29 |

2.85 |

-20.90% |

NA |

|

Computer

Services |

116 |

45.38 |

9.98% |

1.86 |

|

Computers/Peripherals |

52 |

40.61 |

12.30% |

2.97 |

|

Construction

Supplies |

46 |

84.99 |

11.21% |

2.27 |

|

Diversified |

29 |

26.18 |

9.58% |

1.86 |

|

Drugs

(Biotechnology) |

547 |

31 |

18.96% |

1.14 |

|

Drugs

(Pharmaceutical) |

287 |

122.82 |

11.28% |

2.09 |

|

Education |

38 |

26.92 |

14.76% |

1.75 |

|

Electrical

Equipment |

122 |

51.61 |

1.85% |

15.93 |

|

Electronics (Consumer &

Office) |

22 |

57.06 |

20.95% |

0.66 |

|

Electronics

(General) |

157 |

81.09 |

15.15% |

2.72 |

|

Engineering/Construction |

61 |

27.42 |

11.33% |

2.38 |

|

Entertainment |

118 |

908.12 |

17.03% |

3.18 |

|

Environmental

& Waste Services |

86 |

538.13 |

11.58% |

3.72 |

|

Farming/Agriculture |

32 |

26.45 |

17.84% |

1.38 |

|

Financial Svcs.

(Non-bank & Insurance) |

235 |

24.3 |

13.59% |

1.08 |

|

Food Processing |

101 |

268.11 |

13.87% |

1.54 |

|

Food Wholesalers |

18 |

320.61 |

11.97% |

0.71 |

|

Furn/Home

Furnishings |

40 |

29.97 |

15.23% |

1.25 |

|

Green &

Renewable Energy |

25 |

56 |

12.25% |

5.25 |

|

Healthcare

Products |

265 |

330.73 |

16.92% |

2.81 |

|

Healthcare Support

Services |

129 |

101.84 |

16.32% |

1.03 |

|

Heathcare

Information and Technology |

139 |

189.47 |

21.56% |

1.82 |

|

Homebuilding |

30 |

19.46 |

16.91% |

0.67 |

|

Hospitals/Healthcare

Facilities |

32 |

72.23 |

13.75% |

1.33 |

|

Hotel/Gaming |

66 |

51.99 |

-15.51% |

NA |

|

Household

Products |

140 |

592.23 |

9.46% |

2.98 |

|

Information

Services |

77 |

102.24 |

11.15% |

4.86 |

|

Insurance

(General) |

21 |

65.34 |

33.98% |

0.63 |

|

Insurance

(Life) |

26 |

18.97 |

7.81% |